- United States

- /

- Banks

- /

- NYSE:TFIN

Triumph Financial (TFIN): Exploring Valuation After Launching Integrated Freight Broker Intelligence Platform

Reviewed by Kshitija Bhandaru

Triumph Financial (TFIN) just introduced an integrated Pricing and Performance Intelligence solution designed for freight brokers. The new platform brings pricing, performance, and capacity sourcing together in one place. This product highlights Triumph’s ongoing push into technology-driven logistics solutions.

See our latest analysis for Triumph Financial.

Triumph Financial’s new intelligence platform comes after a series of strategic acquisitions and is part of a consistent pattern of technology investment. While the company has expanded its suite of services, investors have observed a modest 1-year total shareholder return of -0.34%, indicating that momentum in the share price has yet to develop despite operational initiatives.

If you’re interested in finding opportunities beyond the banking and logistics space, consider expanding your search to fast growing stocks with high insider ownership.

With shares lagging over the past year but fundamental innovations underway, is Triumph Financial currently undervalued and presenting a buying opportunity, or is the market already accounting for the company’s future growth prospects?

Most Popular Narrative: 20% Undervalued

Triumph Financial’s most closely followed narrative values the company at $60.5 per share, around 20% above the latest closing price. This viewpoint is anchored in ambitious expectations for the company’s growth and margin expansion, anticipating that recent technology investments will drive rapid profit gains.

Integration of Greenscreens into Triumph's platform, with its $40B in proprietary audit and payment data, is significantly improving product accuracy and penetration within the top freight brokers. This is accelerating adoption, elevating average contract value, and positioning the intelligence business as Triumph's fastest-growing segment, supporting higher fee-based revenue and improved earnings growth.

The story isn’t just about logistics or software. There is a bold financial bet baked into this fair value. Behind the scenes are powerful revenue growth, a profit surge, and a future price multiple that turns heads. Wondering what assumptions drive this aggressive price target? The financial engine of this narrative might surprise you.

Result: Fair Value of $60.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, industry volatility and execution risks around technology investments could challenge Triumph Financial’s growth story if sector downturns or integration issues arise.

Find out about the key risks to this Triumph Financial narrative.

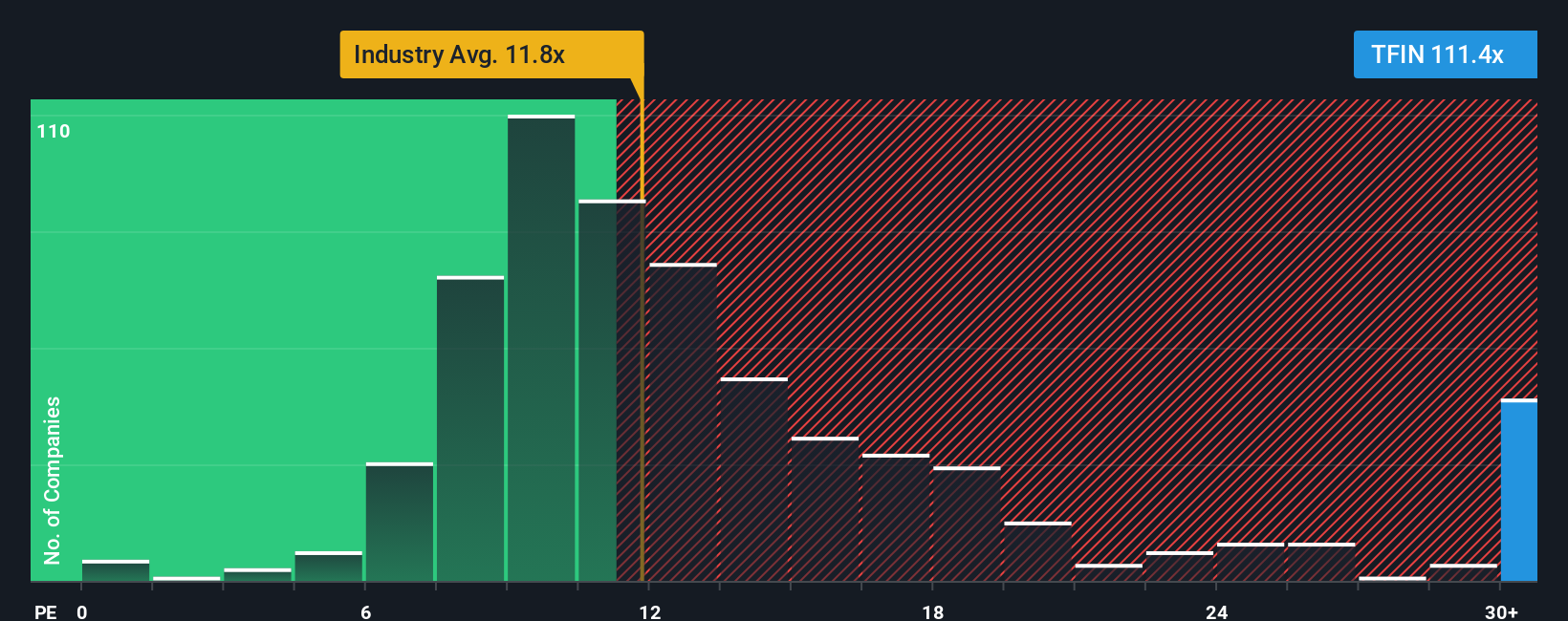

Another View: High Price Tag Through the Lens of Market Comparisons

Looking at Triumph Financial through the lens of price-to-earnings, things look less optimistic. Its ratio stands at 110.3x, which is far steeper than the US Banks sector average of 11.8x, its peers at 30.2x, and even our fair ratio estimate of 51.1x. This suggests the stock trades at a premium, which might leave little room for error if high growth does not arrive as forecast. Should investors be wary of overpaying, or is the market simply expecting a major turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triumph Financial Narrative

If you think there’s more to the story or prefer your own approach, you can quickly assemble an independent analysis using the available data. Do it your way.

A great starting point for your Triumph Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Find Your Next Investing Edge?

Make your search work harder by getting fresh ideas that match your goals. Don’t settle for yesterday’s winners; act now to uncover stocks the crowd hasn’t spotted yet.

- Grow your portfolio by targeting steady income with these 19 dividend stocks with yields > 3% and spot companies paying solid yields above 3%.

- Tap into tomorrow’s innovation leaders by seizing opportunities among these 24 AI penny stocks that are shaping the artificial intelligence landscape.

- Catch undervalued gems early with these 910 undervalued stocks based on cash flows, filtering for stocks that the market may be missing based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives