- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU) Appoints Renowned Economist Campos Neto To Management Team And Board

Reviewed by Simply Wall St

Nu Holdings (NYSE:NU) witnessed a 30% price increase over the last month, coinciding with the significant upcoming appointment of former Brazilian Central Bank President Roberto Campos Neto. Starting July 1, 2025, his new roles at Nubank, a subsidiary, include Vice Chairman and Global Head of Public Policy. This development has possibly added weight to Nu Holdings’ upward momentum amidst a flat overall market context, where global stocks exhibited mixed movements in anticipation of interest rate decisions. The appointment could position Nu for growth, spotlighting its international ambitions amid market fluctuations.

Be aware that Nu Holdings is showing 1 weakness in our investment analysis.

The recent appointment of Roberto Campos Neto as Vice Chairman and Global Head of Public Policy at Nubank may further strengthen Nu Holdings' global positioning and boost investor confidence, which has already driven a notable 30% share price increase over the last month. This news aligns with the company's strategy to expand into secured lending and diversify its product offerings, potentially enhancing profitability and financial resilience. The expansion into new markets and products could propel revenue and earnings growth, but execution risks remain as market penetration and consumer adoption are still uncertain.

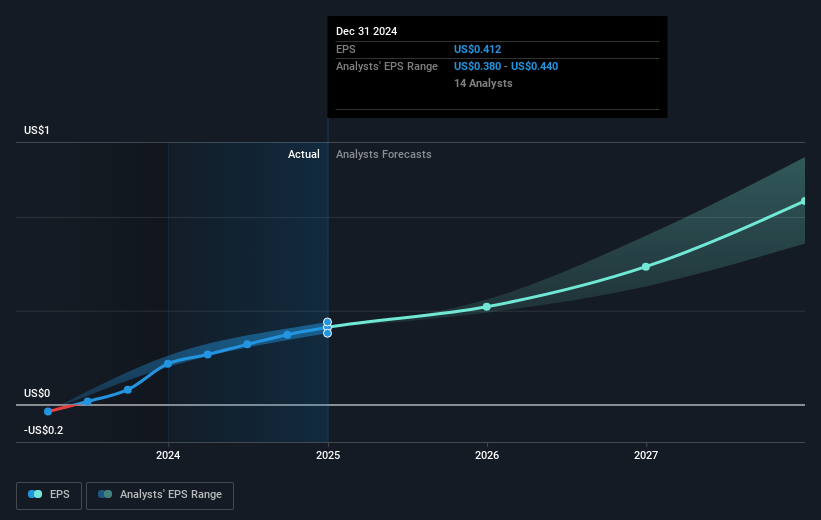

Over the last three years, Nu Holdings achieved a total shareholder return of 184.67%, highlighting substantial longer-term value creation compared to its recent short-term gains. However, the company's recent performance lags behind both the US market, which returned 7.2%, and the US Banks industry, which returned 15.8% over the past year. Analysts project revenue growth of 68.4% annually over the next three years, although profit margins may decrease from 35.8% to 20.5%, partially due to these ambitious expansion efforts.

The current share price of US$12.41 is trading below the consensus analyst price target of US$14.21, representing a 12.7% potential upside if these growth trajectories are realized. As the company continues to commit to investing in technology and services to maintain low service costs, it will be crucial for long-term investors to consider both the risks and potential gains that come with such growth initiatives.

Our valuation report unveils the possibility Nu Holdings' shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives