- United States

- /

- Banks

- /

- NYSE:PNC

Assessing PNC Stock Value After Fed Signals Possible Rate Cuts in 2025

Reviewed by Bailey Pemberton

So, you are wondering what to make of PNC Financial Services Group’s stock right now. With its latest close at $190.16, PNC is not just another name lost in the shuffle of bank stocks. This is a company that has served up a long-term return of 107.7% over the last five years, and even with a tricky year-to-date performance of -0.6%, it is clear many investors are still paying attention. After some recent turbulence, with the stock down 4.2% this past week and 6.7% over the past month, the question on everyone’s mind is whether this is compelling value or just another value trap.

Some of these ups and downs can be traced to wider shifts in the financial sector, such as changing interest rate expectations and evolving investor attitudes toward risk. As markets digest each new headline, the story around PNC continues to develop. Despite short-term bumps, PNC has managed to deliver an impressive 47.0% return over three years and a solid 7.5% gain over the past twelve months, indicating that recent challenges have not derailed its longer-term growth.

If you are focused on valuation, here is something to consider. PNC scores a 4 out of 6 using a set of standard undervaluation checks, meaning it passes four key indicators that flag stocks as potentially undervalued. Still, as any seasoned investor knows, numbers alone cannot tell the whole story. Next, let’s break down those valuation methods and see which ones matter most, before going beyond the basics to uncover if there is an even smarter way to decide whether PNC is a true bargain.

Why PNC Financial Services Group is lagging behind its peers

Approach 1: PNC Financial Services Group Excess Returns Analysis

The Excess Returns Model estimates a company's intrinsic value by evaluating how efficiently it generates returns beyond the basic cost of its equity capital. In PNC Financial Services Group’s case, this approach asks whether its leaders are truly making the most of investors’ money and turning it into sustainable profits over time.

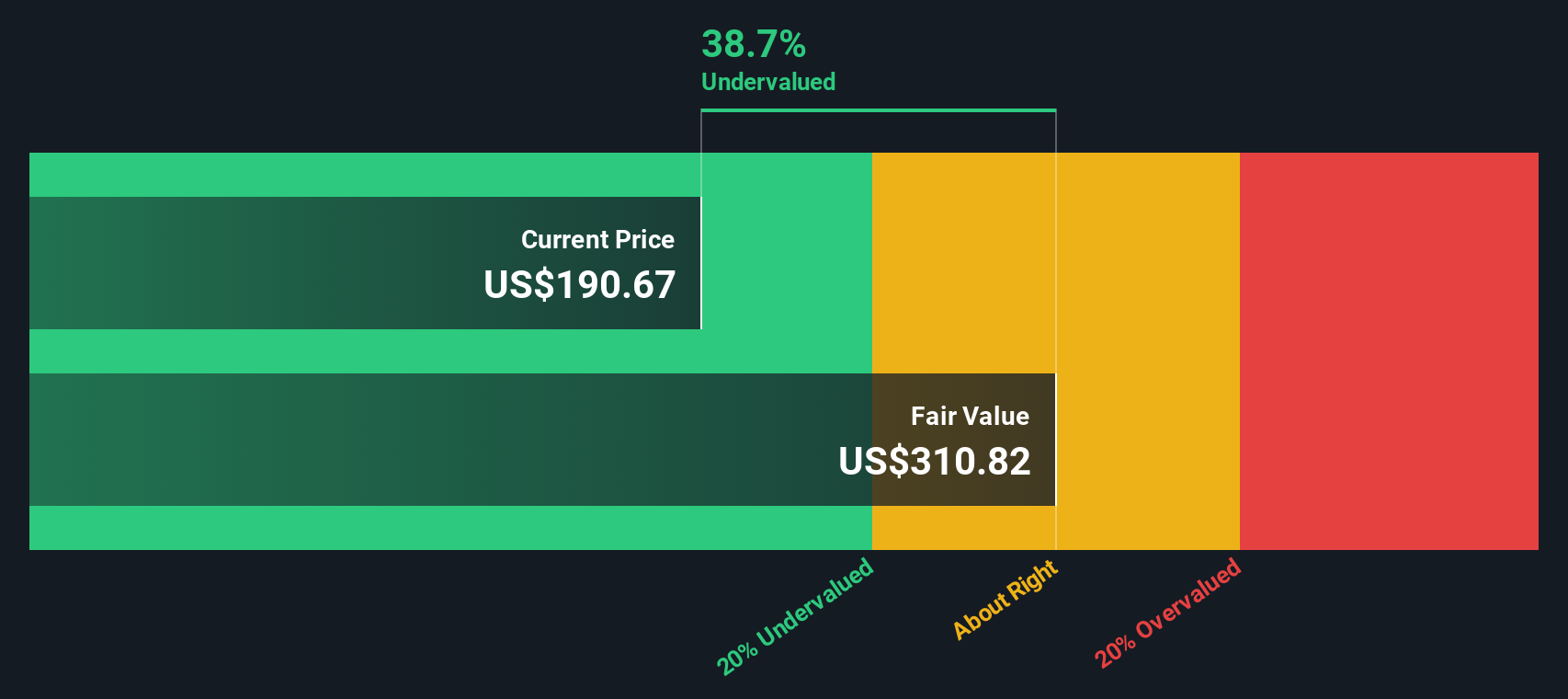

PNC’s financials show a strong foundation. Its Book Value stands at $131.61 per share, while analysts project a Stable EPS of $17.88 per share, anchored by a weighted average future Return on Equity of 12.18% from 13 analysts. PNC’s Cost of Equity is $10.81 per share, which means its Excess Return, the profits above what shareholders demand for their investment, hits $7.07 per share. Over the long term, a Stable Book Value of $146.78 per share is estimated, reflecting a prudent approach to growth (as sourced from 12 analysts).

When these factors are combined, the model estimates PNC’s intrinsic value at $311.87 per share, significantly higher than its latest close at $190.16. This implies the stock is currently trading at a 39.0% discount under this framework, pointing strongly to undervaluation rather than a value trap.

Result: UNDERVALUED

Our Excess Returns analysis suggests PNC Financial Services Group is undervalued by 39.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PNC Financial Services Group Price vs Earnings

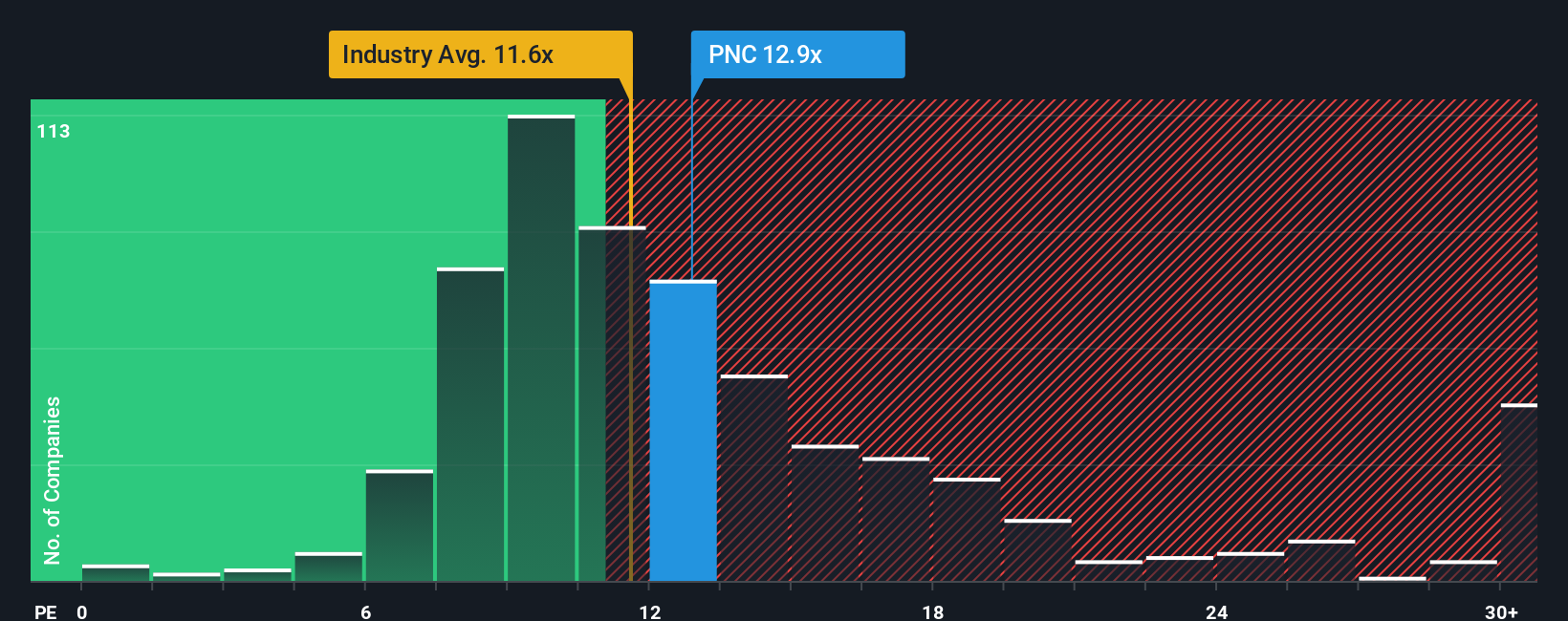

The price-to-earnings (PE) ratio is especially useful for valuing established, profitable companies such as PNC Financial Services Group. This metric tells us how much investors are willing to pay for every dollar of the company’s current earnings. The “right” PE ratio for a stock usually reflects how fast its earnings are expected to grow and the level of risk investors see in the business and its industry. Higher growth or lower risk often justify a higher ratio, while slower growth or higher risk push it down.

PNC currently trades at a PE ratio of 12.8x, which is just above the banking industry’s average of 11.7x and below the average of its closest peers at 17.7x. However, the Simply Wall St Fair Ratio for PNC is calculated at 14.2x. The Fair Ratio is a proprietary measure that goes a step beyond simple comparisons. It incorporates important factors like earnings growth, profit margins, risk profile, the company’s market cap, and how it stacks up within the broader industry. This gives a more holistic sense of value than just lining up with the industry or a group of peers.

Since PNC’s current PE is moderately below the Fair Ratio (12.8x versus 14.2x), the stock appears undervalued by this method. Investors may find there is value yet to be realized, even taking broader industry trends and risk factors into account.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PNC Financial Services Group Narrative

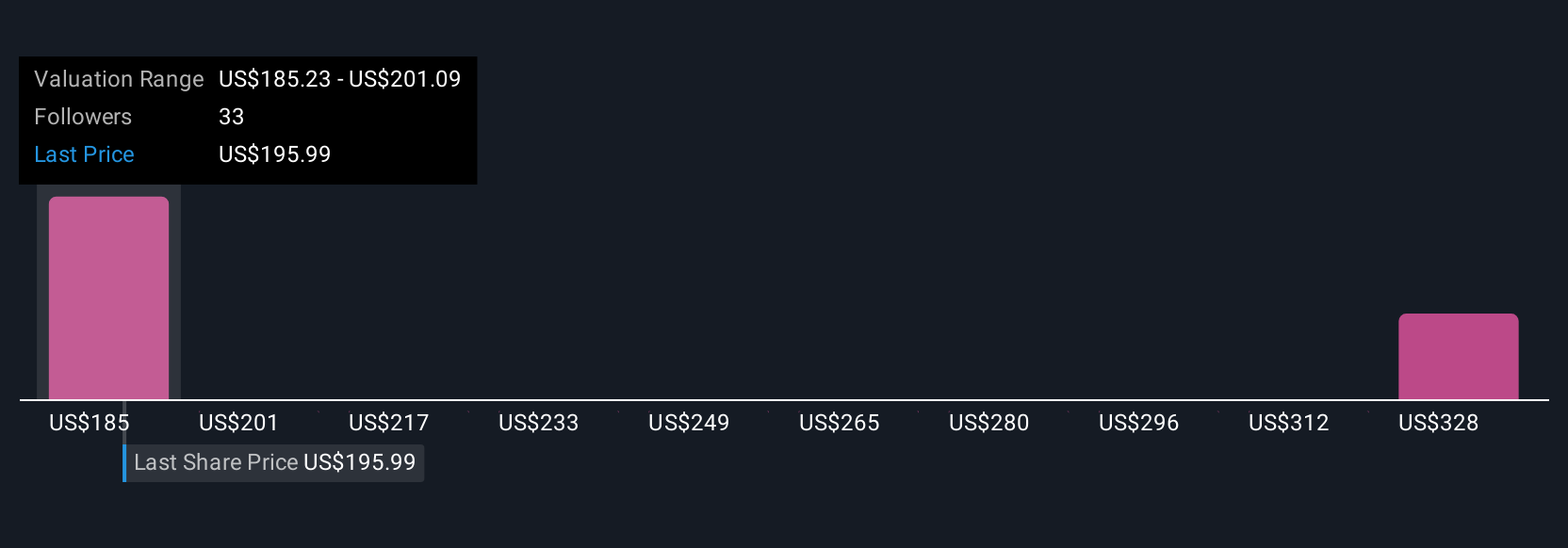

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. Simply put, a Narrative connects a company’s story, your perspective on where the business is headed, to real numbers like projected revenues, earnings, and profit margins. This results in a custom fair value estimate for the stock.

Narratives make investing personal and accessible, allowing you to anchor your investment decisions around your beliefs about PNC Financial Services Group’s future while using clear financial models. On the Simply Wall St Community page, millions of investors share their Narratives. Each narrative represents how investors interpret recent news, earnings, and strategy updates, and how these shape their outlook for fair value compared to the current price.

The power of Narratives is their ability to adapt. Every time fresh earnings data or news is released, your Narrative automatically updates, ensuring your fair value remains relevant. For example, some investors, seeing strong leadership and disciplined expense management, estimate PNC’s fair value as high as $238.0 per share. More cautious users, concerned about economic headwinds, see it closer to $186.0.

By building your own Narrative or reviewing others, you gain a dynamic framework for deciding whether to buy, hold, or sell, grounded in both rigorous analysis and individual conviction.

Do you think there's more to the story for PNC Financial Services Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives