- United States

- /

- Banks

- /

- NYSE:OBK

Origin Bancorp (OBK): Taking a Closer Look at Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

Origin Bancorp (OBK) shares have slid about 4% this past week, adding to a 7% decline over the past month. Investors are keeping a close eye on recent market trends and what they might mean for the outlook of the regional banking sector.

See our latest analysis for Origin Bancorp.

Origin Bancorp’s share price has lost some steam recently, coming off a sharp 13% slide over the past three months even as its total shareholder return for the past year remains positive at 3.8%. This shift suggests investors are becoming more cautious after an earlier period of optimism. Sentiment and valuation are both facing renewed scrutiny in today’s market environment.

If you’re weighing opportunities beyond regional banks, it could be a great time to widen your search and discover fast growing stocks with high insider ownership

With shares now trading at a notable discount to analyst estimates and strong fundamentals still in play, is Origin Bancorp presenting a compelling entry point for contrarian investors, or is the market wisely anticipating slowing growth ahead?

Most Popular Narrative: 25% Undervalued

With Origin Bancorp's fair value based on the consensus narrative coming in at $44, a significant gap has opened up from the last close of $32.98. Investors are watching closely as this divergence invites deeper scrutiny into what is powering such a bullish outlook among market observers.

Origin Bancorp's long-term positioning in high-growth Southern U.S. markets, including recent expansion efforts in Texas, Louisiana, Mississippi, and the Southeast region, positions the bank to benefit from robust regional population and business growth. This supports future increases in loan demand and revenue generation.

Think this optimism is just hype? The real story is hidden inside a handful of high-stakes financial forecasts, rapid geographic moves, and a profit transformation plan you will not want to miss. One detail in particular could flip the traditional valuation script. Click in to uncover the catalyst behind these sky-high analyst expectations.

Result: Fair Value of $44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory challenges and concentrated exposure to Southern markets could dampen Origin Bancorp’s earnings potential if economic conditions weaken or competition intensifies.

Find out about the key risks to this Origin Bancorp narrative.

Another View: Multiples Signal Market Hesitation

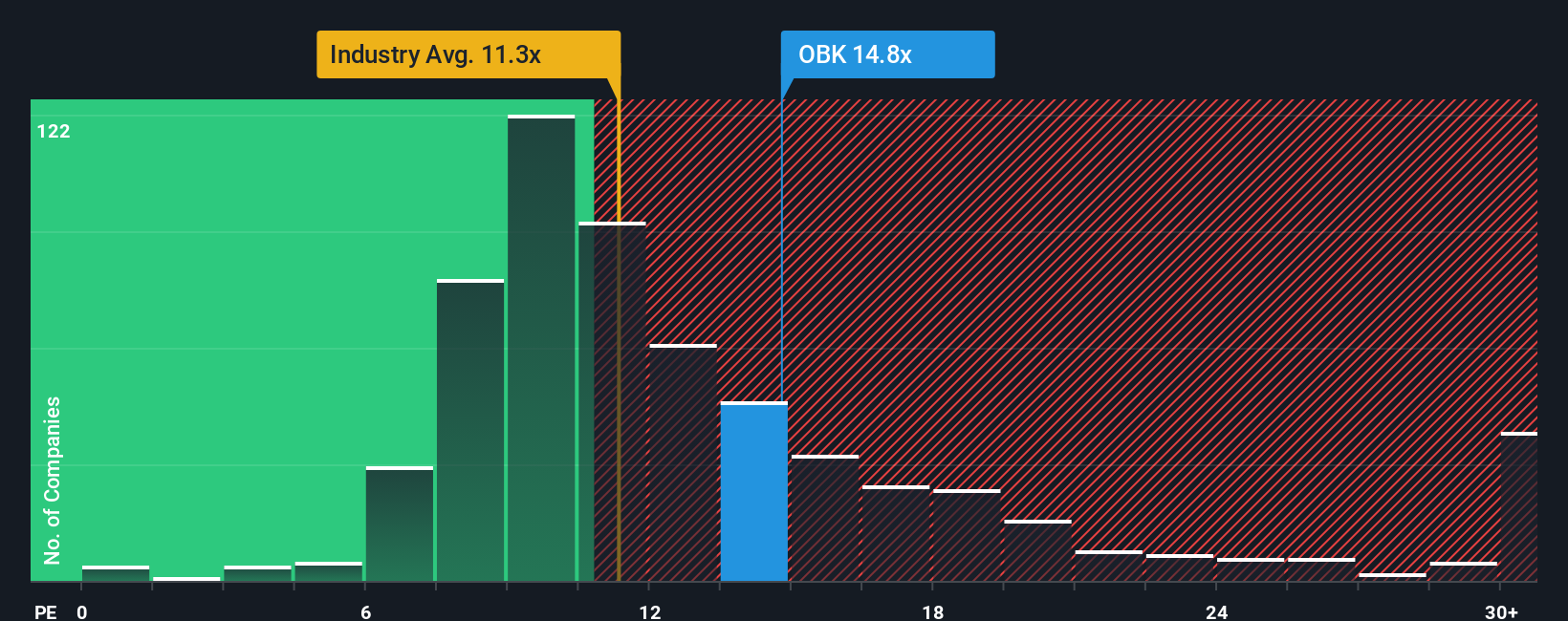

Taking a closer look at valuation using price-to-earnings ratios, Origin Bancorp trades at about 14.7 times earnings, which sits noticeably higher than both the US Banks industry average (11.3x) and its main peers (10.1x). The market’s pricing is also above the fair ratio of 14.2x, suggesting investors are assigning a premium, possibly for perceived growth or stability. However, this also invites greater expectation risk. Is the market getting ahead of itself, or does this confidence signal untapped upside despite lagging recent performance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Origin Bancorp Narrative

If you think there’s more to the story or want to run your own numbers, you can put together a full narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Origin Bancorp.

Looking for More Investment Ideas?

Don’t let a great opportunity pass you by. Use the Simply Wall Street Screener to pinpoint stocks with serious potential in just a few clicks.

- Tap into serious upside by following these 893 undervalued stocks based on cash flows that stand out for their attractive valuations and strong fundamentals in today’s unpredictable market.

- Stay ahead of health trends by checking these 33 healthcare AI stocks transforming diagnostics, treatments, and patient outcomes with smarter medical technology.

- Unleash the power of compounding returns with these 19 dividend stocks with yields > 3% that keep rewarding investors with yields above 3% and proven cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion