- United States

- /

- Banks

- /

- NasdaqGS:CCBG

Discovering 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

In a market environment where major indices like the Dow Jones, S&P 500, and Nasdaq are reaching new records despite ongoing challenges such as the U.S. government shutdown, investors are increasingly looking for opportunities beyond the usual suspects. Amidst this backdrop of optimism and resilience, discovering lesser-known stocks with strong fundamentals can offer intriguing prospects for those willing to explore beyond the headlines.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Morris State Bancshares | 9.38% | 4.01% | 3.59% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Capital City Bank Group (CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. is a financial holding company for Capital City Bank, offering various banking services to individual and corporate clients, with a market capitalization of approximately $712.53 million.

Operations: Capital City Bank Group generates revenue primarily from its commercial banking segment, amounting to $240.94 million. With a market capitalization of approximately $712.53 million, the company focuses on providing banking services to both individual and corporate clients.

Capital City Bank Group, a small cap player with assets totaling US$4.4 billion and equity of US$526.4 million, has been making waves with its robust financial health. With 96% of liabilities funded by low-risk customer deposits, it boasts a solid foundation. The bank's bad loan allowance is set at an impressive 463%, ensuring stability against potential defaults, while non-performing loans are kept minimal at just 0.2%. Recent earnings growth of 13.8% outpaces the industry average, highlighting its competitive edge. Despite significant insider selling recently, the company remains free cash flow positive and trades below estimated fair value by over 40%.

- Navigate through the intricacies of Capital City Bank Group with our comprehensive health report here.

Gain insights into Capital City Bank Group's past trends and performance with our Past report.

West Bancorporation (WTBA)

Simply Wall St Value Rating: ★★★★★★

Overview: West Bancorporation, Inc. is a financial holding company that offers community banking and trust services to individuals and small- to medium-sized businesses in the United States, with a market capitalization of $341.87 million.

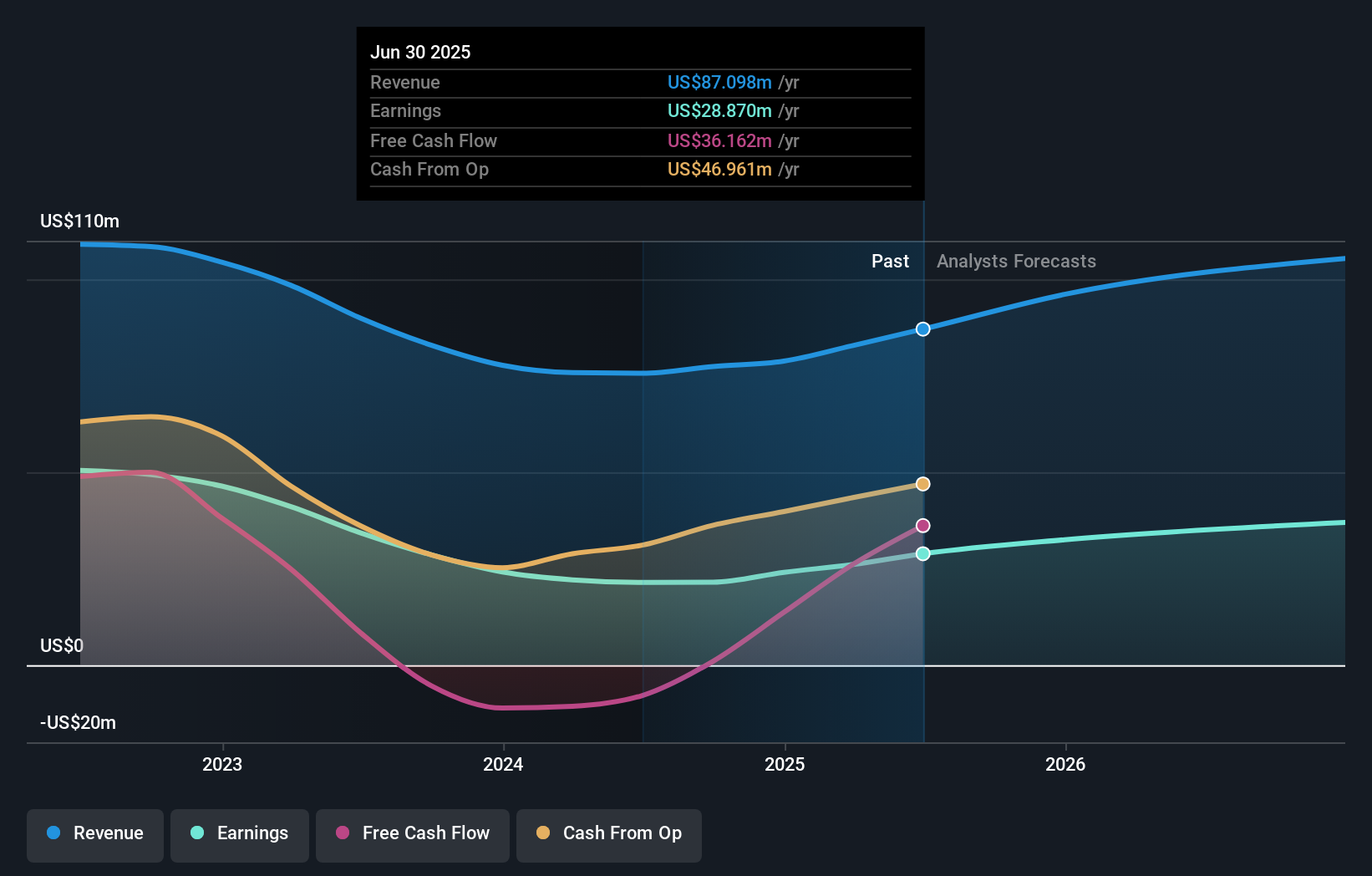

Operations: Revenue primarily stems from community banking, amounting to $87.10 million.

West Bancorporation, with assets totaling US$4.1 billion and equity at US$240.9 million, showcases a robust financial structure. It holds deposits of US$3.4 billion against loans of US$2.9 billion, maintaining a net interest margin of 1.9%. The bank's allowance for bad loans stands at an impressive 0.01% of total loans, reflecting its conservative lending approach and focus on high credit quality, which likely supports its earnings growth that outpaced the industry by reaching 34.7% last year while being valued at 25% below fair value estimates suggests potential upside amidst market dynamics and geographic concentration risks in Iowa and Minnesota.

Northpointe Bancshares (NPB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Northpointe Bancshares, Inc. operates as the bank holding company for Northpointe Bank, offering a range of banking products and services in the United States with a market cap of $592.45 million.

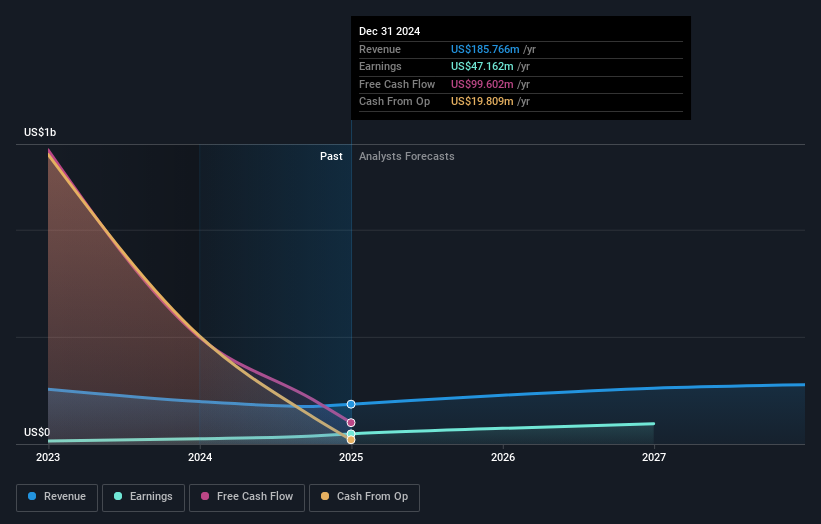

Operations: Northpointe's revenue streams include $155.47 million from Retail Banking and $52.95 million from Mortgage Warehouse (MPP).

With assets totaling $6.4 billion and equity of $604.3 million, Northpointe Bancshares stands out with its robust performance in the banking sector. The company boasts total deposits of $4.5 billion and loans amounting to $5.5 billion, supported by a net interest margin of 2.3%. Despite having a low allowance for bad loans at 14%, it maintains an appropriate level of non-performing loans at 1.6%. Earnings surged by 78% over the past year, significantly outpacing industry growth rates, while trading at nearly 36% below its estimated fair value indicates potential upside for investors seeking undervalued opportunities in finance.

Taking Advantage

- Discover the full array of 284 US Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCBG

Capital City Bank Group

Operates as the financial holding company for Capital City Bank that provides a range of banking services to individual and corporate clients.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives