- United States

- /

- Banks

- /

- NYSE:SSB

SouthState Bank (SSB): Assessing Valuation After Real-Time Payments Platform Draws Investor Interest

Reviewed by Kshitija Bhandaru

SouthState Bank is drawing attention after rolling out a real-time payment platform for Treasury customers. The bank has already handled more than 600,000 transactions worth over $400 million in a pilot. This upgrade could influence how investors view its growth potential.

See our latest analysis for SouthState Bank.

SouthState Bank’s headline-making real-time payments rollout is landing just as the company prepares to share its next batch of quarterly results. The 1-year total shareholder return stands at a modest 6.3 percent, but the nearly 100 percent return over five years shows this is a stock that quietly delivers over the long run. Momentum looks steady, and new tech-driven developments like this suggest investors are watching closely for signs of accelerating growth.

If you’re interested in uncovering companies beyond the usual headlines, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares currently trading well below analyst targets and the company’s rapid earnings growth on display, the question now is whether SouthState Bank is an overlooked bargain or if the market is already factoring in strong future gains.

Most Popular Narrative: 15% Undervalued

SouthState Bank’s last close at $99.37 sits well below the narrative’s projected fair value. This suggests upside that hinges on a specific set of growth bets and margin expansions. The narrative’s assumptions spotlight factors that, if they play out, could put material upward pressure on the stock.

Continued strong loan production growth in Texas and Colorado, which are among the fastest-growing states in the country, positions SouthState to benefit from population migration and economic expansion in the Sunbelt. This is likely to accelerate revenue and earnings growth.

Curious what quantitative targets give this narrative its punch? The fair value calculation leans on revenue and earnings projections well above the industry average. Big financial bets underscore this call. What numbers fuel these bold forecasts? You need to see the full assumptions driving this valuation.

Result: Fair Value of $116.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes and rising deposit costs could limit SouthState’s ability to sustain growth. This may put pressure on both margins and future earnings.

Find out about the key risks to this SouthState Bank narrative.

Another View: What Do Value Comparisons Reveal?

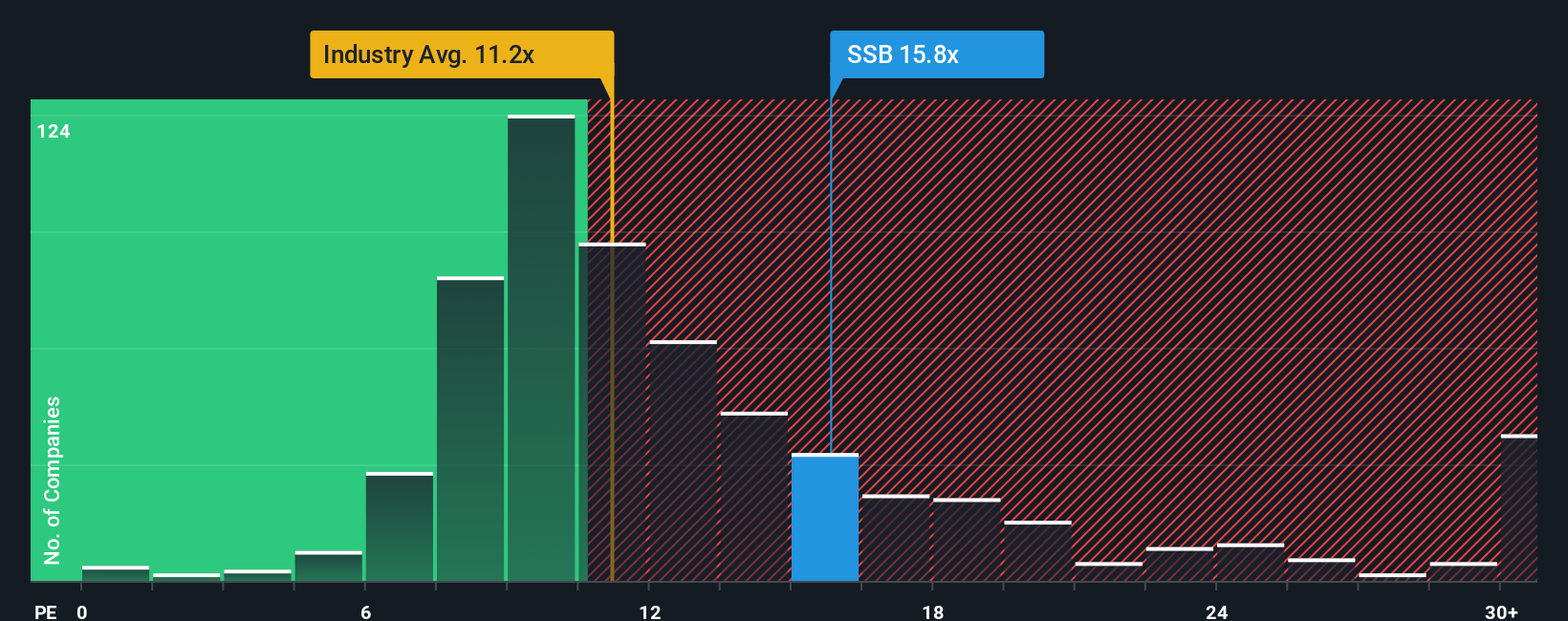

Not everyone sees SouthState Bank as a clear bargain. Against industry peers, its price-to-earnings ratio stands at 17x, well above both the US Banks industry average of 11.8x and the peer group’s 13.2x. Even compared to its fair ratio estimate of 16.4x, the stock looks expensive, not cheap. Could these higher multiples signal more risk than opportunity, or is the market pricing in something others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SouthState Bank Narrative

If you want to look beyond the popular takes or arrive at your own conclusion, you can analyze the numbers and craft a custom narrative in just a few minutes, your way. Do it your way

A great starting point for your SouthState Bank research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. Now is the time to target high-potential stocks you may not have considered. Here are three ways you can supercharge your watchlist today:

- Boost your yield by selecting reliable companies offering strong payouts through these 19 dividend stocks with yields > 3% to stay ahead with consistent income streams.

- Capitalize on the momentum of game-changing technology by scanning these 25 AI penny stocks that are set to redefine sectors with artificial intelligence breakthroughs.

- Jump on undervalued gems with solid fundamentals using these 887 undervalued stocks based on cash flows to spot stocks the broader market may be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSB

SouthState Bank

Operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives