- United States

- /

- Banks

- /

- NYSE:OFG

Is Improved Credit Performance Shaping the Investment Case for OFG Bancorp (OFG)?

Reviewed by Simply Wall St

- OFG Bancorp recently reported its financial results for the second quarter ended June 30, 2025, highlighting net interest income of US$151.93 million and net income of US$51.8 million, alongside reduced net charge-offs of US$12.8 million.

- This improvement in credit performance, coupled with consistent profitability, reflects the company’s ability to manage loan quality while maintaining stable earnings.

- We’ll look at how improved net charge-offs may reinforce OFG Bancorp’s outlook for operational efficiency and credit quality progress.

OFG Bancorp Investment Narrative Recap

To own OFG Bancorp stock, an investor needs confidence in the company’s ability to manage credit quality in Puerto Rico’s unique economic climate, despite ongoing local risks and competition. The latest drop in net charge-offs, paired with steady profitability in Q2 2025, supports the company’s near-term outlook for operational efficiency and credit quality improvements. However, the overall impact on short-term catalysts and risks, such as heightened competition on lending and deposits, appears limited for now.

Among recent updates, the Q2 earnings announcement stands out, showing net interest income of US$151.93 million and net income of US$51.8 million, both slightly higher year-over-year. This performance, fueled partly by improved credit outcomes, ties directly to OFG’s ability to control loan losses, a key underpinning for sustaining earnings momentum as they continue expanding core lending and digital offerings.

Yet, despite these gains, investors should remain aware that rising competition from regional and Florida banks could pressure margins...

Read the full narrative on OFG Bancorp (it's free!)

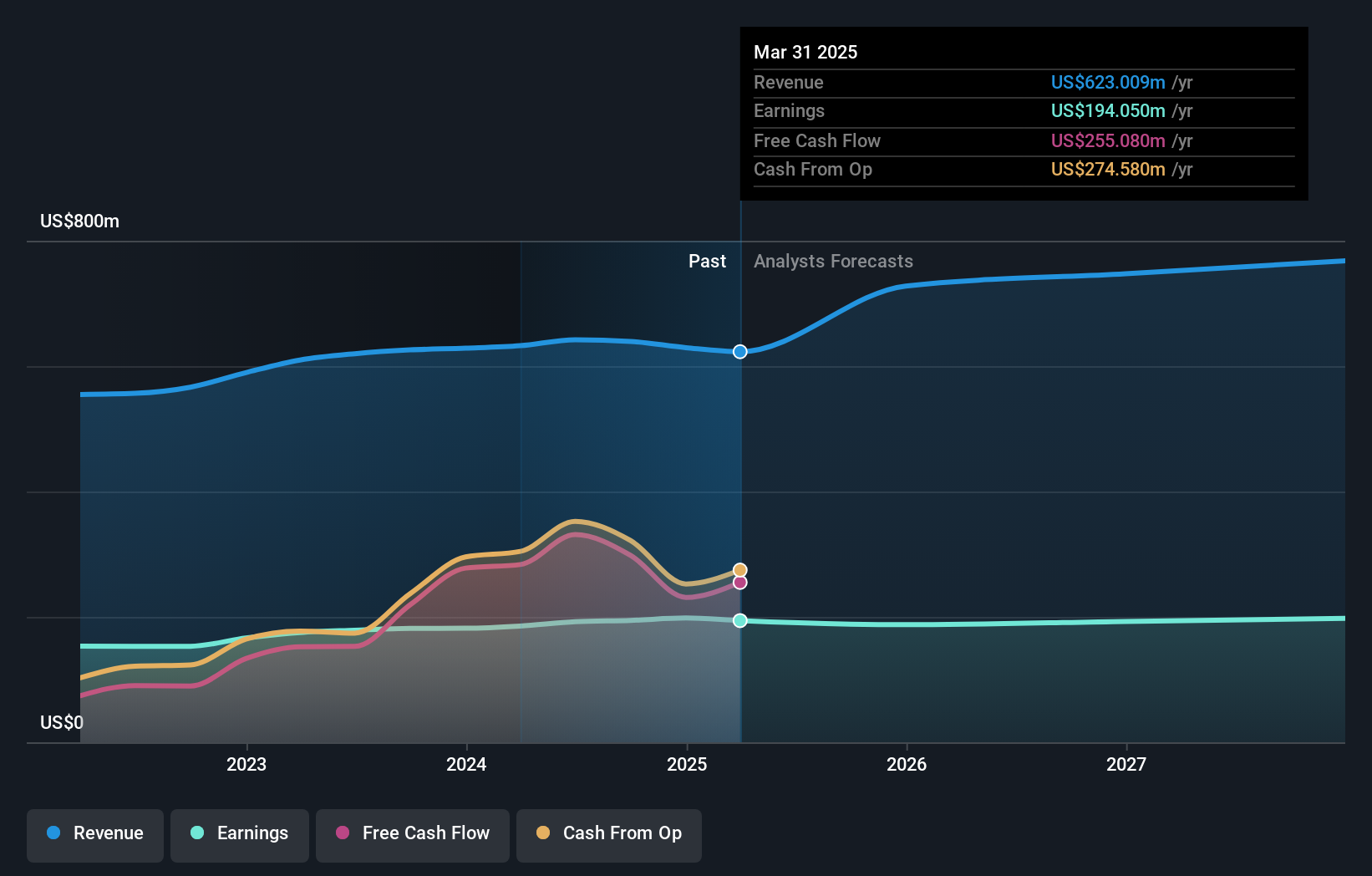

OFG Bancorp's narrative projects $828.3 million revenue and $204.3 million earnings by 2028. This requires 10.2% yearly revenue growth and an increase of $9.6 million in earnings from $194.7 million currently.

Uncover how OFG Bancorp's forecasts yield a $50.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assessed OFG Bancorp’s fair value between US$26.70 and US$50.00, based on two different outlooks. As competition intensifies on both lending and deposits, you can see how opinions on future profitability and risk can sharply diverge.

Build Your Own OFG Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OFG Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OFG Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OFG Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OFG

OFG Bancorp

A financial holding company, provides a range of banking and financial services in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives