- United States

- /

- Banks

- /

- NYSE:OBK

Origin Bancorp (OBK) Margin Decline Reinforces Debate on Premium Valuation and Growth Narratives

Reviewed by Simply Wall St

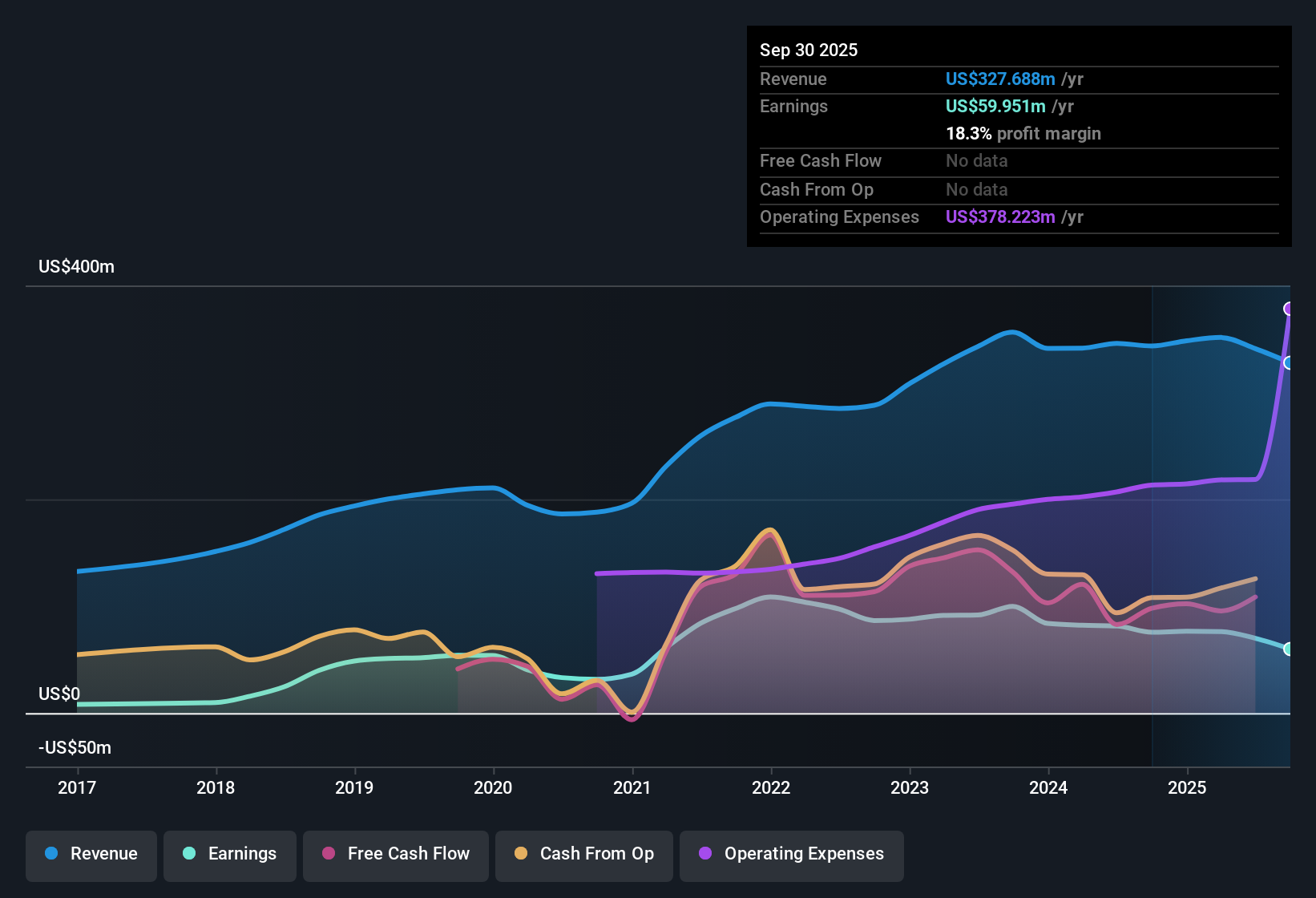

Origin Bancorp (NYSE:OBK) reported net profit margins of 20.5%, down from 23.5% a year ago. Earnings have risen at an annual rate of 3.7% over the past five years. Shares currently trade at $33.09, which is well below the company’s estimated fair value of $59.93. Looking ahead, OBK’s earnings are forecast to grow at 19.8% per year, which is above the broader US market expectation of 15.5% annual growth. However, with revenue growth projected to lag the market and margins coming under pressure, the results present a mixed but compelling picture for investors.

See our full analysis for Origin Bancorp.The next step is comparing these numbers against the most widely discussed narratives around OBK. Let’s see which themes hold up and which might need rethinking.

See what the community is saying about Origin Bancorp

Profit Margins Projected to Recover

- Analysts expect profit margins to rise from 20.5% today to 34.1% within three years, suggesting a significant recovery after the margin drop noted in the latest filing.

- According to the analysts' consensus view, initiatives like branch optimization and digital upgrades are expected to help reverse last year’s margin compression.

- Annualized pre-tax earnings improvement is already being delivered via streamlining, restructuring, and automation.

- However, rising regulatory and compliance costs could reduce fee income by around $6 million per year, acting as a counterbalance to these efficiency wins.

- Consensus view implies profit margins can recover despite digital and regulatory pressures, amplifying the stakes for these operational projects. 📊 Read the full Origin Bancorp Consensus Narrative.

Valuation Sits Above Peers Despite Discount to DCF Fair Value

- Origin Bancorp trades at a price-to-earnings ratio of 14.8x, higher than the US banks industry average (11.3x) and peer average (10.4x). Its $33.09 share price is well below the DCF fair value estimate of $59.93 and the analyst target of $43.00.

- Analysts' consensus narrative highlights how this valuation gap creates both opportunity and risk for investors.

- Trading below DCF fair value and consensus price targets could appeal to value-focused investors.

- But the premium to industry PE ratios raises questions about whether growth expectations can justify paying up for the stock right now.

Commercial Real Estate Exposure Clouds the Upside

- Commercial real estate and ADC loans make up 228% and 49% of total risk-based capital, levels that expose Origin Bancorp to heightened market and regulatory risks versus many peers.

- Analysts' consensus view underscores that while robust earnings growth is projected, heavy exposure to CRE could undermine long-term credit quality or pressure capital if regional market conditions weaken.

- This is especially relevant given mid-single digit loan growth guidance and recent deposit declines.

- These factors create a tension between anticipated top-line growth and the potential for future loan losses or regulatory capital actions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Origin Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your perspective and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Origin Bancorp.

See What Else Is Out There

Despite encouraging earnings forecasts, Origin Bancorp faces balance sheet risks from heavy commercial real estate exposure and mounting regulatory costs. These factors could threaten capital stability.

If you want greater peace of mind around financial robustness, now’s the time to check out solid balance sheet and fundamentals stocks screener (1982 results) and find companies built on stronger foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion