- United States

- /

- Banks

- /

- NYSE:RNST

A Fresh Look at Renasant (RNST) Valuation as Shares Recover from Recent Dip

Reviewed by Simply Wall St

See our latest analysis for Renasant.

Renasant’s share price has slipped about 6% over the past month but remains down only modestly for the year. Recent trading reflects a balancing act between investor caution and confidence in the bank’s fundamentals. Notably, its one-year total shareholder return is a positive 2.9%, and the five-year total return stands at an encouraging 37%, highlighting that longer-term investors have been rewarded even through shorter-term volatility.

If you’re curious about other opportunities with momentum and insider alignment, this could be the ideal time to broaden your search and explore fast growing stocks with high insider ownership

With shares trading at a noticeable discount to analyst targets even after double-digit annual growth in revenue and profits, the key question for investors is whether Renasant offers true value at current levels or if the market is already factoring in its future upside.

Most Popular Narrative: 16.6% Undervalued

Compared to Renasant’s last close at $34.88, the most widely followed narrative assigns a fair value of $41.83. With the share price trading well below this estimate, the case for upside centers on big-picture growth drivers and recent strategic moves.

“The merger with The First Bancshares increases scale and provides a larger footprint in regions experiencing strong small business formation, enabling Renasant to capitalize on rising entrepreneurial activity. This should enhance lending opportunities and fee income over time.”

Curious what bold projections led analysts to this valuation? The secret sauce combines explosive top-line expansion, margin acceleration, and a transformation in earnings power. Can't believe the scale of forecasted improvement? Uncover the exact assumptions driving this price. Read the full narrative for the numbers and the story behind them.

Result: Fair Value of $41.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to Southeastern markets and lagging digital innovation could disrupt growth. This reminds investors that not all catalysts point upward.

Find out about the key risks to this Renasant narrative.

Another View: What About the PE Ratio?

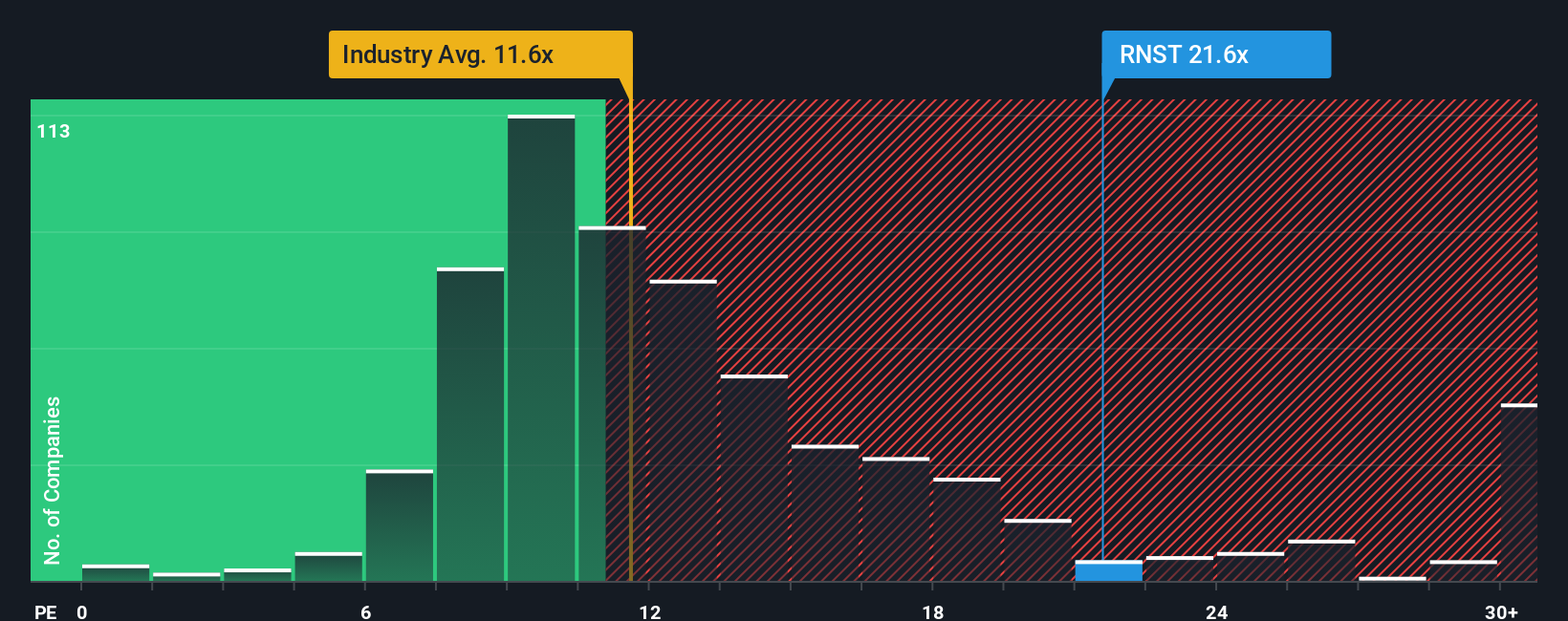

Stepping away from growth and narrative, let’s examine Renasant’s valuation through its price-to-earnings ratio. RNST currently trades at 20.7 times earnings, which is significantly higher than the US banks industry average of 11.2 and above its calculated fair ratio of 19.4. This premium suggests the market expects outperformance, but it could also point to a valuation risk if growth falls short. Are investors paying up for genuine upside, or just chasing momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Renasant Narrative

If you see things differently, or would rather draw your own conclusions, you can build a personal narrative with just a few minutes of your research, and Do it your way.

A great starting point for your Renasant research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for future success by tapping into unique opportunities. Let our powerful tools spotlight the companies and sectors others overlook. Take action now and boost your portfolio with fresh perspectives before the crowd catches on.

- Capitalize on fast growth by reviewing these 872 undervalued stocks based on cash flows to see which gems might be trading below their potential.

- Pursue passive income opportunities by checking out these 17 dividend stocks with yields > 3% featuring stocks with attractive yields above 3%.

- Stay ahead of industry-changing trends when you investigate these 27 AI penny stocks driving innovation in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNST

Renasant

Operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives