- United States

- /

- Consumer Durables

- /

- NYSE:HBB

Uncovering US Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet over the past 12 months, it has experienced a 13% rise with earnings anticipated to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering undiscovered gems that may offer promising opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

China Yuchai International (CYD)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Yuchai International Limited, with a market cap of $912.07 million, operates through its subsidiaries to manufacture, assemble, and sell diesel and natural gas engines for various applications including trucks, buses, construction equipment, and marine uses in China and internationally.

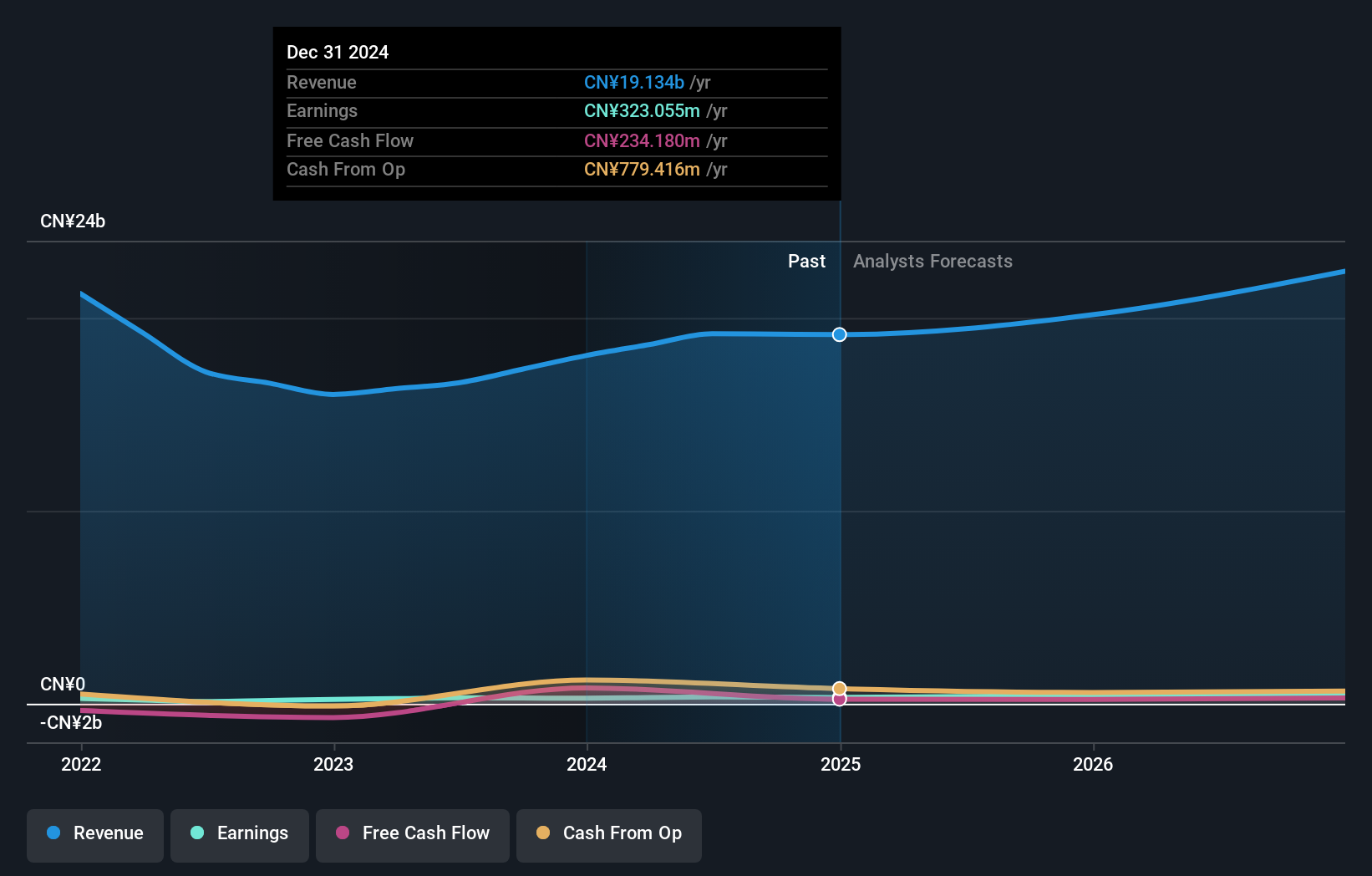

Operations: The company generates revenue primarily from its Yuchai segment, which accounted for CN¥19.10 billion, while HL Global Enterprises Limited contributed CN¥30.78 million. The focus on the Yuchai segment highlights its significance in the overall revenue model.

China Yuchai International, a notable player in the machinery sector, has seen its earnings grow by 13.1% over the past year, outpacing the industry's 0.4% growth. The company's price-to-earnings ratio of 20.3x is attractive compared to the industry average of 23.8x, suggesting it trades at good value relative to peers. With more cash than total debt and a debt-to-equity ratio rising from 17.8% to 20.4% over five years, financial stability remains solid despite increased leverage. Recent strategic moves include partnerships expanding ASEAN market presence and shelf registration filings for $43.76 million in common stock offerings tied to ESOP initiatives.

Hamilton Beach Brands Holding (HBB)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamilton Beach Brands Holding Company designs, markets, and distributes small electric household and specialty housewares appliances globally, with a market cap of $257.54 million.

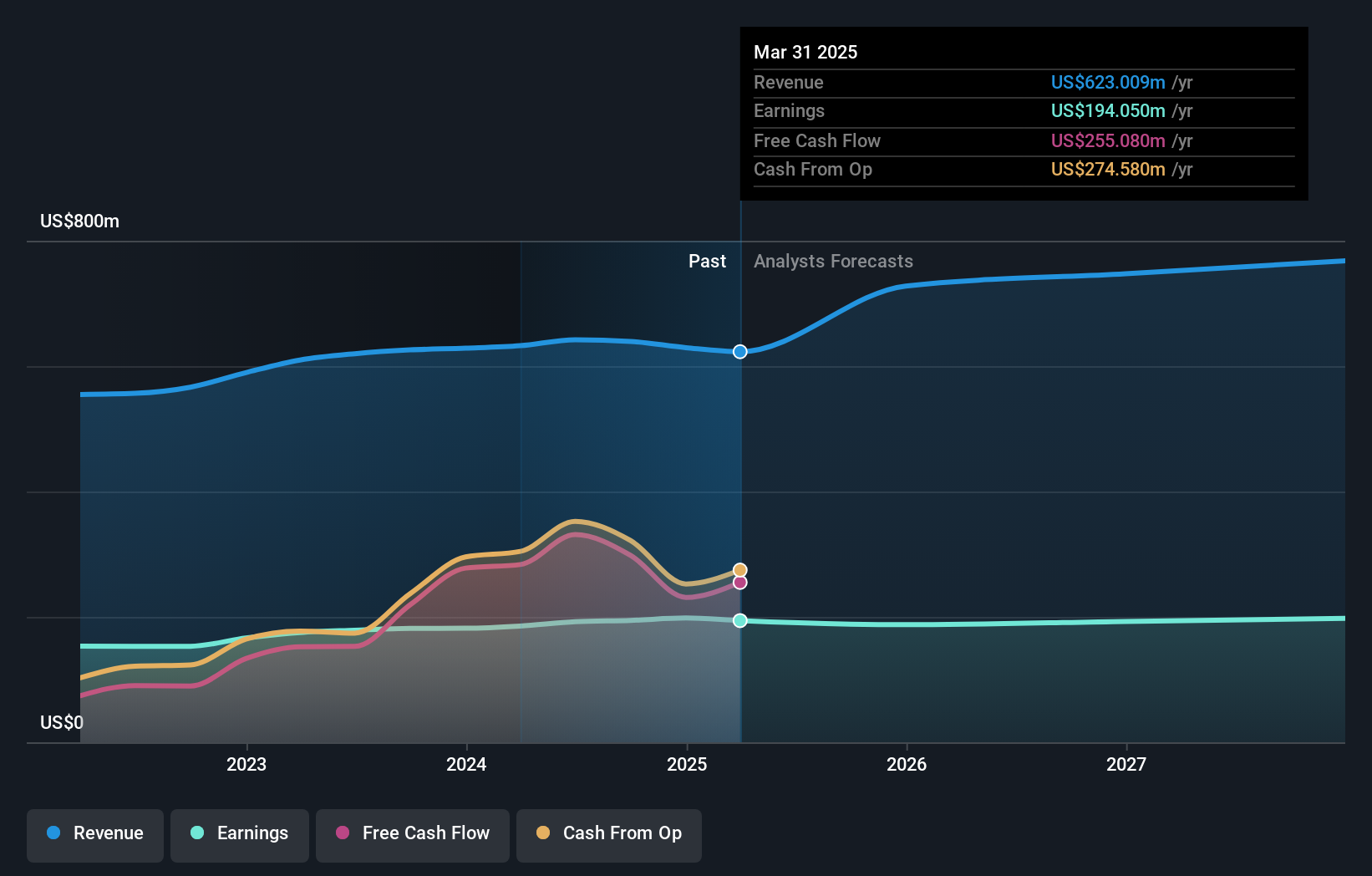

Operations: Hamilton Beach Brands Holding generates revenue primarily from its Home and Commercial Products segment, which accounts for $654.54 million, while the Health segment contributes $5.25 million.

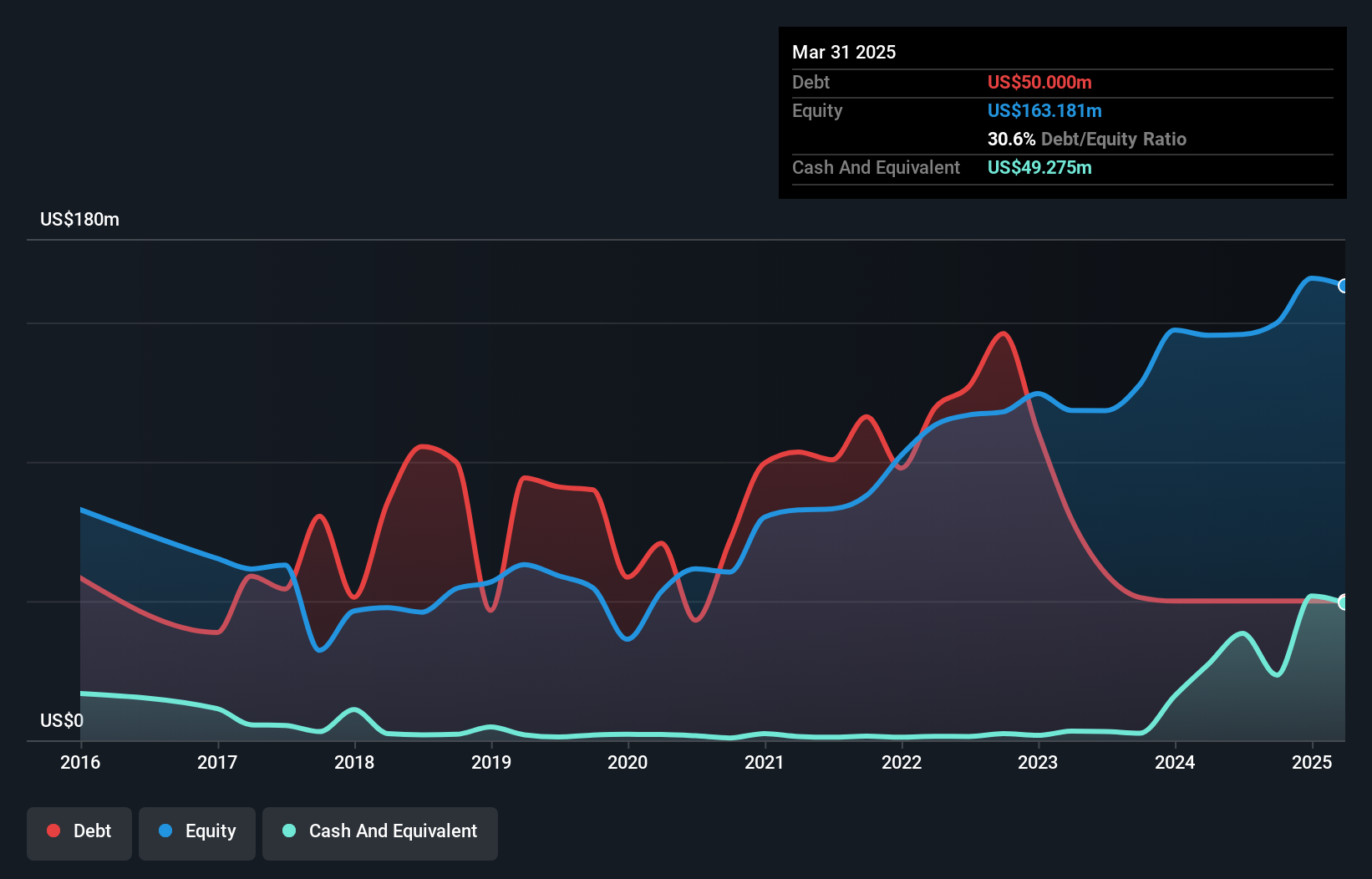

Hamilton Beach Brands Holding, a compact player in the consumer durables sector, has been making waves with its robust performance. The company recently reported earnings growth of 16.9%, outpacing the industry average of -3.3%. Trading at 69.3% below its estimated fair value, it presents a compelling value proposition for investors. Its debt management is commendable with a net debt to equity ratio at a satisfactory 0.4%, and interest payments are well covered by EBIT at an impressive 103.7 times coverage. Additionally, recent buybacks saw the repurchase of over 141,000 shares for US$2.68 million this year alone, signaling confidence in its future prospects.

OFG Bancorp (OFG)

Simply Wall St Value Rating: ★★★★★★

Overview: OFG Bancorp is a financial holding company offering diverse banking and financial services in the United States, with a market capitalization of approximately $2 billion.

Operations: OFG Bancorp generates revenue primarily through its Banking segment, contributing $471.99 million, followed by Treasury at $115.15 million and Wealth Management at $35.87 million. The company's net profit margin reflects its operational efficiency in managing costs relative to its income streams.

OFG Bancorp, with total assets of US$11.7 billion and equity of US$1.3 billion, stands out due to its robust financial health. The bank's total deposits amount to US$9.9 billion while loans reach US$7.7 billion, reflecting a solid lending base supported by a net interest margin of 5.6%. OFG shows prudent risk management with bad loans at just 1.1% and an allowance for bad loans at an impressive 207%. Recent moves include a share repurchase program worth up to US$100 million and quarterly dividends affirming shareholder returns, despite net income slipping slightly from last year’s figures.

Turning Ideas Into Actions

- Embark on your investment journey to our 278 US Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Beach Brands Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HBB

Hamilton Beach Brands Holding

Designs, markets, and distributes small electric household and specialty housewares appliances in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives