- United States

- /

- Banks

- /

- NYSE:LOB

New Chief Risk Officer and Restatement Plans Might Change The Case For Investing In Live Oak Bancshares (LOB)

Reviewed by Sasha Jovanovic

- Live Oak Bancshares recently appointed Ewa M. Stasiowska as Chief Risk Officer of both the holding company and Live Oak Bank, formalizing a dedicated risk leadership function that was previously combined with the General Counsel role.

- The move comes after Live Oak crossed the US$10.00 billion asset threshold and disclosed plans to restate financial statements for cash flow misclassifications, underscoring a sharper focus on governance and enterprise-wide risk controls.

- Next, we’ll examine how appointing a seasoned Chief Risk Officer after crossing US$10.00 billion in assets may reshape Live Oak’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Live Oak Bancshares Investment Narrative Recap

To own Live Oak Bancshares, you need to believe in its niche-focused, tech-enabled small business banking model and its ability to manage the complexity that comes with rapid digital growth and heavy use of government-guaranteed lending. The appointment of a seasoned Chief Risk Officer after crossing US$10,000,000,000 in assets and amid financial statement restatements is a visible response to governance and control concerns, but it does not remove the near term risk around regulatory scrutiny and asset quality.

Among recent developments, the planned restatement of cash flow classifications in prior financial statements is most relevant here, because it sits directly alongside Live Oak’s effort to formalize risk leadership. For investors watching key catalysts like scaling digital platforms and expanding SBA lending, the combination of restatements and heightened legal attention puts a brighter spotlight on how effectively the new Chief Risk Officer can reinforce internal controls and protect the growth story.

Yet investors should be aware that higher regulatory scrutiny and restatement related legal risk could still weigh on...

Read the full narrative on Live Oak Bancshares (it's free!)

Live Oak Bancshares’ narrative projects $1.1 billion revenue and $328.0 million earnings by 2028.

Uncover how Live Oak Bancshares' forecasts yield a $42.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

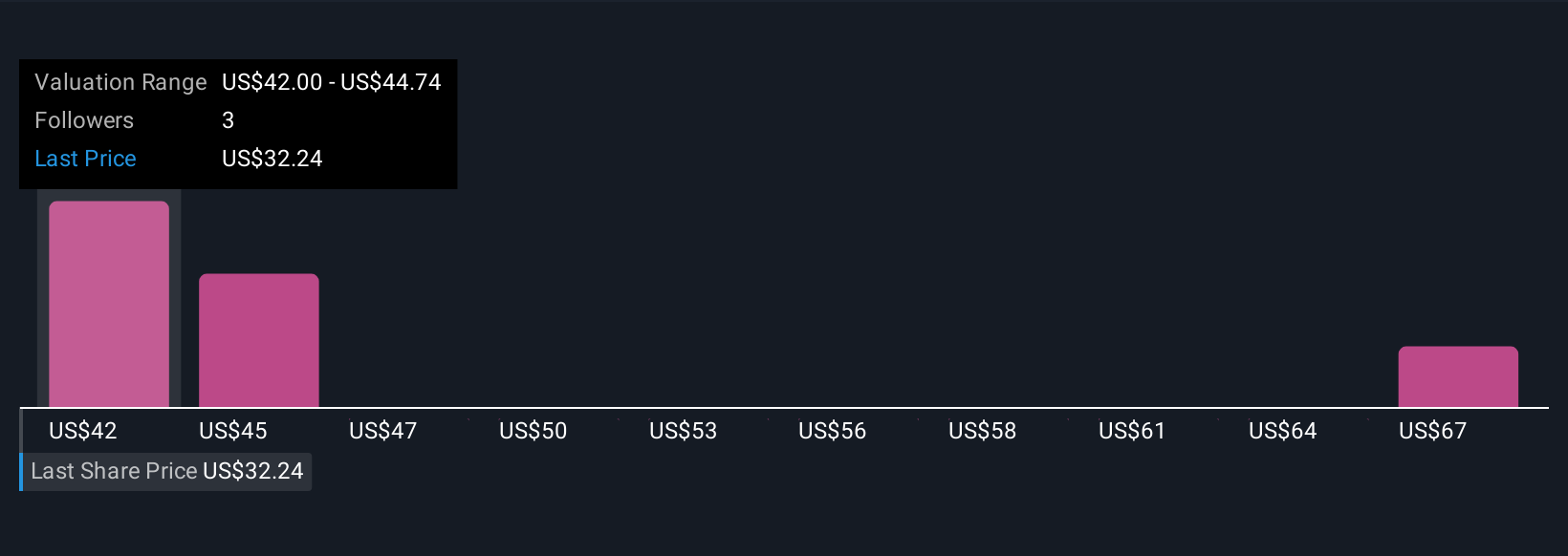

Three members of the Simply Wall St Community see fair value between US$42 and US$69.40, a wide span of individual models. Against that backdrop, Live Oak’s concentration in government backed lending and rising regulatory attention could have very different implications for returns depending on how you think risk control and growth will balance out over time, so it is worth weighing several viewpoints.

Explore 3 other fair value estimates on Live Oak Bancshares - why the stock might be worth just $42.00!

Build Your Own Live Oak Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Live Oak Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Live Oak Bancshares' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026