- United States

- /

- Banks

- /

- NYSE:WBS

Is Webster Financial Set for More Gains After 36.5% One-Year Surge in 2025?

Reviewed by Bailey Pemberton

If you are sizing up Webster Financial right now, you are not alone. With the stock closing at $58.96 and boasting a remarkable 132.2% return over five years, many investors are wondering if it is still a smart buy or if the easy money has already been made. While there have been some recent dips, including a 1.4% decline over the past week and 5.3% for the month, the year-to-date gain stands strong at 7.6%, and the one-year return is an impressive 36.5%. These moves suggest that market confidence has grown, but that sentiment can shift as new risks and opportunities emerge.

As market conditions evolve, so does the perception of value. Despite some short-term headwinds, Webster Financial’s six-out-of-six value score hints at a compelling story: according to our set of rigorous undervaluation checks, the company clears every single one. That is not something you see every day, and it is reason enough to take a closer look at what is driving these numbers.

So how did Webster Financial manage to rate so highly across a full spectrum of valuation measures, and what does that mean for the stock’s future? Let us break down each approach. After running through the standard valuation scorecard, we will dig into a method that offers an even clearer view on what this company is really worth.

Approach 1: Webster Financial Excess Returns Analysis

The Excess Returns valuation approach aims to determine a company’s intrinsic value by focusing on its ability to generate returns above the cost of capital. For Webster Financial, this involves looking closely at its return on invested capital, the cost of equity, and sustainable growth rates as projected by analysts.

Here are the key numbers: Webster Financial has a Book Value of $54.19 per share and a Stable EPS of $6.69 per share, based on future return on equity estimates from nine analysts. The Cost of Equity is $4.23 per share, which results in an Excess Return of $2.45 per share. Average Return on Equity stands at 10.96%. Looking further ahead, the Stable Book Value per share is projected at $60.99, as estimated by ten analysts.

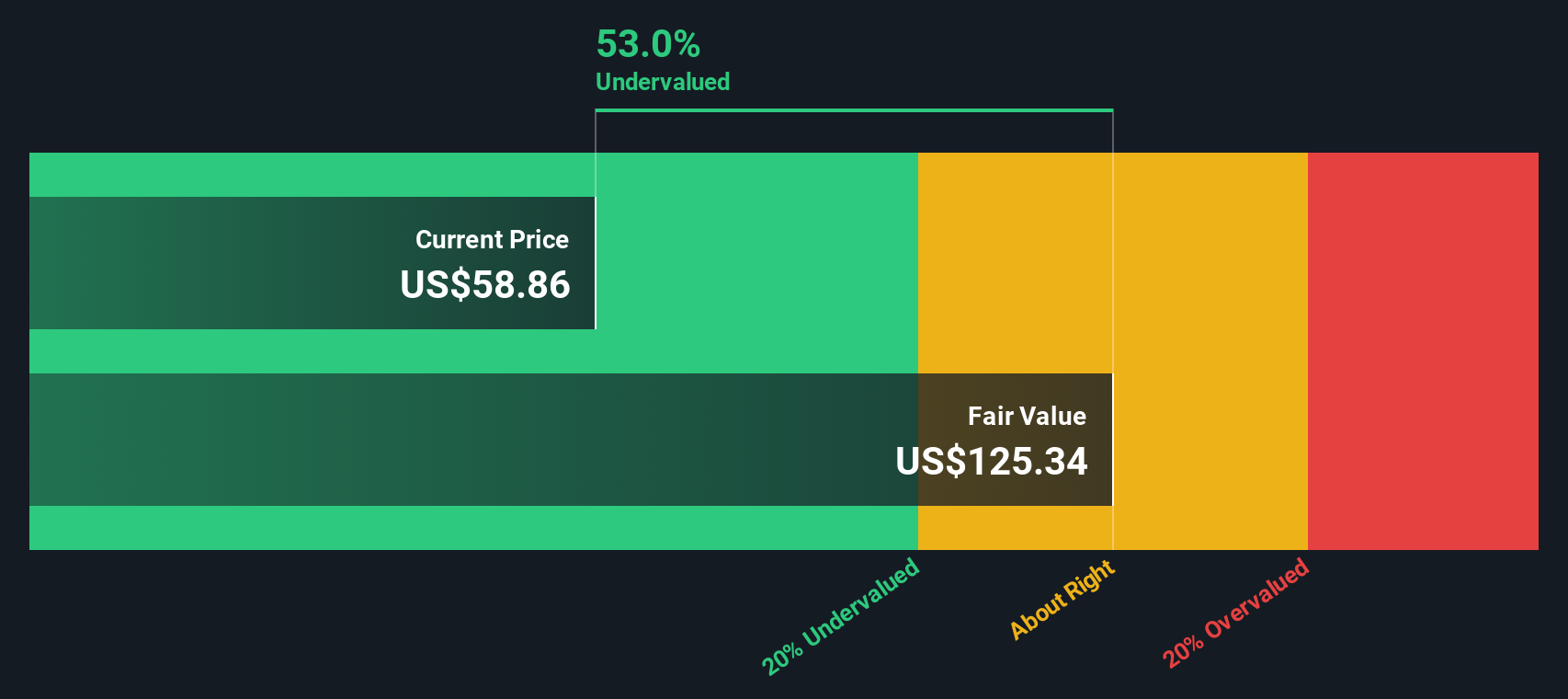

Based on these steady-state assumptions, the Excess Returns model produces an estimated intrinsic value of $124.58 per share. With the current market price at $58.96, this represents a 52.7% discount, suggesting substantial undervaluation according to this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests Webster Financial is undervalued by 52.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Webster Financial Price vs Earnings

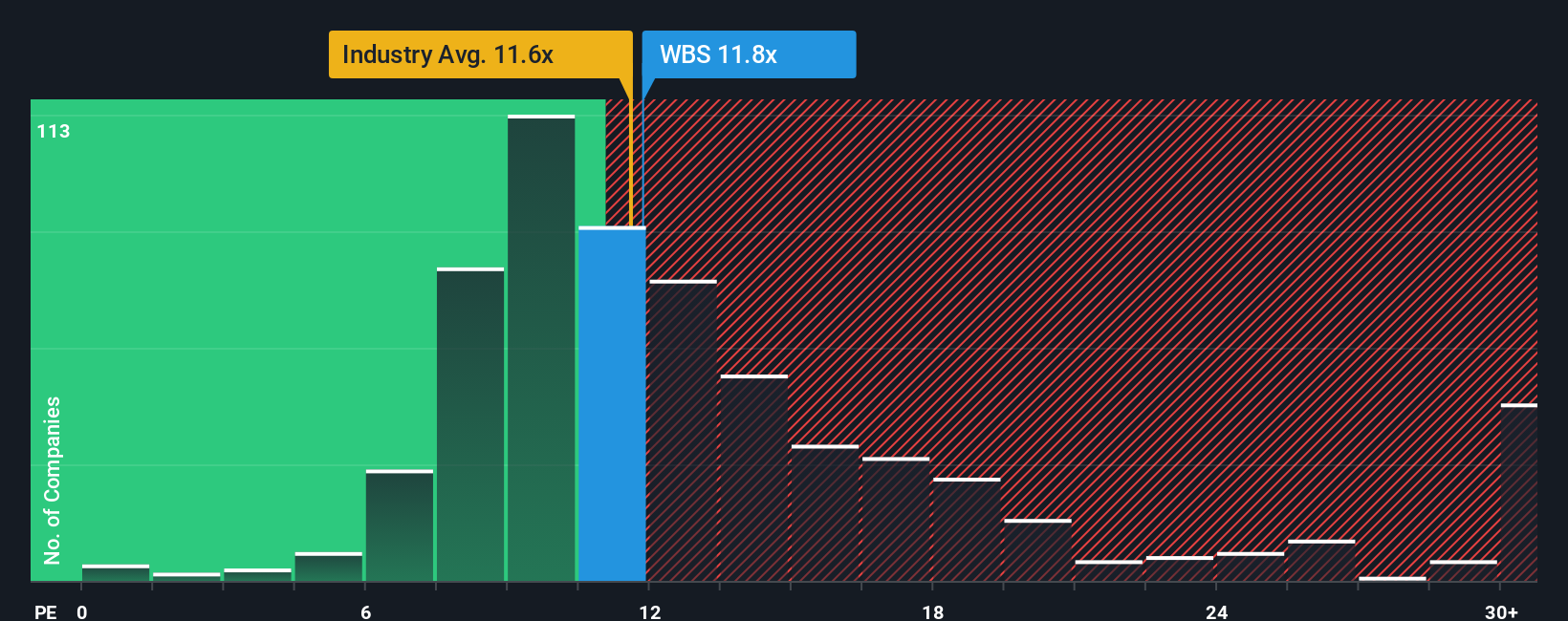

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies because it directly relates a company’s share price to its per-share earnings. For firms like Webster Financial, which has steady profits and a robust earnings history, using the PE ratio provides a clear sense of what investors are willing to pay for each dollar of current earnings.

It is important to remember that a “normal” or “fair” PE ratio depends on expectations for future growth and the risk investors perceive. Companies with strong growth prospects or lower risk typically command higher PE ratios, while those with slower growth or higher uncertainty might trade at a discount.

Currently, Webster Financial trades at an 11.8x PE ratio. This is close to the industry average PE of 11.7x for banks and below its peer group average of 14.3x. Instead of just comparing Webster Financial to these benchmarks, Simply Wall St assigns a proprietary “Fair Ratio” for Webster, which is 14.3x. This Fair Ratio stands out because it is based on a holistic set of factors including the company’s earnings growth, its profit margins, market capitalization, risk profile and its industry context, giving a more nuanced view than either industry or peer averages alone.

Comparing these numbers, Webster Financial’s PE ratio is noticeably below its Fair Ratio. This suggests that, based on its fundamentals and outlook, the stock is undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Webster Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is the story or perspective you bring to a company. It connects the facts, your assumptions about future growth, and your interpretation of what is likely to drive value. Narratives make investing personal and actionable by letting you combine your own estimates and views (like future revenues, margins, or fair value) with the company’s actual numbers.

What makes Narratives powerful is that they help you translate your story into a full financial forecast and a Fair Value for the stock, all with simple inputs and instant feedback. On Simply Wall St’s Community page, millions of investors use Narratives to clarify, track, and test their thinking. Plus, they update dynamically whenever fresh news, earnings, or company events are released.

With Narratives, it becomes much easier to make buy or sell decisions by comparing your Fair Value (based on your assumptions) to the current Price and seeing how new developments change that gap over time.

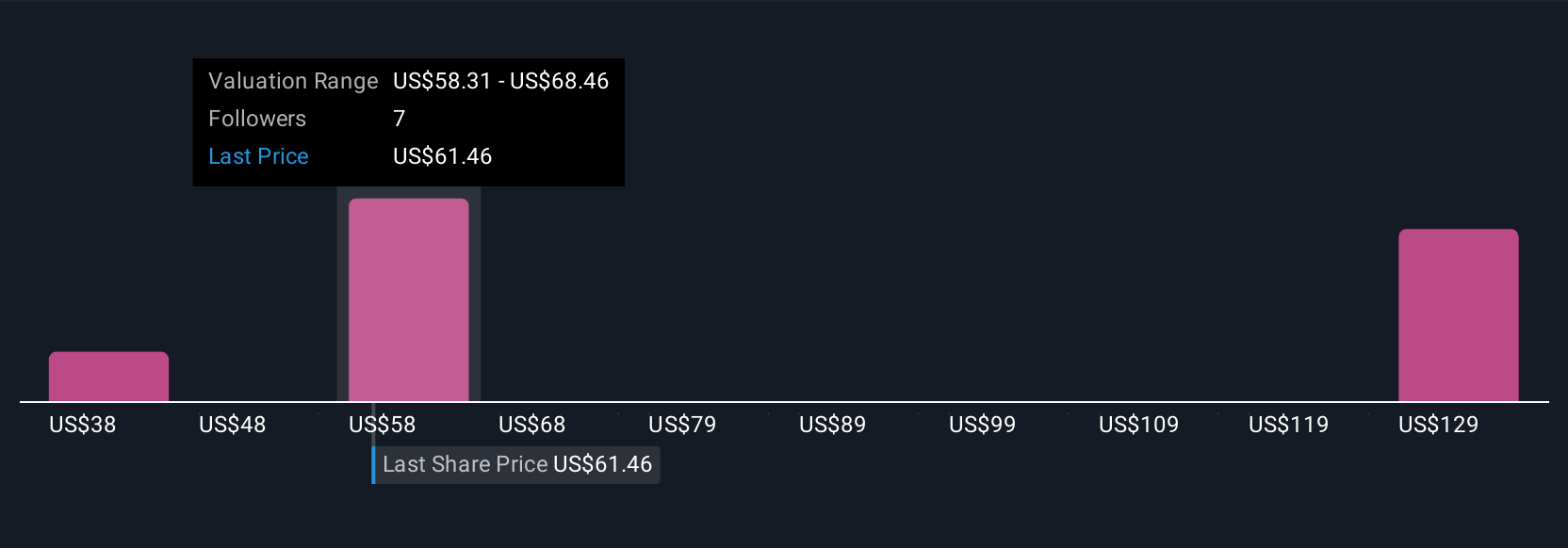

- For example, bulls on Webster Financial, inspired by new healthcare legislation and digital banking growth, can justify a Fair Value of $70.82 per share based on robust future earnings, as seen in optimistic Narratives.

- Meanwhile, more cautious investors, focusing on risks like commercial real estate exposure and regulatory changes, may develop a much lower Fair Value and would potentially hold off buying at today’s price.

No matter your outlook, Narratives put the power of data-driven, story-backed investing in your hands.

Do you think there's more to the story for Webster Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webster Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WBS

Webster Financial

Operates as the bank holding company for Webster Bank, National Association that provides various financial products and services to businesses, individuals, and families in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives