- United States

- /

- Banks

- /

- NYSE:OBK

Origin Bancorp (OBK): Evaluating Valuation After Fed Rate Cut Sparks Sector Rally

Reviewed by Kshitija Bhandaru

If you have been keeping an eye on Origin Bancorp (OBK) lately, you probably noticed the share price moving higher alongside its regional bank peers. The spark? The Federal Reserve’s recent decision to trim its benchmark interest rate by 25 basis points and indicate that more rate cuts could be on the horizon. In a sector sensitive to rate trends, this move helped shift Wall Street sentiment and prompted investors to scoop up shares of banks like Origin that could benefit if borrowing costs move lower.

Momentum has been building for Origin Bancorp throughout the year, especially following the Federal Reserve’s announcement. Despite some setbacks, including a board resignation and new concerns over credit losses after a customer bankruptcy, the stock’s 12% gain over the past year suggests renewed optimism. Institutional investors have stayed active by adjusting their positions, and the year-to-date performance indicates that buyers are returning even though the longer-term three-year trend has been more volatile.

With these changes underway, the real question for investors is whether Origin Bancorp’s recent increase signals an undervalued opportunity or if the market has already priced in the bank’s expected earnings growth and policy tailwinds.

Most Popular Narrative: 18.8% Undervalued

The prevailing narrative suggests that Origin Bancorp remains significantly undervalued relative to its projected fair value, with analysts forecasting notable upside potential if current assumptions are met.

Origin Bancorp's long-term positioning in high-growth Southern U.S. markets, including recent expansion efforts in Texas, Louisiana, Mississippi, and the Southeast region, positions the bank to benefit from robust regional population and business growth. This supports future increases in loan demand and revenue generation. Targeted investments in digital banking platforms, automation, and data management, including strategic projects leveraging robotics and AI, are set to improve operational efficiency, enhance customer acquisition, and reduce expenses. These changes may contribute to higher net margins over time.

Curious about what underpins this bold valuation? Behind the scenes, analysts are betting on rapid financial growth and efficiency moves that could set a new standard for regional banks. Want to see what assumptions drive such high expectations for profits and margins? Dive deeper into the details that could change the way you look at OBK’s future.

Result: Fair Value of $44.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy exposure to regional real estate and rising digital competition could challenge Origin Bancorp's growth and put pressure on margins if conditions worsen.

Find out about the key risks to this Origin Bancorp narrative.Another View: Market-Based Comparison

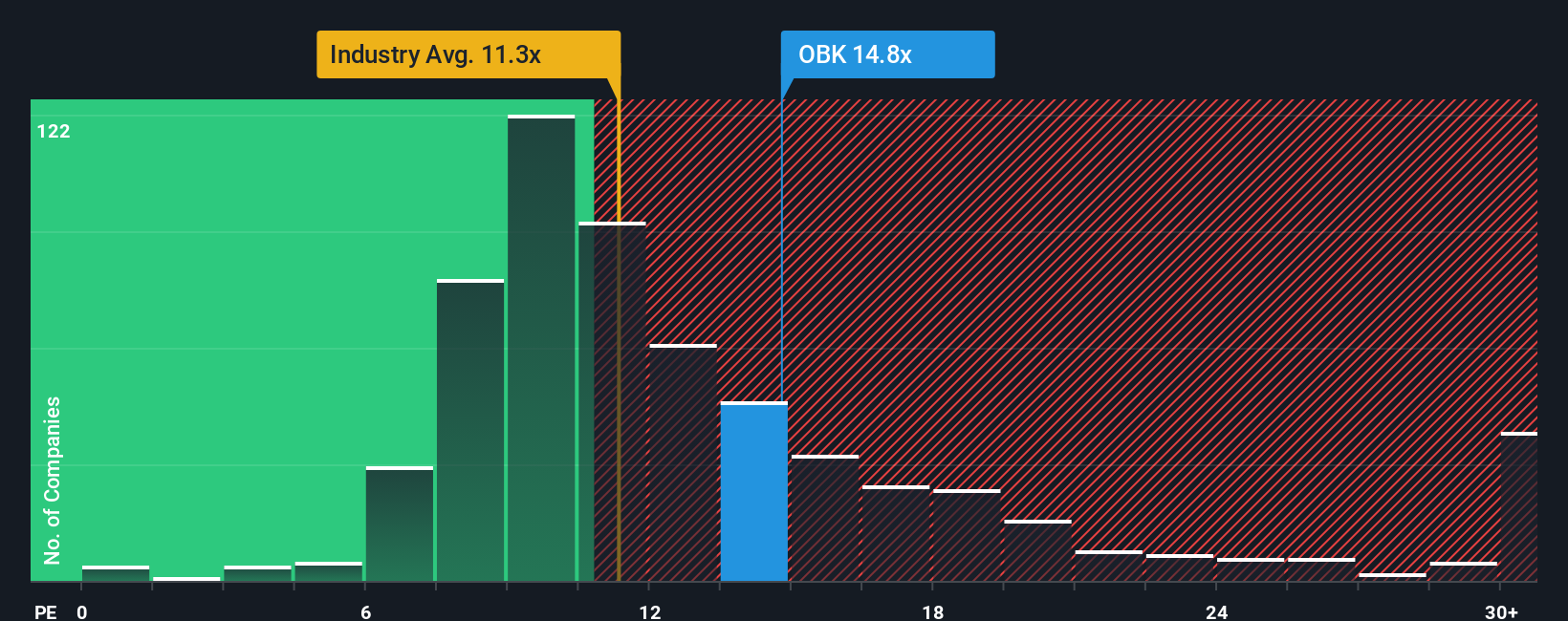

Looking at the market’s standard price-to-earnings yardstick, Origin Bancorp actually comes across as pricier than most other U.S. banks in this sector. Does the market see hidden strengths that analysts may have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Origin Bancorp to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Origin Bancorp Narrative

If you have your own perspective or would rather dig into the numbers yourself, it’s easy to craft your own take on Origin Bancorp in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Origin Bancorp.

Looking for more ways to supercharge your investing?

Don't settle for the ordinary. Expand your portfolio potential by uncovering stocks with strong financials, game-changing technology, or reliable income streams using these hand-picked shortcuts on Simply Wall Street.

- Spot undervalued gems that could be hidden beneath the radar by tapping into our undervalued stocks based on cash flows quick-pick.

- Zero in on innovative companies transforming healthcare with artificial intelligence by browsing our healthcare AI stocks stock alert.

- Grow your long-term returns with companies offering robust yields by scanning our latest dividend stocks with yields > 3% selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion