- United States

- /

- Banks

- /

- NYSE:OBK

Origin Bancorp (OBK): Reassessing Valuation After Its Recent Inclusion in the Russell 1000 Index

Reviewed by Simply Wall St

Origin Bancorp, Inc., a regional bank based in Ruston, Louisiana, was recently added to the Russell 1000 Index, a shift that could quietly reshape how larger institutions and index followers treat the stock.

See our latest analysis for Origin Bancorp.

That backdrop helps explain why investors have pushed Origin’s share price to about $39.76, with a 1 month share price return of 17.04 percent and a 1 year total shareholder return of 23.34 percent. This suggests momentum is building rather than fading.

If you are reassessing your financials exposure after Origin’s Russell 1000 move, it could be worth exploring fast growing stocks with high insider ownership as another way to spot emerging opportunities.

Yet with the shares trading just below analyst targets and our models still implying a sizable intrinsic discount, investors now face a key question: Is Origin Bancorp undervalued, or is the market already pricing in that growth?

Most Popular Narrative Narrative: 9.6% Undervalued

With Origin Bancorp last closing at $39.76 against a narrative fair value of $44.00, the story points to modest upside grounded in earnings power.

Analysts expect earnings to reach $175.5 million (and earnings per share of $5.58) by about September 2028, up from $69.9 million today. The analysts are largely in agreement about this estimate.

Want to see how such aggressive earnings expansion translates into today’s price tag and tomorrow’s potential? The narrative leans on bold margin gains and a strikingly lower future multiple. Curious how those moving parts fit together?

Result: Fair Value of $44.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commercial real estate concentration and mounting regulatory pressures could easily chip away at those bullish earnings and valuation assumptions.

Find out about the key risks to this Origin Bancorp narrative.

Another View: Multiples Flash a Warning

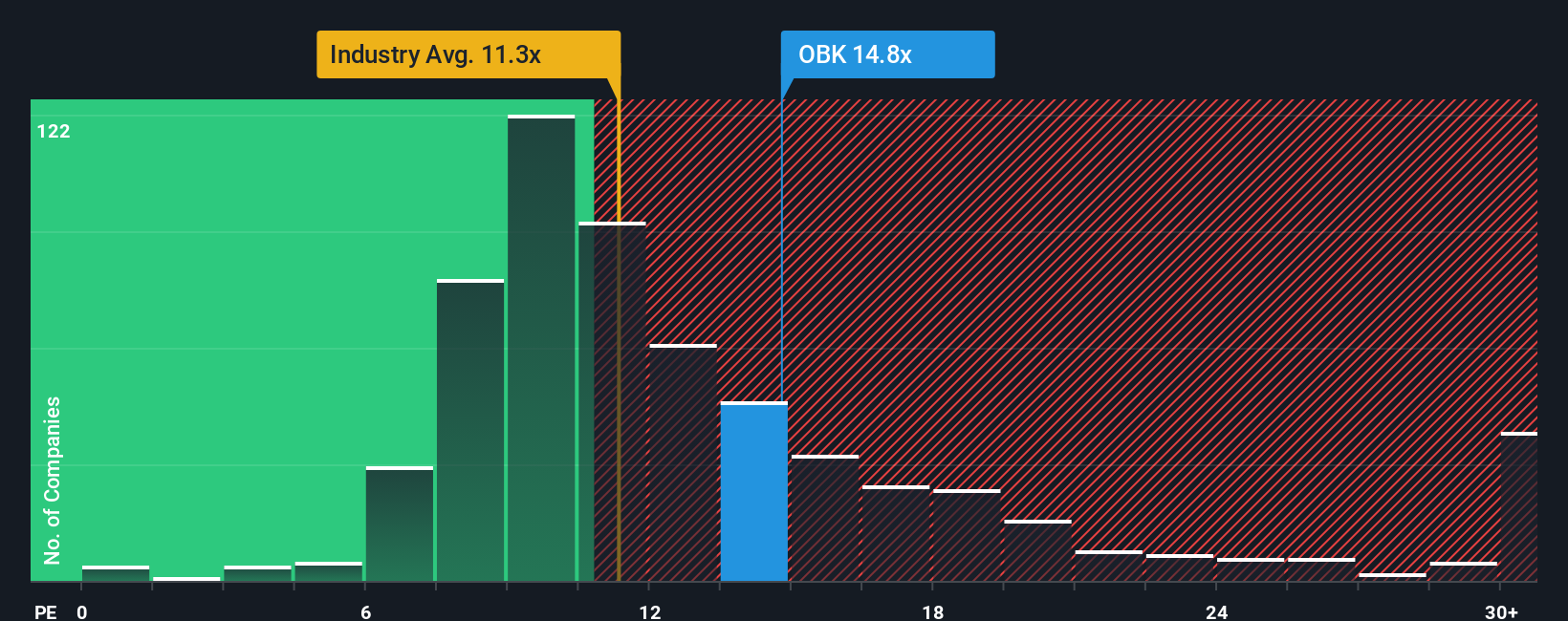

While narratives and intrinsic models hint at upside, the market’s basic yardstick tells a tougher story. Origin trades on a P E of 20.5 times, far richer than the US banks at 12 times, peers at 11.3 times, and even above its 16.1 times fair ratio. This leaves little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Origin Bancorp Narrative

If you see the story differently or just prefer getting hands on with the numbers, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Origin Bancorp.

Looking for your next investing edge?

Do not stop at Origin; the smartest moves come from comparing ideas, testing themes, and spotting patterns early across different corners of the market.

- Capture high-upside potential by scanning these 3629 penny stocks with strong financials that already show strong balance sheets and earnings quality.

- Capitalize on secular growth by targeting these 24 AI penny stocks positioned at the intersection of automation, data, and next generation software.

- Lock in value opportunities by focusing on these 917 undervalued stocks based on cash flows where prices still lag behind underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion