- United States

- /

- Banks

- /

- NYSE:WAL

Will Western Alliance (WAL) Broader Push Into Affordable Housing Reshape Its Core Lending Strategy?

Reviewed by Simply Wall St

- Western Alliance Bank recently supported the opening of Serenity, an affordable, age-restricted mixed-use residential development in South Los Angeles, by providing US$22.2 million in construction-to-permanent financing alongside R4 Capital Funding.

- This initiative highlights the bank's focus on affordable housing finance and showcases its role in addressing critical community needs through partnerships and significant capital commitments.

- We'll examine how Western Alliance's expanded affordable housing financing capabilities in Los Angeles may influence its investment outlook moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Western Alliance Bancorporation Investment Narrative Recap

Investors focused on Western Alliance Bancorporation often look for a combination of strong growth in core banking markets and disciplined risk management, particularly as the company expands specialty lending like affordable housing. The recent Serenity project underlines Western Alliance’s increased activity in community-focused finance, but this US$22.2 million commitment is not likely to materially move the needle near term for the company’s most important catalysts, broad loan growth and digital transformation, or alter the central risks tied to commercial real estate exposure.

The brand unification initiative announced in July stands out here, aiming to sharpen customer awareness and provide tangible support for growth in both traditional and specialty segments, including affordable housing finance. Visibility through new community projects may build goodwill, but investors are still weighing competition from larger national banks and fintechs, which remains a key external challenge for Western Alliance’s core deposit and fee income growth.

Yet, if market conditions shift unexpectedly, especially in commercial real estate, investors should be aware that...

Read the full narrative on Western Alliance Bancorporation (it's free!)

Western Alliance Bancorporation is projected to reach $4.4 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 11.9% and an earnings increase of about $566 million from the current earnings of $833.4 million.

Uncover how Western Alliance Bancorporation's forecasts yield a $96.80 fair value, a 8% upside to its current price.

Exploring Other Perspectives

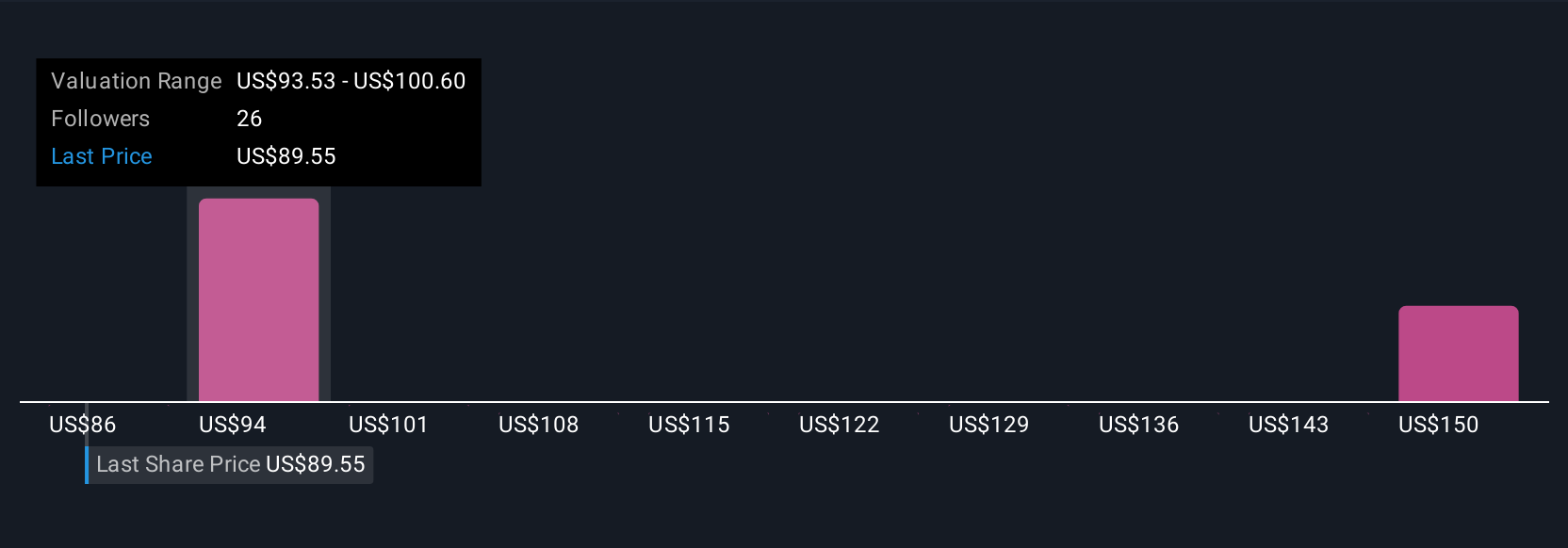

Seven Simply Wall St Community fair value estimates for Western Alliance Bancorporation range widely from US$86.46 to US$157.17 per share. As you consider these valuations, keep in mind that many market participants remain alert to the earnings impact of any ongoing pressure in the commercial real estate portfolio.

Explore 7 other fair value estimates on Western Alliance Bancorporation - why the stock might be worth just $86.46!

Build Your Own Western Alliance Bancorporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Alliance Bancorporation research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Alliance Bancorporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Alliance Bancorporation's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives