- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NU) Is Up 8.6% After Amazon Brazil Partnership and Record Q3 Results – What's Changed

Reviewed by Sasha Jovanovic

- Nu Holdings recently presented at the Bloomberg New Economy Forum in Singapore, announcing a partnership with Amazon Brazil to integrate NuPay and highlighting its record Q3 2025 results, with net income reaching US$783 million and a growing customer base of 127 million.

- This collaboration with Amazon further advances Nu’s presence in digital payments, while extensive customer growth underscores its position in Latin America’s evolving fintech landscape.

- We'll explore how the Amazon Brazil partnership may strengthen Nu Holdings' investment narrative through expanding digital payments reach.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Nu Holdings Investment Narrative Recap

To be a Nu Holdings shareholder, an investor needs to believe in the continued rise of digital banking and payment adoption across Latin America, fueled by technology and a large, underbanked population. The recent Amazon Brazil partnership and record Q3 2025 earnings reinforce Nu’s growth story, and may boost its payments reach, yet the primary short-term catalyst remains rapid digital payments adoption, while the top risk is increasing exposure to subprime credit markets; this news does not materially alter either dynamic.

One of the most relevant recent developments is Nu’s appointment of Roberto Campos Neto, former President of the Central Bank of Brazil, to its board and as Global Head of Public Policy. This move signals a deeper focus on regulatory expertise just as the company expands partnerships and enters new markets, aligning closely with both expansionary catalysts and evolving compliance challenges.

In contrast, investors should be aware that rising loan exposure to riskier credit segments means that if economic conditions worsen or rates rise …

Read the full narrative on Nu Holdings (it's free!)

Nu Holdings' narrative projects $33.0 billion in revenue and $6.1 billion in earnings by 2028. This requires 78.1% yearly revenue growth and a $3.8 billion increase in earnings from $2.3 billion today.

Uncover how Nu Holdings' forecasts yield a $17.98 fair value, a 4% upside to its current price.

Exploring Other Perspectives

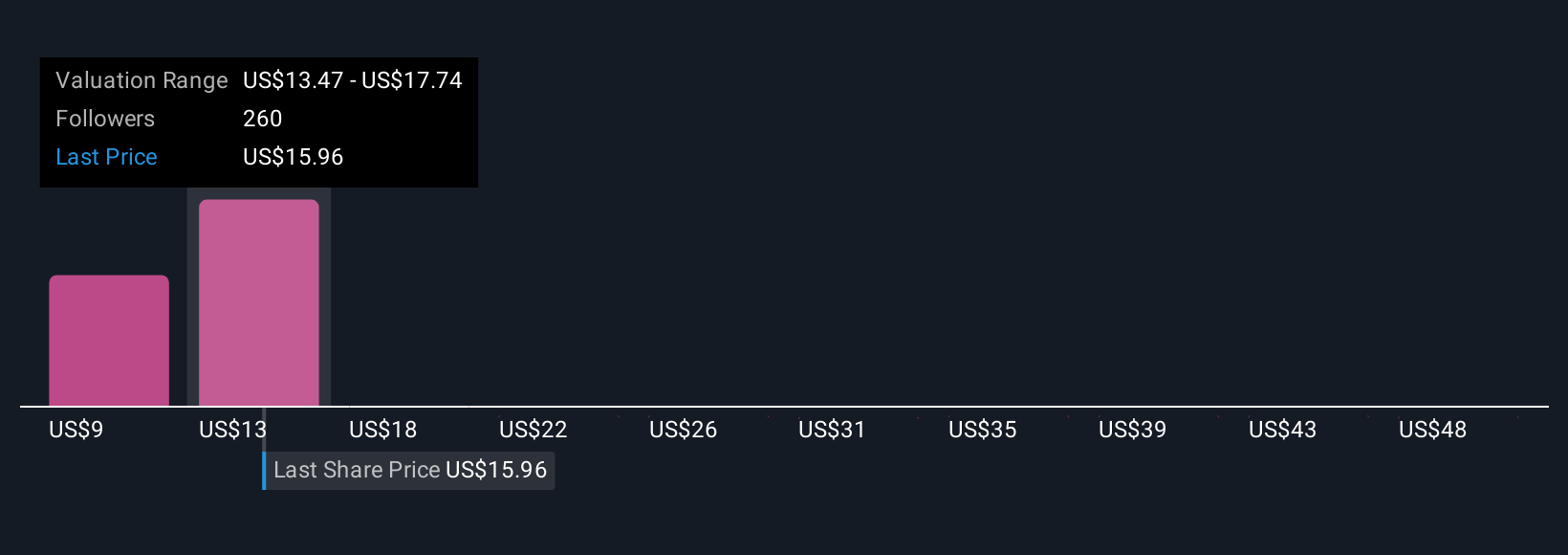

Simply Wall St Community members produced 28 fair value estimates for Nu Holdings spanning US$10.15 to US$22.84 per share. While expectations for ongoing digital payment adoption remain strong, opinions on valuation and growth potential differ sharply, prompting you to consider multiple viewpoints before making decisions.

Explore 28 other fair value estimates on Nu Holdings - why the stock might be worth 41% less than the current price!

Build Your Own Nu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nu Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.