- United States

- /

- Banks

- /

- NYSE:NU

A Look at Nu Holdings (NYSE:NU) Valuation as It Applies for U.S. Bank Charter and Expands Board

Reviewed by Kshitija Bhandaru

Nu Holdings (NYSE:NU) is taking a major leap in its global journey, having just applied for a national bank charter with U.S. regulators. The announcement comes alongside new high-profile board appointments and highlights the company's strategy for U.S. market growth.

See our latest analysis for Nu Holdings.

Momentum has been steadily building for Nu Holdings this year, with the company’s 44.6% year-to-date share price return and a 268.6% total shareholder return over three years. This reflects growing investor conviction about its global growth strategy. Recent news, from applying for a U.S. bank charter to assembling a high-profile board, further amplifies this positive sentiment and positions Nu as a formidable force in digital banking both in Latin America and abroad.

If you’re interested in finding more companies with breakout growth and strong insider backing, there’s no better time to explore fast growing stocks with high insider ownership.

Yet after such a rapid run-up in Nu Holdings' share price, investors face a crucial question: is there still value left to unlock, or has the market already priced in Nu’s high-octane growth potential?

Most Popular Narrative: 9.5% Undervalued

With Nu Holdings trading at $15.37 and the narrative fair value at $16.99, the stage is set for an ambitious growth story that contrasts with a relatively modest gap to the consensus target.

The rapid growth of Latin America's digitally native population, combined with expanding smartphone and internet adoption, is creating a sustained surge in demand for Nu's app-based financial services. This is fueling long-term customer acquisition, higher engagement, and driving topline revenue growth. The ongoing transition from cash to digital payments and online banking in historically underserved markets continues to accelerate Nu's transaction volumes and increases opportunities for cross-sell and ecosystem stickiness, supporting robust net margin expansion as digital penetration deepens.

Want to know what’s powering this high fair value? The secret mix: market-defining adoption rates, product innovation, and an earnings forecast that defies norms. What’s the bold quantitative argument that analysts are rallying behind? Unlock the numbers and see what’s at stake in the full breakdown.

Result: Fair Value of $16.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from both legacy banks and new fintech entrants, as well as riskier credit exposure, could challenge Nu's ambitious outlook.

Find out about the key risks to this Nu Holdings narrative.

Another View: How Market Comparisons Shift the Story

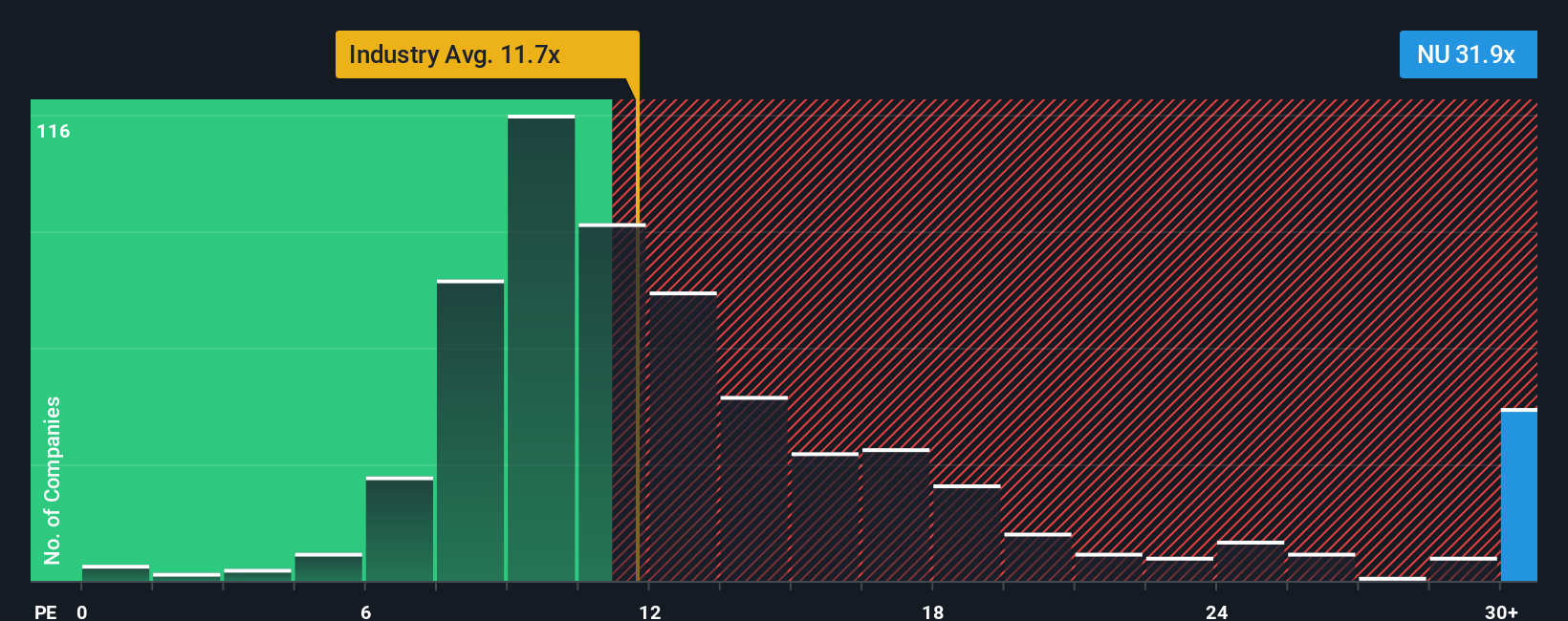

Looking at traditional valuation measures, Nu Holdings trades at a price-to-earnings ratio of 32.3x. This makes it notably pricier than both its industry peers at 11.9x and its fair ratio estimate of 22.7x. This premium reflects high market confidence but also elevates the risk if future growth falls short. Will investors continue to pay a premium for rapid expansion, or is a market reversion in store?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you want to challenge the consensus or dive deeper on your own, our tools let you craft your own perspective in just minutes with Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Jump on the next trend before it takes off. Expand your horizon and uncover fresh opportunities in real, active markets with these handpicked categories below.

- Tap into hidden value as you browse these 897 undervalued stocks based on cash flows that analysts believe have room to run based on robust cash flow data.

- Ride the artificial intelligence wave by checking out these 25 AI penny stocks, giving you access to innovative companies pioneering tomorrow’s technology.

- Boost your portfolio’s income by reviewing these 18 dividend stocks with yields > 3% offering reliable yields and steady cash returns. This can be appealing for investors seeking consistent rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives