- United States

- /

- Banks

- /

- NYSE:TFIN

Triumph Financial (TFIN) Margin Slide Challenges Bullish Growth Narrative Despite Aggressive Earnings Forecasts

Reviewed by Simply Wall St

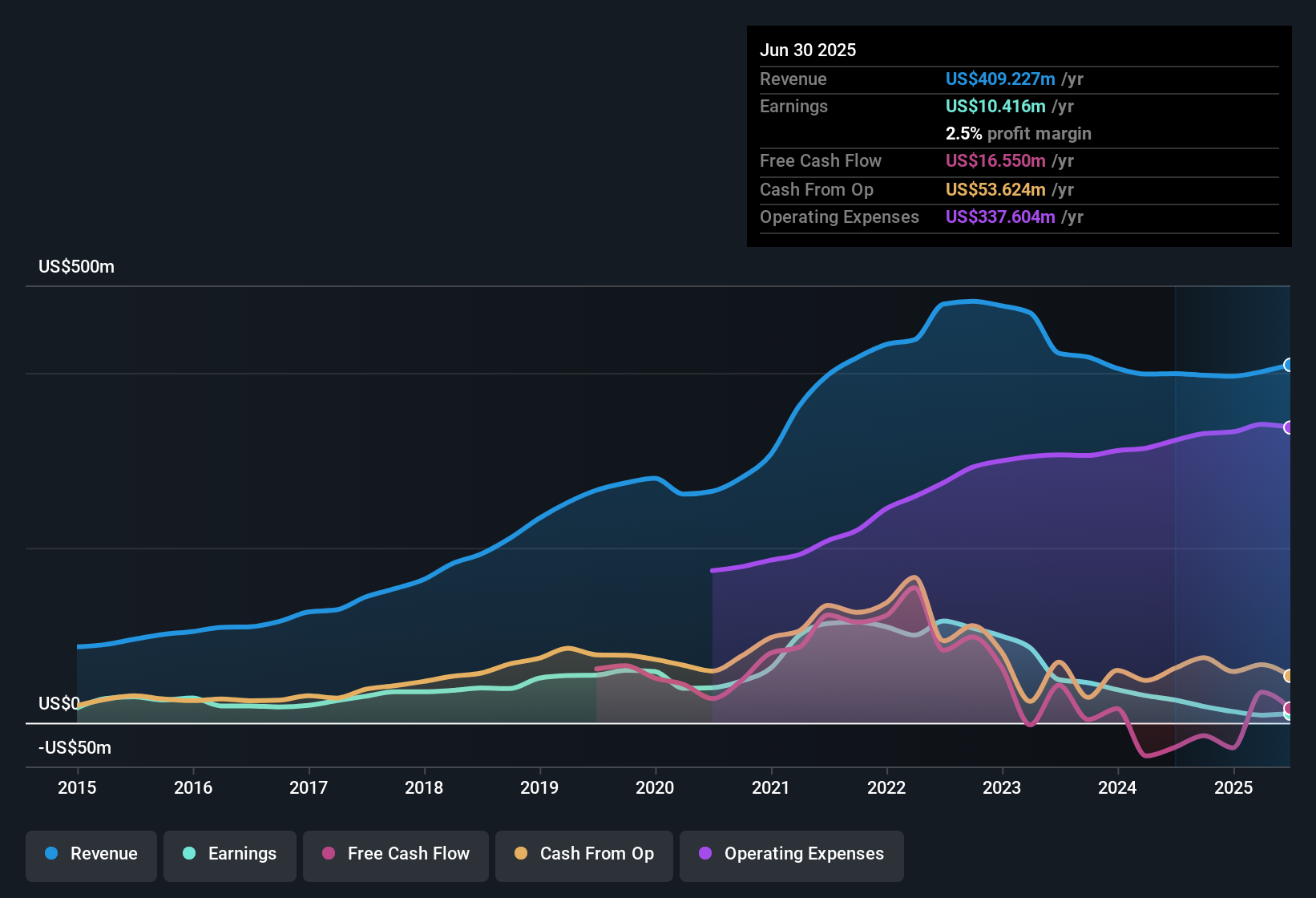

Triumph Financial (TFIN) is projected to deliver a dramatic turnaround, with earnings forecast to surge 157.69% per year and revenue expected to climb 16.3% annually, both far surpassing the broader US market’s growth outlook. Yet, the company currently posts a net profit margin of just 1.7%, down from 4.7% the year before, and has seen its earnings decline by 33.4% per year over the last five years. Despite a promising growth outlook, recent margin compression and a sharp drop in historical earnings mean investors must weigh the sustainability of Triumph’s rebound against its premium valuation.

See our full analysis for Triumph Financial.Next, we put these headline results side by side with the wider market narrative to see which stories hold up and where expectations might get reset.

See what the community is saying about Triumph Financial

Technology Bets Drive Platform Strength

- Integration of Greenscreens’ $40 billion audit and payment data has propelled Triumph’s intelligence platform to become its fastest-growing segment. This signals a meaningful shift toward fee-based, recurring revenue streams beyond core banking.

- Analysts' consensus view connects this growth to Triumph’s investments in AI and digital products. Enhanced accuracy and automation are seen as accelerating product adoption and improving margins.

- Fee-based digital offerings like TriumphPay and LoadPay, supported by proprietary data, are enabling margin improvements and positioning the firm to benefit from the digitalization of freight finance.

- Consensus narrative highlights that targeted scaling of payments and freight intelligence supports both higher contract values and a potential rebound in profitability, even as net profit margins remain compressed in the near term.

- Consensus narrative highlights Triumph’s ability to carve out market share in small and mid-sized carrier segments. The firm is leveraging its technology advantage to create defensible growth even as competition intensifies in the space.

To see how the full consensus narrative weighs the risk and reward of Triumph Financial’s tech-driven business model, unpack the big strategic themes in the community’s discussion: 📊 Read the full Triumph Financial Consensus Narrative.

Margin Expansion Ambitions Tested by Reality

- While analysts project profit margins to climb from 2.5% today to 21.8% within three years, Triumph’s current net profit margin has slipped to just 1.7%. This is down sharply from 4.7% last year and highlights near-term pressure on profitability.

- The consensus narrative notes a tension between Triumph’s long-term goal of 40% EBITDA margins, supported by digital scale, and the drag from increased tech investment and higher compliance costs.

- Margin expansion remains an optimistic target, with management relying on digital operating leverage. However, the current operating environment is still absorbing substantial regulatory and cybersecurity costs.

- Consensus also notes rising credit and counterparty risks due to Triumph’s focus on the freight and logistics sector, which could further dampen margin growth during any cyclical downturn.

Premium Valuation Leaves Little Room for Error

- Triumph’s stock trades at a price-to-earnings ratio of 126.6x today, far above the US banking sector’s 11.4x. The current share price of $51.29 is just 12% below the single analyst target of $58.25, indicating consensus views the stock as fairly priced despite ambitious growth assumptions.

- According to the consensus narrative, investors need confidence that Triumph’s projected earnings ramp, reaching $131.3 million by 2028, will materialize quickly enough to justify premium pricing. Persistent margin pressure could mean limited upside from here.

- The relatively small gap between today’s share price and the analyst target implies limited market expectation for upside. This underscores that much of the anticipated growth is already reflected in the valuation.

- Consensus also highlights that Triumph’s dependence on executing technological integration and achieving margin targets is unusually high for a sector peer, increasing sensitivity to any changes in operational performance or market shifts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Triumph Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to reframe the numbers and put your own spin on Triumph’s story? It only takes a few minutes to shape your unique point of view. Do it your way

A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Triumph Financial’s high valuation and recent margin compression raise uncertainty about whether ambitious growth targets will materialize quickly enough to justify its price.

If you’re looking for stocks with more attractive pricing and stronger upside potential, see which companies are signaling opportunity now with these 876 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives