- United States

- /

- Banks

- /

- NYSE:NU

U.S. Bank Charter Application and New Board Might Change the Case For Investing In Nu Holdings (NU)

Reviewed by Sasha Jovanovic

- Nu Holdings recently announced that it has applied for a U.S. national bank charter with the Office of the Comptroller of the Currency, a move backed by the formation of a new U.S. board led by former Central Bank of Brazil President Roberto Campos Neto.

- This development marks Nu Holdings' intent to expand beyond Latin America and signals a potential transformation into a global digital banking provider, supported by executive talent with significant regulatory expertise.

- We'll explore how the OCC charter application and new leadership could shape Nu Holdings' future growth and global ambitions.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Nu Holdings Investment Narrative Recap

To own Nu Holdings, I believe you need to have confidence in its ability to convert Latin America's digital banking momentum into global growth, especially as the bank now targets the competitive U.S. market. While the OCC bank charter application confirms its global ambitions, the most immediate catalyst remains sustained customer and revenue growth in core markets; however, regulatory hurdles and compliance costs in new geographies are now a more pressing risk, but the impact will depend on the pace and outcome of U.S. regulatory approvals.

Of the recent announcements, the appointment of a new U.S. board, headed by former Central Bank of Brazil President Roberto Campos Neto, stands out. This move directly supports Nu Holdings' compliance-first approach in entering the U.S. and strengthens oversight as the company manages complex operational and regulatory demands linked to its global scaling ambitions.

Yet, as impressive as the expansion is, investors should focus on the growing regulatory complexity that comes with entering new markets, especially since...

Read the full narrative on Nu Holdings (it's free!)

Nu Holdings' outlook forecasts $33.0 billion in revenue and $6.1 billion in earnings by 2028. This projection assumes a 78.1% annual revenue growth rate and represents a $3.8 billion increase in earnings from the current $2.3 billion.

Uncover how Nu Holdings' forecasts yield a $16.99 fair value, a 12% upside to its current price.

Exploring Other Perspectives

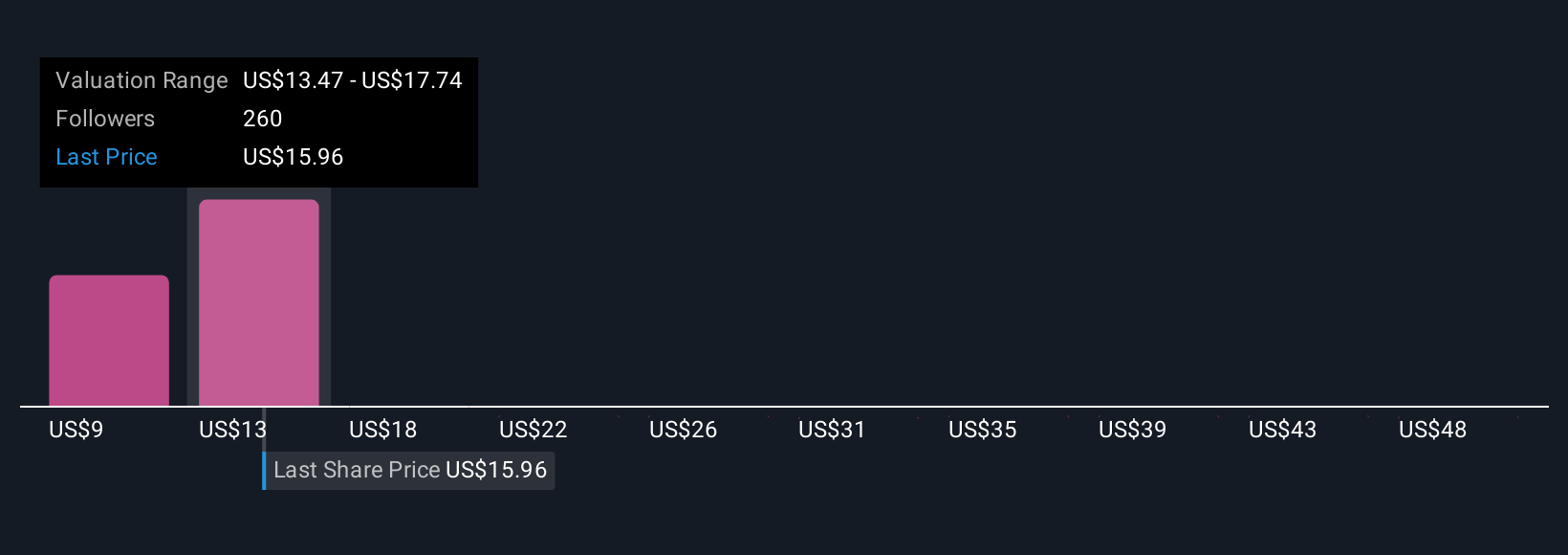

Fair value estimates from 45 Simply Wall St Community members stretch from US$9.30 to US$59.35 per share, showing broad opinion diversity. With regulatory exposure heightened by the U.S. entry, you might want to compare these views before deciding where you stand.

Explore 45 other fair value estimates on Nu Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Nu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nu Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives