- United States

- /

- Banks

- /

- NYSE:WFC

Did Wells Fargo’s (WFC) Board Independence Debate Just Redefine Its Risk and Growth Outlook?

Reviewed by Sasha Jovanovic

- Earlier this week, The Accountability Board filed a proposal urging Wells Fargo to reinstate an independent board chair policy, reigniting the discussion over the separation of CEO and board chair roles following changes to the company's bylaws in 2025.

- This governance debate emerges at a time when Wells Fargo is in the midst of major fixed-income offerings and heightened analyst focus ahead of its upcoming quarterly earnings report.

- We'll examine how the revived board independence debate intersects with analyst expectations for Wells Fargo's long-term growth and risk profile.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Wells Fargo Investment Narrative Recap

To be a shareholder in Wells Fargo right now, you need to believe that its mix of digital expansion, expense discipline, and renewed growth potential following regulatory relief will outweigh headwinds from regulatory scrutiny and fierce competition. The revived board independence debate is unlikely to materially shift the biggest near-term catalyst, upcoming earnings performance, or the main risk, which remains tied to regulatory and compliance pressures and how they impact profitability and reinvestment opportunities.

Among recent announcements, Wells Fargo’s substantial fixed-income offerings stand out as most relevant, signaling efforts to enhance funding flexibility and support growth initiatives. This capital-raising activity intersects with analyst expectations for balance-sheet expansion, an area made more visible amid activist demands for stronger governance and board oversight as the bank prepares for its next earnings report.

Yet, in sharp contrast to recent optimism, investors should be aware that ongoing regulatory obligations...

Read the full narrative on Wells Fargo (it's free!)

Wells Fargo's outlook anticipates $90.6 billion in revenue and $22.1 billion in earnings by 2028. This is based on a projected 5.3% annual revenue growth rate and a $2.6 billion increase in earnings from the current $19.5 billion.

Uncover how Wells Fargo's forecasts yield a $89.12 fair value, a 15% upside to its current price.

Exploring Other Perspectives

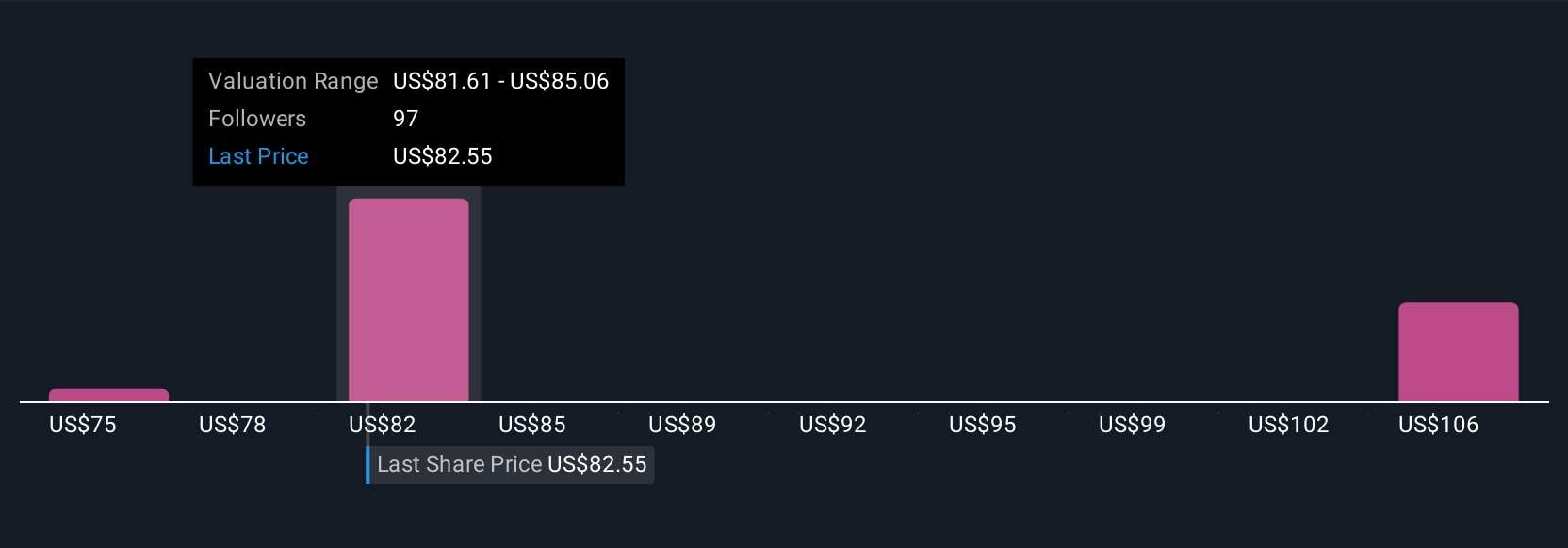

Five Simply Wall St Community members estimate Wells Fargo’s fair value between US$74.70 and US$100.25 per share. As regulatory and compliance demands persist, the range illustrates how investors can interpret the company’s path forward in very different ways.

Explore 5 other fair value estimates on Wells Fargo - why the stock might be worth as much as 29% more than the current price!

Build Your Own Wells Fargo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wells Fargo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wells Fargo's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives