- United States

- /

- Banks

- /

- NYSE:SSB

A Fresh Look at SouthState Bank (SSB) Valuation Following Sector Charge-Off Concerns

Reviewed by Kshitija Bhandaru

After two regional lenders revealed major charge-offs and collateral shortfalls, shares of banks across the sector came under renewed pressure. SouthState Bank (SSB) also faced declines as investors reassessed risk profiles.

See our latest analysis for SouthState Bank.

After a year that saw the share price drift lower and sector nerves flare up on news of peer charge-offs, SouthState Bank has faced renewed scrutiny. Despite these headwinds, its three-year total shareholder return stands at a healthy 17%. The stock is currently trading at $92.47 and remains well ahead over the long haul.

If changes in SouthState’s risk outlook have you thinking about where momentum might turn next, it could be the perfect moment to discover fast growing stocks with high insider ownership.

But with recent volatility and SouthState trading at an almost 28 percent discount to analyst targets, investors may wonder whether the current price is an undervalued entry point or if the market is already factoring in future growth expectations.

Most Popular Narrative: 21.9% Undervalued

SouthState Bank’s widely followed narrative sees its fair value at $118.35, notably above the latest close of $92.47. This gap grabs attention as optimism in analyst projections aligns with recent updates in revenue and profit margin expectations.

The successful integration of recent acquisitions (notably Independent Bank) and the bank's established scale are driving operational efficiencies and enabling further investments in technology and digital platforms, which supports higher net margins over time.

Wondering what bold growth targets and efficiency moves lie beneath this optimistic valuation? The narrative anchors its price on rapid expansion and next-level profitability, but only a deep dive reveals how aggressive those underlying assumptions truly are.

Result: Fair Value of $118.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated regional exposure or a sustained commercial real estate downturn could quickly challenge the current optimism in SouthState’s growth outlook.

Find out about the key risks to this SouthState Bank narrative.

Another View: Are Multiples Sending a Different Signal?

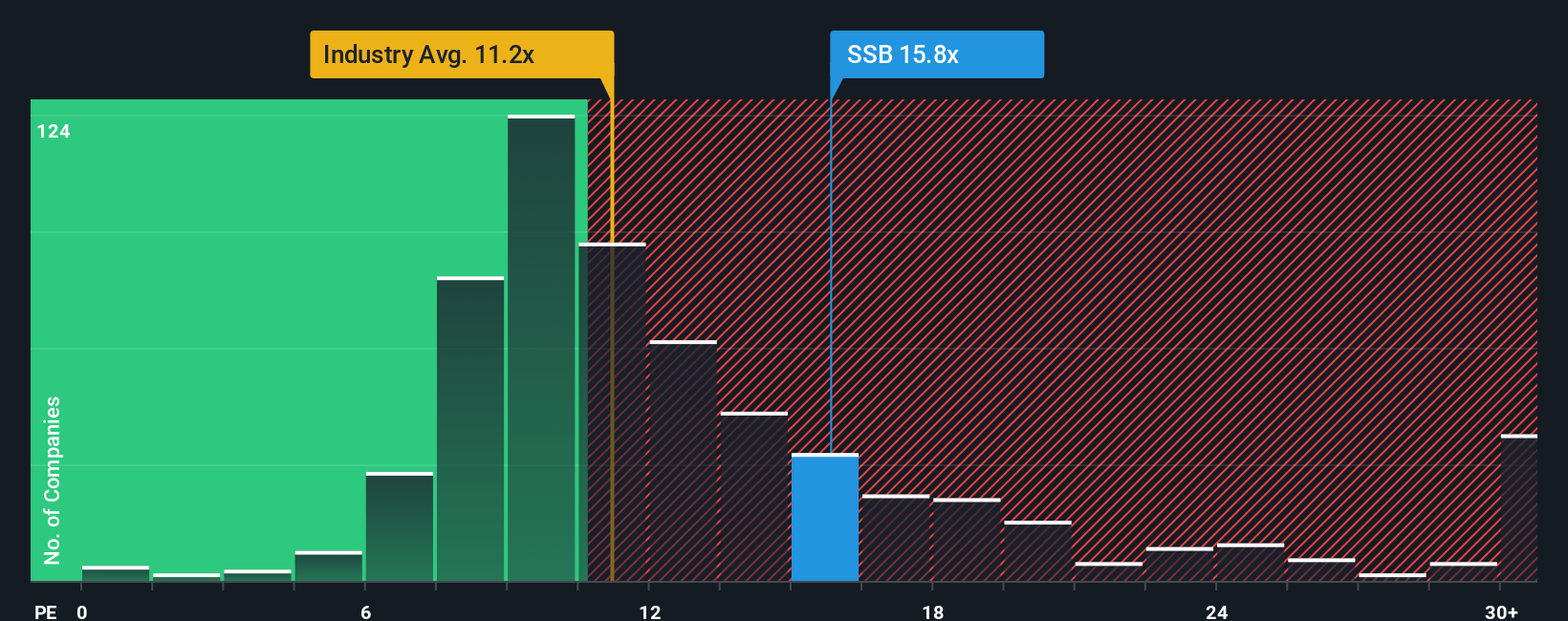

While the fair value narrative paints SouthState Bank as undervalued, there is a twist when we look at its price-to-earnings ratio. SouthState trades at 15.8x, notably higher than both the US banking industry average (11.2x) and its peers (12.8x). Even compared to the fair ratio of 16.2x, the gap is slim. Multiples like this can indicate that, despite growth, the market is already pricing in much of the upside. Can the fundamentals catch up to the valuation, or is there less room to run than DCF models suggest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SouthState Bank Narrative

If you see things differently, or want to dig into the numbers your own way, you can shape your own story in just a few minutes using Do it your way.

A great starting point for your SouthState Bank research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let the best stock opportunities pass you by. Tap into powerful investment ideas with the Simply Wall Street Screener and take control of your portfolio's growth today.

- Capture attractive yields from established businesses by checking out these 18 dividend stocks with yields > 3% offering stable income potential and robust fundamentals.

- Tap into the explosive potential of artificial intelligence by reviewing these 24 AI penny stocks set to disrupt industries with innovation and scalable growth.

- Seize bargains with strong cash flow track records among these 877 undervalued stocks based on cash flows that could be prime for a rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSB

SouthState Bank

Operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives