- United States

- /

- Banks

- /

- NYSE:OBK

Origin Bancorp (OBK): Assessing Valuation Following Strong Q3 Results and Notable Insider Buying

Reviewed by Simply Wall St

Origin Bancorp (OBK) caught investors’ attention after sharing strong Q3 results, including a notable jump in pretax pre-provision ROA and double-digit revenue growth. Insider buying trends are also signaling confidence from within the company.

See our latest analysis for Origin Bancorp.

Origin Bancorp’s latest share price of $35.45 reflects a pickup in momentum, supported by solid Q3 results and recent insider buying. After a steady year, the 30-day share price return stands out at 7.5%, and while its 1-year total shareholder return is just under 1%, longer-term holders have seen a 46% gain over five years. This provides evidence of the bank’s ability to navigate an ever-changing environment.

If Origin Bancorp’s recent moves have you looking to expand your watchlist, it might be a great moment to discover fast growing stocks with high insider ownership.

With robust results and insiders showing strong support, does Origin Bancorp’s current share price still offer value to new investors, or is the market already factoring in its future growth potential?

Most Popular Narrative: 19.4% Undervalued

Origin Bancorp’s most followed narrative signals a fair value well above the current price, with valuation driven by ambitious projections for earnings and margin expansion. Investors are watching closely to see whether these forecasts will be met or exceeded.

“Targeted investments in digital banking platforms, automation, and data management, including strategic projects leveraging robotics and AI, are set to improve operational efficiency, enhance customer acquisition, and reduce expenses. These factors are expected to contribute to higher net margins over time.”

Curious about which bold financial targets and operational upgrades are powering this high fair value estimate? The narrative hinges on aggressive growth, margin improvements, and efficiency leaps that could redefine Origin Bancorp’s future. Unlock the underlying assumptions and find out what’s fueling the optimism.

Result: Fair Value of $44.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to commercial real estate loans and increased regulatory costs could challenge Origin Bancorp’s ability to fully deliver on those bullish forecasts.

Find out about the key risks to this Origin Bancorp narrative.

Another View: Are Valuation Ratios Sending a Different Signal?

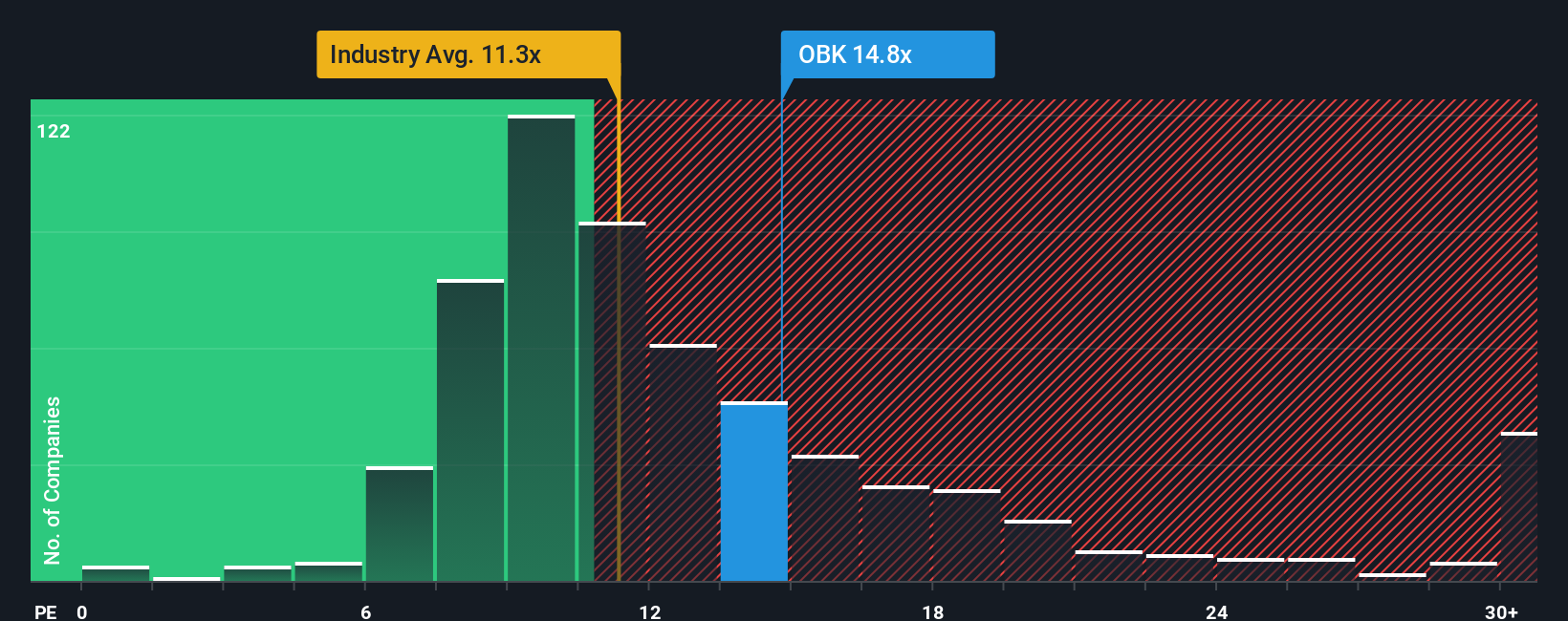

While fair value estimates suggest Origin Bancorp is undervalued, its price-to-earnings ratio of 18.3x is noticeably higher than both the peer average of 10.2x and the US Banks industry average of 11.1x. The fair ratio, based on market trends, is 15.1x. This premium could mean investors are paying up for expected growth, but it also introduces valuation risk if those expectations are not met. Will the market continue to reward optimism or could sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Origin Bancorp Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own Origin Bancorp story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Origin Bancorp.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Switch up your perspective and discover where smart capital is flowing next with these handpicked stock ideas from Simply Wall St:

- Uncover stable income streams by targeting high-yield opportunities through these 16 dividend stocks with yields > 3% packed with companies offering strong and consistent dividends.

- Tap into the potential of tomorrow's game-changers by tracking these 25 AI penny stocks focused on companies transforming industries with artificial intelligence breakthroughs.

- Secure an edge in market value by focusing on these 876 undervalued stocks based on cash flows that could offer upside based on their robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives