- United States

- /

- Banks

- /

- NYSE:TFIN

Triumph Financial (TFIN): A Fresh Look at Valuation Following Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Triumph Financial.

Momentum around Triumph Financial’s share price has cooled since the start of the year, with a 1-year total shareholder return of -41% and shares currently sitting at $52.72. While the company has delivered three- and five-year total returns of roughly 10% and 15% respectively, the recent slide suggests investors are still weighing last year's growth against shifting risk perceptions and near-term headwinds.

If today’s uncertain mood has you looking for the next opportunity, consider broadening your search and discovering fast growing stocks with high insider ownership.

With shares well off their highs and the current price still trailing analyst targets, the big question is whether Triumph Financial is now trading at a bargain, or if the market has already accounted for any rebound in growth.

Most Popular Narrative: 12.9% Undervalued

Triumph Financial's most followed narrative assigns a fair value that comes in well above the current share price, hinting at significant upside if its growth blueprint delivers as projected.

Expansion in financial products, including rapid LoadPay account growth and supply chain finance capabilities, addresses the large, underserved small trucker and broker segments. This approach leverages Triumph's data advantage to deepen relationships and create new recurring revenue streams, directly enhancing top-line growth and supporting net margin expansion.

Want a glimpse behind this upbeat valuation? The driving force is an aggressive leap in revenue, profit margins, and the kind of earnings transformation that disrupts industry expectations. Something in these projections sets Triumph apart. See which numbers spark Wall Street’s bullish stance.

Result: Fair Value of $60.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Triumph’s heavy dependence on freight and logistics leaves it vulnerable to industry downturns or integration risks, which could slow revenue growth.

Find out about the key risks to this Triumph Financial narrative.

Another View: What About Multiples?

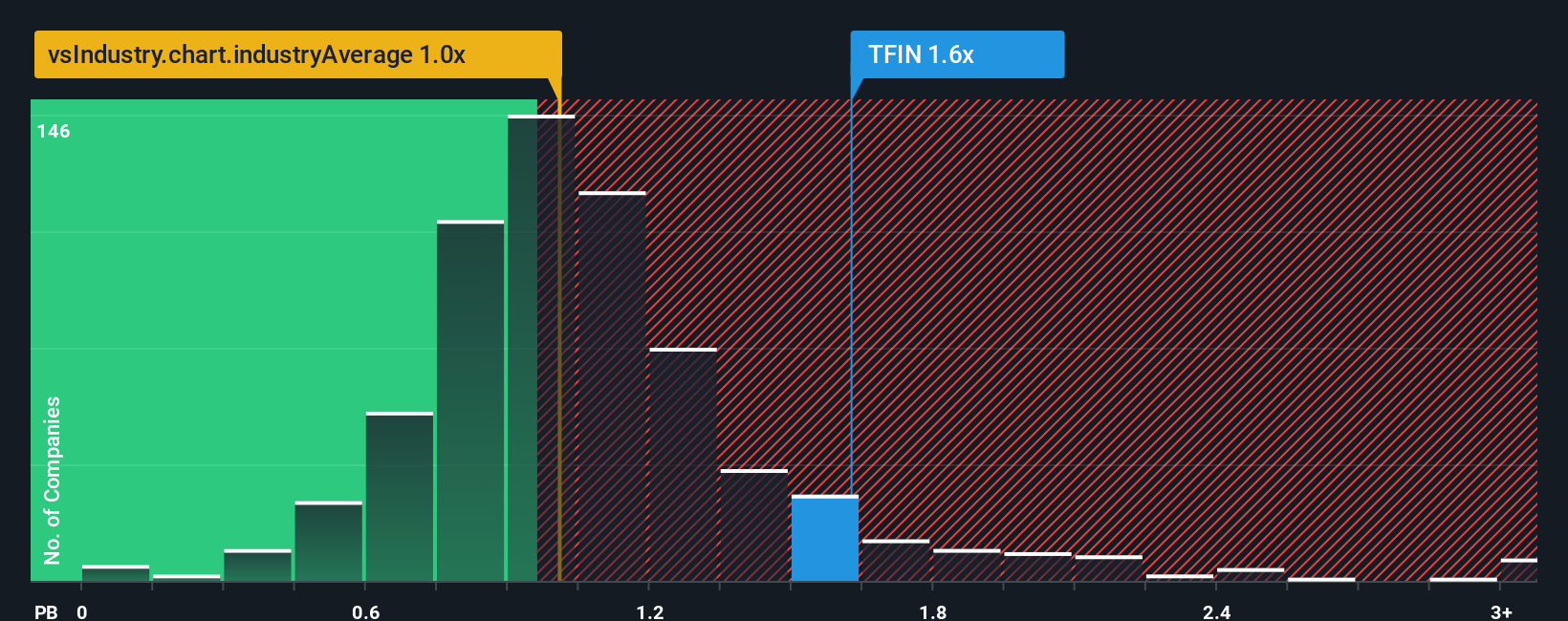

Looking from a different angle, Triumph Financial’s price-to-book ratio stands at 1.4x, which is notably higher than both the US Banks industry average of 1x and its peer average of 0.8x. This higher ratio suggests that, on traditional market multiples, the stock appears expensive compared to similar banks. That could spell extra risk if expectations do not play out. Does that mean future growth is already reflected in the price, or is there room for surprises?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triumph Financial Narrative

If you think the story unfolds differently or want to dig deeper, you can craft your own perspective based on the latest data in just a few minutes. Do it your way.

A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one company. Gain an edge by tapping into handpicked opportunities that match your goals and keep you ahead of the curve.

- Unearth income potential by checking out these 18 dividend stocks with yields > 3%, which delivers consistent yields above 3% for those who want their investments to work harder.

- Capitalize on tech disruption and see how these 24 AI penny stocks are powering breakthroughs that could define tomorrow’s leaders.

- Catch undervalued gems early by starting with these 3596 penny stocks with strong financials, featuring strong financials and standout momentum others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives