- United States

- /

- Banks

- /

- NYSE:UCB

A Look at United Community Banks's Valuation Following Recent Share Price Rebound

Reviewed by Simply Wall St

United Community Banks (UCB) shares moved slightly higher today, tracking a modest rebound after a recent dip over the past month. Investors are watching for signs of stabilization following several weeks of downward pressure.

See our latest analysis for United Community Banks.

United Community Banks’ latest uptick comes after an extended 30-day share price decline of nearly 7%, part of a broader run that has seen momentum fade over recent months despite an 8.96% total shareholder return over the past year. The modest recovery today suggests investors are weighing both long-term gains and renewed near-term caution as they reassess risk and growth potential in the current environment.

If you're curious about what else is gaining attention beyond the banking sector, this could be the perfect time to consider fast growing stocks with high insider ownership.

With shares still trading at a notable discount to analyst targets and steady profit growth in recent years, the key question is whether United Community Banks remains undervalued or if the market is already factoring in future prospects. Could this present a buying opportunity, or has optimism peaked?

Most Popular Narrative: 16% Undervalued

With United Community Banks’ last close at $29.34, the most widely followed narrative places fair value far higher, which raises eyebrows about future upside. The narrative consolidates analyst assumptions, sector trends, and growth levers into one bold outlook. Below, see what’s powering this bullish stance.

Robust hiring of top commercial lending talent and recruitment in fast-growing metro areas positions the bank to capture outpaced small business formation in its footprint, supporting sustainable loan pipeline growth and higher fee income, ultimately strengthening future earnings.

Want a peek behind the curtain? The formula for this valuation rests on accelerated revenue, rising profit margins, and a forecasted profit multiple. Projections like these are usually reserved for market leaders. Which future numbers tip this narrative into bullish territory? The full story holds the clues.

Result: Fair Value of $34.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stiff competition from larger banks and a heavier reliance on acquisitions could threaten deposit growth and limit the impressive earnings trajectory of United Community Banks.

Find out about the key risks to this United Community Banks narrative.

Another View: What Do Market Comparisons Say?

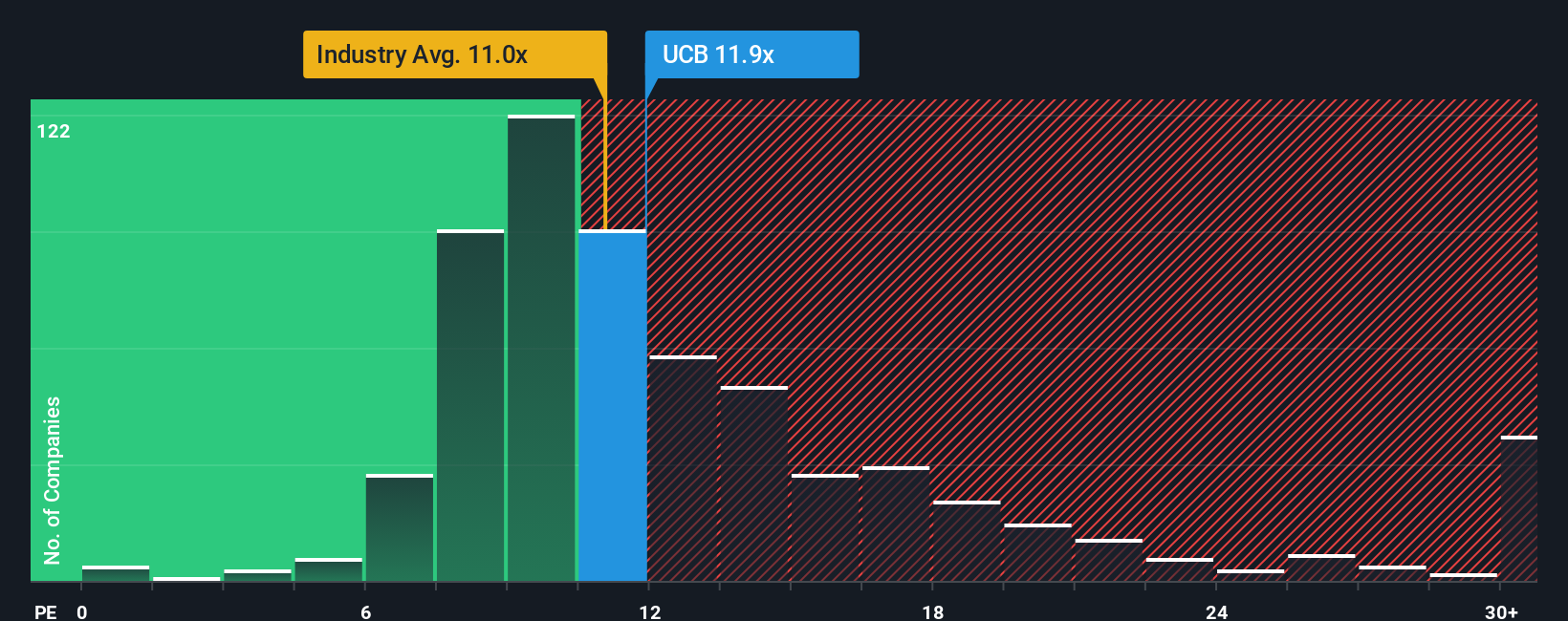

Although the fair value narrative points to United Community Banks being undervalued, the market's favored price-to-earnings measure tempers that enthusiasm. UCB trades at 11.7x earnings, nearly identical to the US Banks industry average of 11x and close to its fair ratio of 11.6x. Compared to its peers’ 27.4x, it looks attractively priced. However, any narrowing of this gap could pose risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Community Banks Narrative

Prefer to draw your own conclusions or take a deeper dive? The data is all here, and building your personal narrative takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Community Banks.

Ready for More Investment Opportunities?

The smartest investors never stop searching for an edge. See what you could be missing by tapping into new sectors, future trends, and powerful income opportunities now.

- Tap into stable income streams when you scan for these 18 dividend stocks with yields > 3% with generous yields exceeding 3%.

- Ride the next wave of innovation by checking out these 28 quantum computing stocks, which is reshaping computing power and technology breakthroughs.

- Capitalize on underestimated value by reviewing these 840 undervalued stocks based on cash flows, offering attractive prices driven by strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UCB

United Community Banks

Operates as the bank holding company for United Community Bank that provides financial products and services to commercial, retail, government, education, energy, health care, and real estate sectors in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives