- United States

- /

- Banks

- /

- NYSE:TFC

Should Analyst Upgrade on Loan Growth and New Clients Prompt Action From Truist Financial (TFC) Investors?

Reviewed by Sasha Jovanovic

- Following its recent fiscal Q3 2025 earnings report, Truist Financial saw a major analyst upgrade after highlighting 4% total revenue growth and a 2.5% increase in average loan balances fueled by broad-based gains across consumer and wholesale segments.

- The analyst upgrade underscores growing confidence in Truist’s operational momentum, with expanding loan balances and new client acquisition driving its business performance.

- We’ll explore how the analyst upgrade, fueled by Truist’s broad-based loan growth and new client gains, influences its investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Truist Financial Investment Narrative Recap

At its core, the Truist Financial investment case relies on believing the bank can translate solid loan growth and new client gains into improved profitability while managing headwinds from commercial real estate exposure and a large branch network. The analyst upgrade after Q3 2025 earnings, highlighting 4% revenue growth and expanded loan balances, affirms positive operational momentum but does not materially reduce the near-term risk around credit losses in commercial real estate, which remains the most important consideration for shareholders today.

Among recent announcements, Truist’s launch of the Truist One View Connect business solution is especially relevant. This product aims to streamline payments and cash management for business clients, directly supporting the short-term catalyst of strengthening commercial and wholesale relationships fueled by this quarter’s broad-based loan growth.

But even with these positive signals, investors should watch for signs of pressure from commercial real estate loan exposures, as this could...

Read the full narrative on Truist Financial (it's free!)

Truist Financial's outlook anticipates $22.5 billion in revenue and $6.3 billion in earnings by 2028. This requires 7.5% annual revenue growth and a $1.4 billion increase in earnings from the current $4.9 billion level.

Uncover how Truist Financial's forecasts yield a $50.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

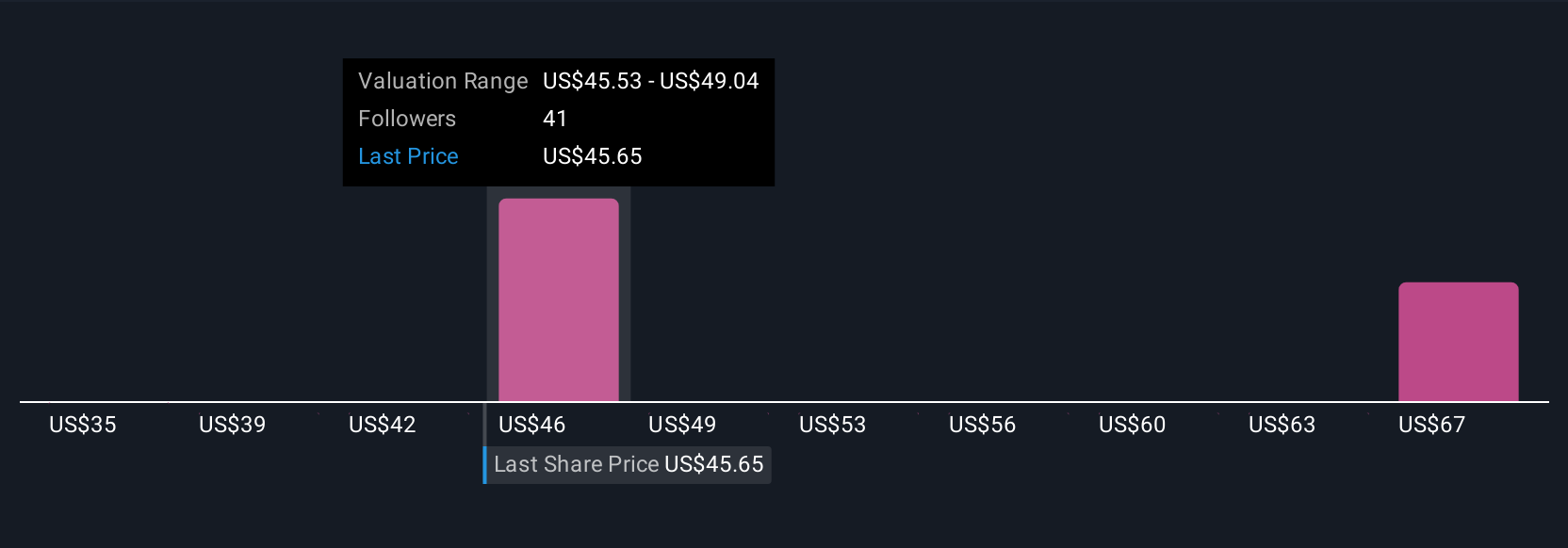

Retail investor estimates from the Simply Wall St Community span US$35 to US$58.93, with four distinct viewpoints shaping expectations. With operational momentum tied to broad-based loan growth, you will want to explore how different forecasts weigh the ongoing risk from Truist's commercial real estate portfolio.

Explore 4 other fair value estimates on Truist Financial - why the stock might be worth 23% less than the current price!

Build Your Own Truist Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Truist Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Truist Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Truist Financial's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives