- United States

- /

- Banks

- /

- NYSE:MTB

M&T Bank (MTB) Margin Growth Reinforces Bullish Narratives Despite Slower Outlook

Reviewed by Simply Wall St

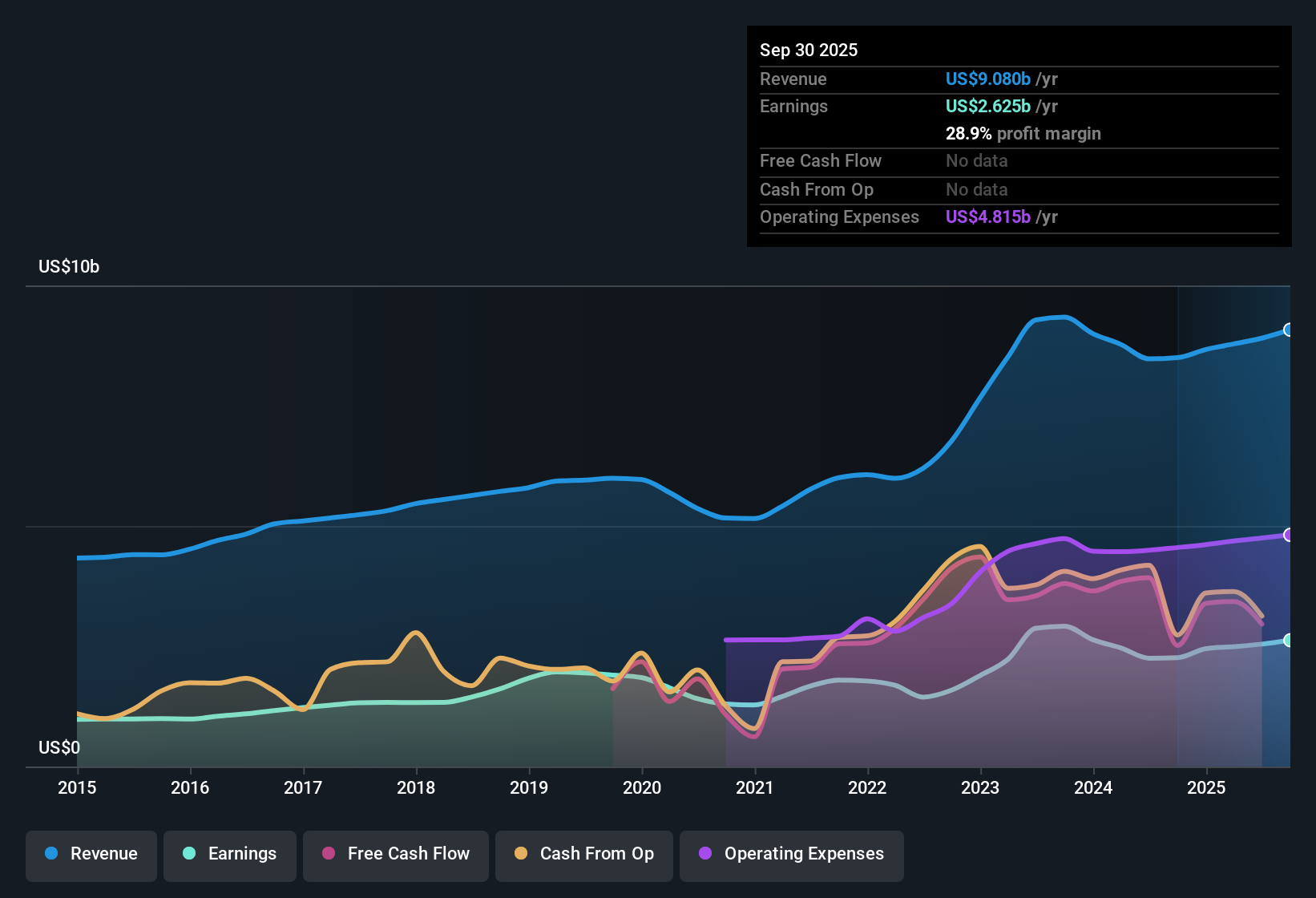

M&T Bank (MTB) reported a net profit margin of 28.6%, up from 26.6% a year ago, demonstrating higher profitability on a year-over-year basis. Over the last five years, earnings have grown at an annual rate of 14.1%, with the most recent year showing 13% earnings growth, while forward-looking projections suggest both earnings and revenue may grow more slowly than the broader US market. With high-quality historical earnings, attractive valuation metrics, and minimal flagged risks, the results are likely to be viewed positively by investors.

See our full analysis for M&T Bank.Next, we will see how M&T Bank’s latest results line up with the narratives that investors and analysts have been following. This will help determine whether those stories stand up to the current numbers.

See what the community is saying about M&T Bank

Share Buybacks Set to Accelerate EPS

- Analysts expect the number of shares outstanding to decrease by 5.82% per year for the next 3 years, which can amplify earnings per share even if total earnings growth is modest.

- According to analysts' consensus, M&T Bank’s focus on capital management and liquidity strength is viewed as a way to maintain a CET1 ratio of 11% by 2025 and deliver value through strategic buybacks.

- This approach aims to enhance shareholder returns, with analysts forecasting earnings to rise from $2.5 billion to $2.6 billion by September 2028, despite slower revenue growth of 4.5% per year.

- Consensus narrative notes that further increases in fee income and service charges could strengthen overall revenue and support the buyback-driven approach as a practical lever for EPS growth.

- For those watching both earnings growth and capital actions, the latest results may reinforce why consensus sees M&T as fairly valued within the current banking landscape. 📊 Read the full M&T Bank Consensus Narrative.

Deposit Pressure and Expense Growth Create Headwinds

- Consensus narrative highlights that a decline in deposit balances, particularly in noninterest-bearing accounts, and increased labor expenses could put pressure on net interest margins and overall profitability in the future.

- Bears argue that even with management’s focus on balance sheet efficiency, macroeconomic pressures such as muted loan origination activity and higher compensation costs threaten to slow loan growth and squeeze margins.

- Challenges including ongoing regulatory scrutiny and possible capital requirement changes may limit flexibility for reinvestment and dampen shareholder returns.

- There is also concern that lower commercial real estate (CRE) balances and competition may continue to temper the bank's primary revenue drivers in a high-rate environment.

Valuation Signals: Discount to DCF, Close to Target

- With the current share price at $178.63, M&T trades below both the DCF fair value of $347.45 and the consensus analyst target price of $221.17, which is about 24% above the latest price.

- According to the consensus narrative, the relatively narrow gap between current trading and the analyst target signals that the market believes M&T is already fairly priced given subdued forecast growth and margin pressures.

- Although valuation multiples such as a price-to-earnings ratio of 11x make it look attractive compared to US Banks industry averages, the requirement for a future PE of 13.2x by 2028 introduces some skepticism about how much upside remains.

- Consensus narrative also emphasizes that it is important to sense check these analyst expectations against your own views, especially given varied analyst targets and the influence of sector momentum.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for M&T Bank on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your insights and shape your personal view in just a few minutes. Do it your way.

A great starting point for your M&T Bank research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While M&T Bank is managing profitability, ongoing deposit pressures, rising expenses, and slowing earnings forecasts create real headwinds compared to more stable peers.

If you want to focus on companies that consistently deliver steady revenue and earnings, pinpoint those with a stronger track record using our stable growth stocks screener (2085 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTB

M&T Bank

Operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that provides retail and commercial banking products and services in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives