- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU): Exploring Valuation as Shares Approach Multi-Year Highs

Reviewed by Kshitija Bhandaru

See our latest analysis for Nu Holdings.

Nu Holdings is drawing renewed attention as its share price remains just off multi-year highs, reflecting growing optimism about the company’s trajectory. Over the past year, the stock’s 3.8% total shareholder return, paired with momentum building from a strong 41% year-to-date share price return, underscores how sentiment has shifted in its favor recently, even as short-term volatility persists.

If you’re curious to discover what else is gaining traction right now, now is an ideal time to broaden your search and see which other fast-growing stocks with high insider ownership are on the move. fast growing stocks with high insider ownership

With Nu Holdings trading just below analyst price targets despite strong fundamentals and impressive long-term returns, investors are left wondering if a potential bargain is being overlooked or if upbeat forecasts are already reflected in the current price.

Most Popular Narrative: 11.7% Undervalued

Nu Holdings closed at $15.00, with the most popular narrative placing fair value at $16.99. This notable gap has caught investor attention. The following perspective helps explain the optimism fueling this estimate.

The rapid growth of Latin America's digitally native population, combined with expanding smartphone and internet adoption, is creating a sustained surge in demand for Nu's app-based financial services. This fuels long-term customer acquisition, higher engagement, and drives topline revenue growth.

Want the full growth story behind this bold valuation? One key driver is expected to reshape the future earnings profile, and it is not what most investors would guess. Record-breaking expansion, innovative fintech bets, and surprising profit assumptions all combine in a narrative that might challenge your expectations. Dive in to uncover the details that set this forecast apart.

Result: Fair Value of $16.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from digital rivals and regulatory hurdles in Latin America could present challenges to Nu Holdings' rapid growth and test its ability to sustain margins.

Find out about the key risks to this Nu Holdings narrative.

Another View: Challenging the Optimism

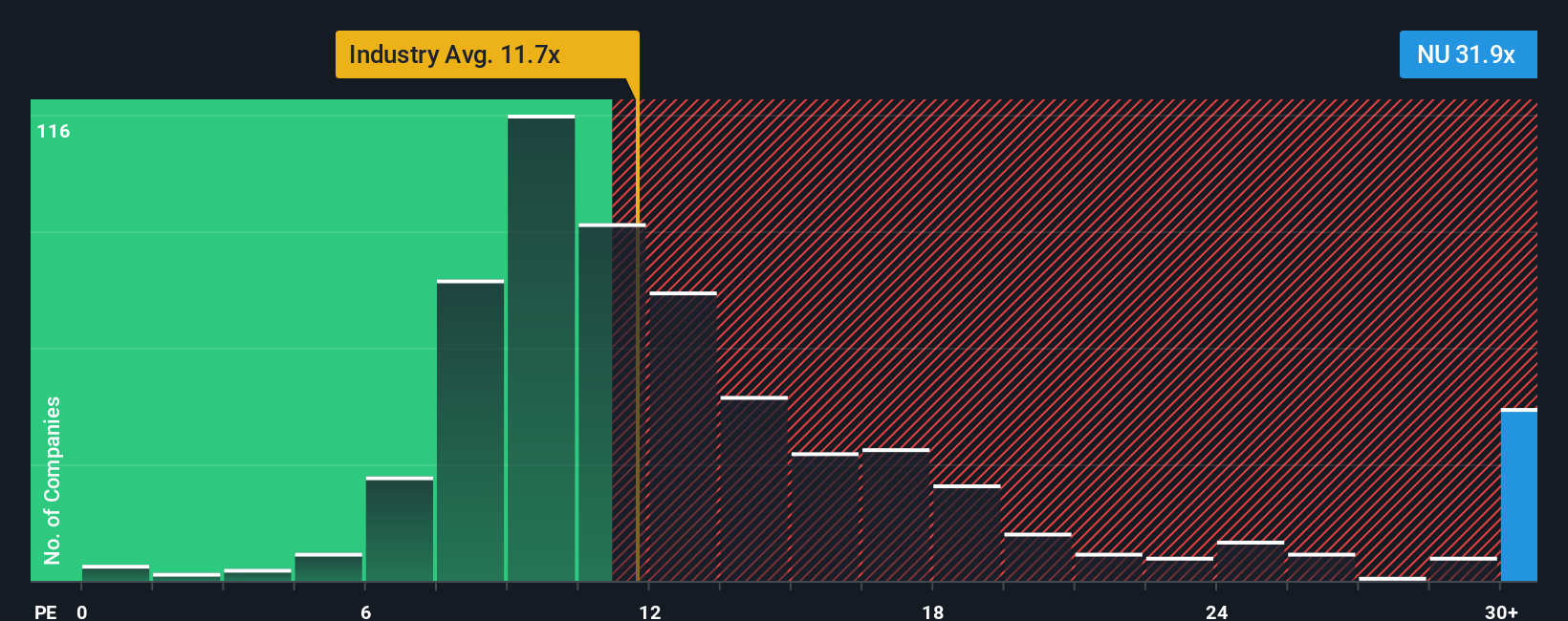

Looking at Nu Holdings through the lens of earnings multiples offers a more cautious perspective. The company's current price-to-earnings ratio is 31.5x, which is nearly triple the US Banks industry average of 11.2x, and also much higher than both the peer average of 11x and its fair ratio of 22.6x. This significant premium means the market is pricing in a lot of future growth, increasing the risk if results fall short. Is the optimism fully justified, or do these expectations set the bar too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

Keep in mind, if your perspective differs or you want to analyze the numbers firsthand, you can craft your own narrative in just a few minutes: Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Want More Winning Investment Ideas?

Seize your investing edge now by tapping into fast-rising opportunities across the market. Use these tailored screens to find promising stocks before others catch on.

- Spot emerging industries by seeing which companies are making waves in artificial intelligence using these 24 AI penny stocks.

- Unlock steady cash flow potential when you check out these 18 dividend stocks with yields > 3% with yields above 3%, helping you build reliable income.

- Act early on undervalued gems that the market may have overlooked by sorting through these 877 undervalued stocks based on cash flows based on intrinsic cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives