- United States

- /

- Banks

- /

- NYSE:LOB

Regional Bank Loan Worries Could Be a Game Changer for Live Oak Bancshares (LOB)

Reviewed by Sasha Jovanovic

- In recent days, disclosures from Zions Bancorp and Western Alliance Bancorp about significant loan quality issues have triggered widespread concerns about credit conditions in the regional banking sector. These developments have focused attention on how rising interest rates and pressure on commercial real estate could increase credit risks for banks nationwide.

- We will now explore how these heightened credit quality concerns among peer regional banks may alter the outlook for Live Oak Bancshares.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Live Oak Bancshares Investment Narrative Recap

To be a shareholder in Live Oak Bancshares, you likely need to believe in the growth of digital banking and the ongoing demand for government-guaranteed small business lending. The recent regional banking news has reignited questions around credit quality risks in the sector, but as of now does not appear to materially shift Live Oak’s biggest short-term catalyst, ongoing digital product adoption, or the main risk related to its lending concentration and policy exposure. Among the latest company announcements, Live Oak’s scheduled Q3 2025 earnings release on October 22 stands out as most relevant. Investors will be closely watching for any signs of rising charge-offs or stress in the bank’s loan book, especially considering the credit concerns hitting its regional peers, making this report a pivotal moment to assess resilience amid macro pressure. Yet, in contrast to the current optimism around new digital products, investors should also be aware of...

Read the full narrative on Live Oak Bancshares (it's free!)

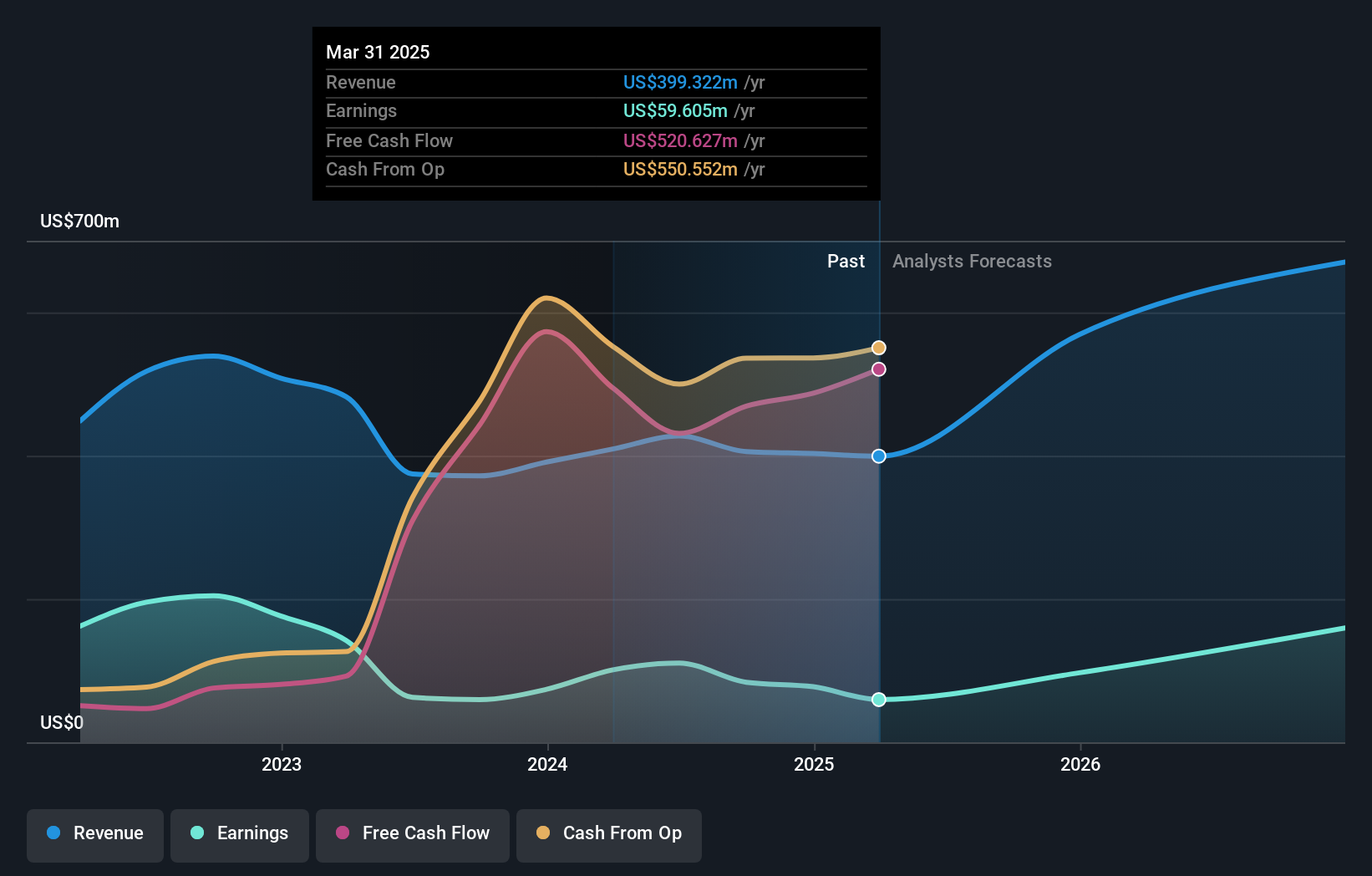

Live Oak Bancshares' outlook anticipates $1.1 billion in revenue and $328.0 million in earnings by 2028. This scenario is based on yearly revenue growth of 37.6% and represents an earnings increase of $271.9 million from current earnings of $56.1 million.

Uncover how Live Oak Bancshares' forecasts yield a $42.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have suggested fair values ranging from US$42 to US$69.40 across three perspectives. With recent sector-wide credit worries, you should consider how your view stacks up against such a wide spread of opinions.

Explore 3 other fair value estimates on Live Oak Bancshares - why the stock might be worth just $42.00!

Build Your Own Live Oak Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Live Oak Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Live Oak Bancshares' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Community Narratives