- United States

- /

- Banks

- /

- NYSE:OBK

Origin Bancorp (OBK): Exploring Valuation After Strong Profit Growth and Operational Restructuring

Reviewed by Simply Wall St

Origin Bancorp (OBK) has delivered a 10% uptick in annual revenue and an even stronger 30% jump in net income. This suggests the bank is steadily growing its profitability. Investors might be weighing these results against recent stock performance.

See our latest analysis for Origin Bancorp.

Origin Bancorp’s share price has gained 6.0% over the past month and stands at $34.81. This continues a steady year-to-date climb with a 4.5% share price return. While recent profit growth has helped sentiment, the three-year total shareholder return of -12.1% indicates that sustained momentum is still a work in progress for longer-term investors.

If solid financials and steady growth potential interest you, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 23% below average analyst price targets and company fundamentals showing improvement, the question remains: is Origin Bancorp undervalued, or has the market already factored in all the upside potential?

Most Popular Narrative: 20.9% Undervalued

Origin Bancorp’s fair value, according to the most widely followed narrative, stands at $44 per share. This compares to the recent closing price of $34.81. This sizeable gap suggests analysts see much more upside if the company meets growth expectations over the coming years.

Ongoing optimization initiatives (Optimize Origin), such as branch network streamlining, organizational restructuring, and FTE reductions, are already delivering significant annualized pre-tax earnings improvement and are expected to further lower costs and improve earnings growth.

Curious what aggressive, behind-the-scenes cost moves could mean for investor returns? The whole narrative hinges on a radical transformation of margins and operational efficiency that could flip conventional forecasts upside down. See what future metrics are expected to be achieved, and why some analysts believe that is the real story behind this 20% discount.

Result: Fair Value of $44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as persistent competition from fintechs or regional slowdowns could quickly shift the outlook for Origin Bancorp despite current optimism.

Find out about the key risks to this Origin Bancorp narrative.

Another View: Price Multiples Raise Doubts

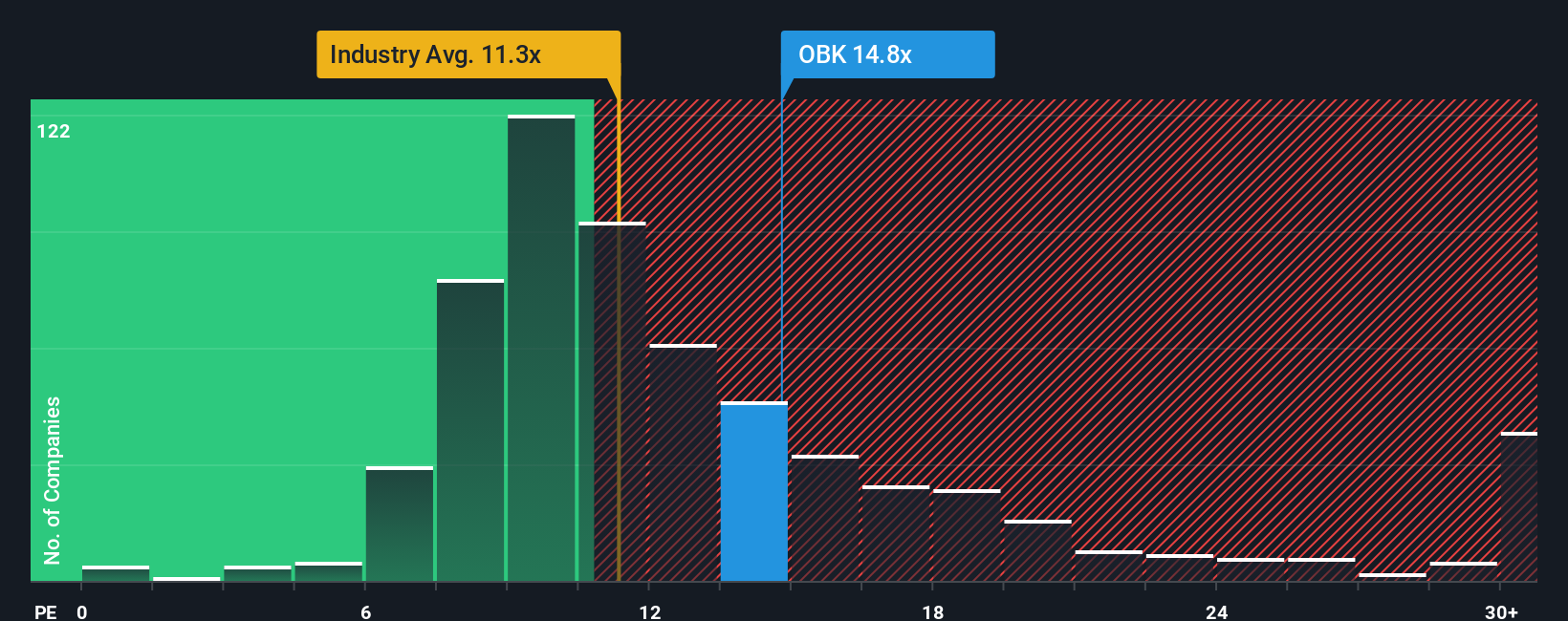

While Origin Bancorp looks undervalued from an earnings growth and DCF perspective, a closer look at its price-to-earnings ratio shows a different angle. The company trades at 18x earnings, which is notably higher than both the US Banks industry average of 11.2x and its peer group’s 10.2x. Even compared to the fair ratio of 15.1x, the stock carries a premium. Does this premium signal a valuation risk, or does the market see something others might be missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Origin Bancorp Narrative

If you see things differently, or want to dig into Origin Bancorp’s numbers yourself, you can craft your own narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Origin Bancorp.

Looking for More Investment Ideas?

Don’t let the next opportunity slip through your fingers. Put your money to work by pursuing unique strategies tailored to the latest market themes. There is so much more waiting beyond a single stock.

- Capitalize on high-yield opportunities by targeting stable businesses in these 16 dividend stocks with yields > 3%. This approach may give your portfolio a potential income boost.

- Catch the AI-driven surge with these 26 AI penny stocks, which are powering the evolution of data, automation, and emerging tech trends.

- Ride the momentum in digital assets through these 82 cryptocurrency and blockchain stocks and get ahead as blockchain shapes the next generation of financial innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives