- United States

- /

- Banks

- /

- NYSE:UCB

United Community Banks (UCB): Assessing Whether Shares Offer Hidden Value After Recent Momentum Shift

Reviewed by Simply Wall St

United Community Banks (UCB) shares have attracted fresh attention as investors assess its recent performance over the past quarter. With returns drifting lower over the past month, some are weighing what might come next for the stock.

See our latest analysis for United Community Banks.

Looking beyond the recent dip, United Community Banks’ share price has cooled off after a modest rally earlier in the year, reflecting a shift in market sentiment. While the 1-year total shareholder return stands at -5.4%, long-term holders can still point to an impressive 34% gain over five years. Momentum is clearly fading. However, the picture could change quickly if perceptions about the bank’s growth or risk outlook shift.

If you’re curious to see what else is catching investor attention, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With United Community Banks trading below analyst price targets and showing solid fundamental growth, investors are left to wonder whether there is untapped value or if the market has already priced in future expectations.

Most Popular Narrative: 14.7% Undervalued

Despite closing at $29.77, the most widely tracked narrative estimates United Community Banks’ fair value much higher. The stage is set for potential upside if key projections materialize.

Strong capital ratios, disciplined expense management, and system integration following recent acquisitions enable UCBI to be opportunistic in future M&A activity. This approach could accelerate geographic expansion and capture cost synergies, which may improve long-term net margins and earnings power.

Curious about the numbers fueling this optimistic valuation? Bold assumptions around earnings, margins, and loan expansion are central to the story. Uncover what makes this narrative so compelling for United Community Banks’ next chapter.

Result: Fair Value of $34.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition from larger banks or a slowdown in Southeastern economic growth could quickly undermine the current optimistic outlook for United Community Banks.

Find out about the key risks to this United Community Banks narrative.

Another View: Is the Market Really Undervaluing UCB?

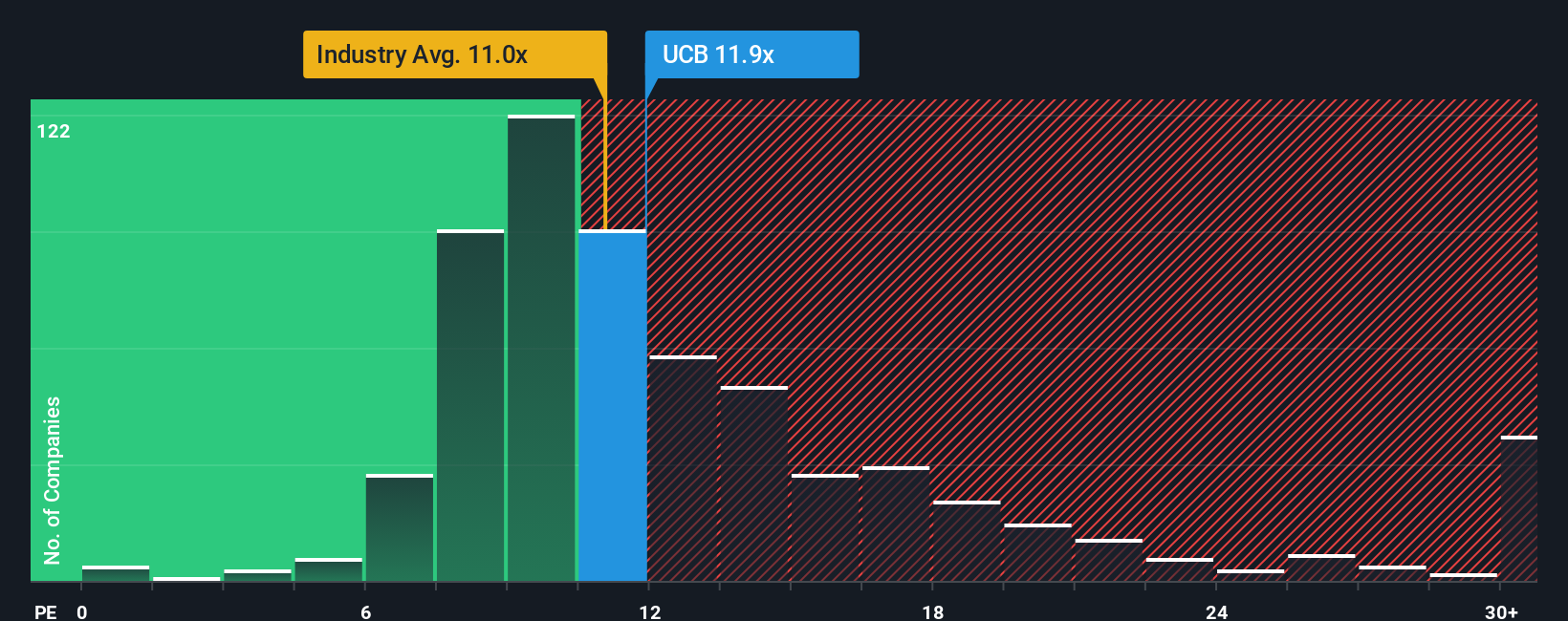

While our fair value estimate suggests United Community Banks is undervalued, a glance at the price-to-earnings ratio tells a more nuanced story. UCB trades at 11.8x earnings, slightly above the US Banks industry average of 11x, and higher than its fair ratio of 11.5x. Compared to a peer average of 20.3x, UCB appears cheap next to rivals, but this premium to industry and fair ratios could signal the market is less convinced about its growth prospects. Is there more risk here than first meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Community Banks Narrative

If you see the story differently or want to dig deeper into the numbers, it takes just a few minutes to develop your own perspective with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Community Banks.

Looking for More Smart Investment Ideas?

Don't let opportunity pass you by. If you want to stay ahead, make your next move by checking out these powerful ideas from the Simply Wall Street Screener:

- Boost your income and minimize risk by targeting high-yield opportunities through these 15 dividend stocks with yields > 3%, focusing on consistent dividends above 3%.

- Capitalize on the growth of artificial intelligence and uncover potential game-changers with these 27 AI penny stocks, which highlight next-generation technologies.

- Benefit from rapid industry shifts and find stocks the market is undervaluing right now with these 895 undervalued stocks based on cash flows, featuring strong cash-flow performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UCB

United Community Banks

Operates as the bank holding company for United Community Bank that provides financial products and services to commercial, retail, government, education, energy, health care, and real estate sectors in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives