- United States

- /

- Banks

- /

- NYSE:WFC

This Estimate of Wells Fargo's (NYSE:WFC) Intrinsic Value will Give Investors a Better Basis for the Company

Today we will run through one way of estimating the intrinsic value of Wells Fargo & Company (NYSE:WFC) by using the Excess Return Model. This approach is used for finance firms where free cash flow is difficult to estimate. Our goal will be to give investors a reference point of the value of the company and help them weigh recent events.

Wells Fargo has recently garnered price moving attention as a report claimed that the US government may become stricter in making sure the bank appropriately compensates people that it has "nudged" into bankruptcy, and for stimulating their sales personnel to open fictitious accounts.

In the Excess Return Valuation Model, the value of a firm can be written as the sum of capital invested currently in the firm and the present value of excess returns that the firm expects to make in the future. The model is sensitive to the Return on Equity of the company versus the Cost of Equity.

See our documentation to learn about this calculation.

View our latest analysis for Wells Fargo

Intrinsic Valuation

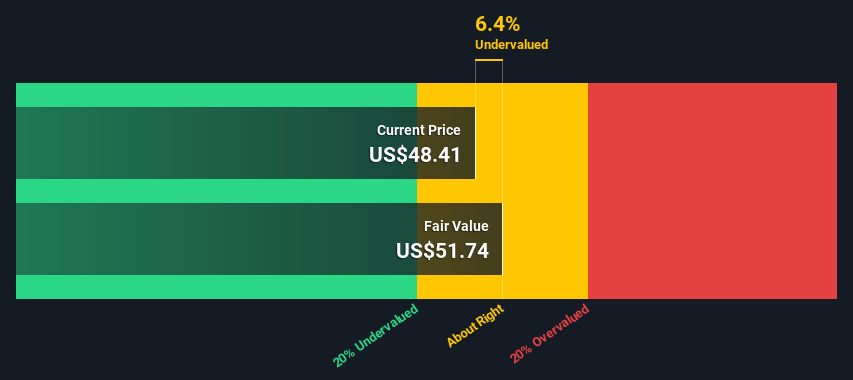

Our model yielded a valuation of US$51.7 per share. The chart below shows, that prior to today's news, the company was trading close to intrinsic value, with little downside risk.

We should always look at the valuation with conjunction of the fundamentals of the company. That way, we get a better understanding of the standing, and the plausibility of the assumptions incorporated in the model.

For example, the model assumes stable operations run by experienced management that make decisions which provide a return on equity greater than the cost of equity of Wells Fargo. To put it simply, one main assumption is that management keeps the company profitable.

Our estimate of the cost of equity for Wells Fargo is 8.06% - you can think of this as a profitability threshold that the company has to meet in order to create value.

On the other side of this equation is the Return on Equity. For Wells Fargo, the ROE is 9.3%. We can see that the return of equity is greater than the cost - this is great! It signals that the company is creating value, and we can use a rough model to value it.

There are always more aspects to consider, such as the Balance Sheet, Future Growth Estimates, and how a company compares to competitors within a sector. If you are following Wells Fargo, it is important to get a clear picture of the fundamentals, which you can do by opening our report.

Relative Valuation

An alternative to an intrinsic valuation, is a relative valuation. This shows us how the company performs in comparison both to the market and other competitors. Because Wells Fargo is a financial institution, one way to compare performance is by using the Price to Book Ratio.

The P/B value compares the Market value (Market Capitalization) of the company to its Book Value of Equity (What is left over when we subtract Total Assets - Total Liabilities).

In the picture below, we can see that Wells Fargo was trading slightly above the other companies in the Financial industry. This means that the company was slightly overvalued on a relative basis. We can ignore the market ratio, because financial companies are a bit different from the rest.

It is now up to investors to decide if the company is on shaky ground, or that today's 5.6% price drop was an overreaction and Wells Fargo will make a swift recovery.

Conclusion

The rough intrinsic and relative valuation models indicate that the firm was trading close to its intrinsic value. The models rely on multiple assumptions, and it is better to take them in conjunction with the fundamentals.

Today's shake-up, offers investors a chance to re-evaluate, and perhaps dig deeper in the company. We can also put forwards a decision tree, where we can ask ourselves:

- What will the value of Wells Fargo be if the threats from enforcers are not materialized?

- To what extent will the actions destroy value for the company if they materialize?

Moving forward, we've put together additional elements you should explore:

- Risks: You should be aware of the 1 warning sign for Wells Fargo we've uncovered before considering an investment in the company.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives