- United States

- /

- Banks

- /

- NYSE:RNST

Renasant (RNST) Profit Margin Decline Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

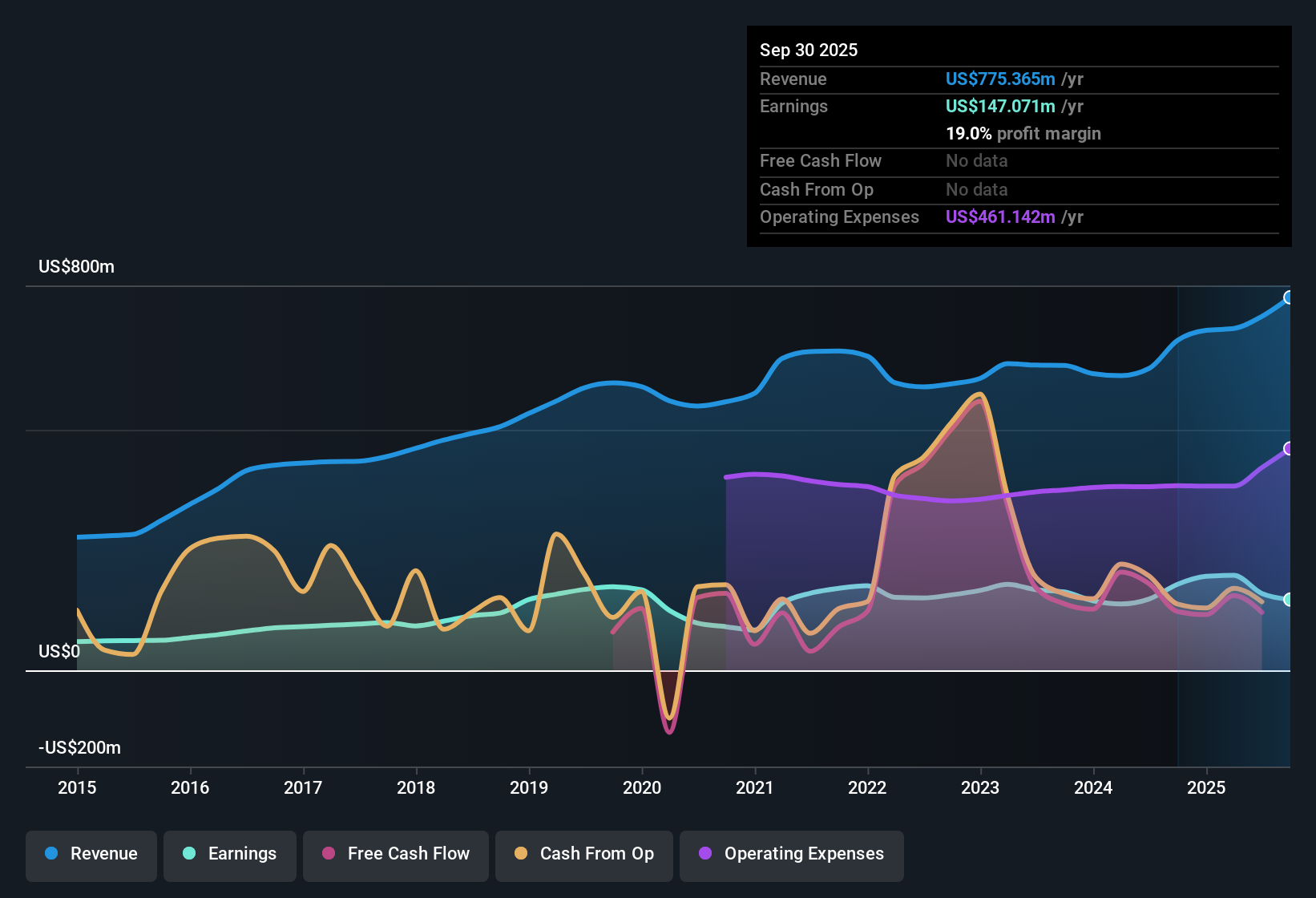

Renasant (RNST) is positioned for standout growth, with annual revenue expected to jump 17.1% and earnings projected to rise 42.6% each year, both easily surpassing the broader US market. Over the last five years, RNST’s earnings have grown by 6.1% annually, though profit margins have declined to 19% from 26.1% a year ago. Solid growth forecasts and a track record of high-quality earnings set an upbeat tone for investors, even as share dilution remains a notable risk.

See our full analysis for Renasant.The next section takes these headline figures and matches them up with the most popular market narratives to explore which stories are reinforced and which may face challenges.

See what the community is saying about Renasant

Share Count to Rise 7% Annually

- Analysts expect Renasant's shares outstanding to climb by an average of 7.0% each year for the next three years, marking a higher rate of shareholder dilution than typically seen in the sector.

- Consensus narrative notes share count growth may blunt earnings-per-share upside, even as analysts forecast underlying earnings to jump from $159.7 million to $581.6 million by 2028.

- While the topline profit jump is eye-catching, an expanding share base means actual per-share gains could be more modest than headline figures suggest.

- Bulls will need to weigh this dilution against the sizable margin expansion expected in analyst forecasts.

- To see how analysts balance these conflicting forces in their long-term expectations, check the full consensus narrative for deeper insights. 📊 Read the full Renasant Consensus Narrative.

Profit Margins Projected to Rebound

- Analysts assume profit margins will improve substantially, rising from 21.7% today to 35.7% in three years. This forecast signals strong cost containment or integration synergies ahead.

- According to the consensus narrative, merger synergies and digital banking upgrades are set to drive net margin recovery, with analysts betting on greater efficiency to push return on equity and return on assets above current levels.

- Margin improvement is supported by ongoing technology investments, back-office automation, and cost saves post-merger, all of which underpin the projected profitability boost.

- Achieving this rebound may depend heavily on successful systems integration and customer retention in newly acquired regions.

Valuation Trades Below Peer Average

- Renasant's current price-to-earnings ratio sits at 21.8x, below the 26.8x peer group average but nearly double the 11.2x US banks industry mean. The current share price of $33.68 is also 38% below the DCF fair value of $54.14 and 26% below the analyst price target of $42.29.

- Consensus narrative frames this discount as both opportunity and risk, highlighting that the muted price gap to the target implies Wall Street sees Renasant as fairly valued based on steady execution rather than a major re-rating.

- The combination of premium to industry (but discount to peers) suggests investors are weighing robust regional growth prospects against sector-specific risks like heavy Southeast exposure.

- Dividend yield and positive analyst sentiment provide a cushion, but a bigger valuation rally may hinge on delivering margin and efficiency improvements as projected.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Renasant on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there’s more to the story in the numbers? It only takes a few minutes to shape your own perspective and share your narrative. Do it your way

A great starting point for your Renasant research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite robust growth projections, Renasant faces the risk that rapid share dilution could limit actual per-share gains and temper returns for investors.

Seeking steadier expansion and more consistent returns? Use stable growth stocks screener (2124 results) to focus on companies delivering reliable growth across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNST

Renasant

Operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives