- United States

- /

- Banks

- /

- NYSE:LOB

Live Oak Bancshares (LOB): Assessing Valuation as Regional Bank Disclosures Spark Fresh Sector Scrutiny

Reviewed by Kshitija Bhandaru

Live Oak Bancshares (LOB) is seeing its stock react alongside other regional bank peers after recent disclosures from Zions Bancorp and Western Alliance Bancorp put the spotlight on loan quality issues and sector vulnerabilities.

See our latest analysis for Live Oak Bancshares.

The ripple effect from peers’ loan quality worries has weighed on Live Oak Bancshares' stock. Recent volatility highlights how quickly risk sentiment can swing in the regional banking space. While the share price has edged up 5.5% over the past 90 days, long-term total shareholder return tells a tougher story. It is down nearly 32% in the past year, reminding investors that momentum has cooled despite earlier growth.

If you’re keeping an eye out for what else is capturing investor interest, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With volatility still lingering and shares trading nearly 23% below their analyst target, investors now face a key question: is Live Oak Bancshares undervalued amid sector fears, or is the market already factoring in future growth?

Most Popular Narrative: 20.3% Undervalued

With Live Oak Bancshares’ fair value pegged at $42, which is around $8.50 higher than the latest closing price, analysts see meaningful upside if the company's growth thesis plays out. Their attention is on the bank’s innovation and digital expansion as primary drivers shaping valuation expectations.

Robust small business loan origination growth (record Q2 production), deepening of customer relationships (rise in clients with both loan and deposit relationships from 3% to 18%), and double-digit deposit growth signal that Live Oak is successfully capitalizing on the long-term trend of rising entrepreneurship and small business formation in the U.S., likely driving above-industry loan growth and fee income.

What is powering that optimistic price target? The narrative teases a sharp trajectory for loan growth, profitability, and market share, all hinging on digital leadership. The real surprise? The full story features bold financial projections and some aggressive margin assumptions. Want to know which numbers could make or break the valuation call? Dive in and see what’s behind the analysts’ conviction.

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, meaningful shifts in government-backed lending policies or a sudden surge in digital competition could quickly challenge this optimistic outlook.

Find out about the key risks to this Live Oak Bancshares narrative.

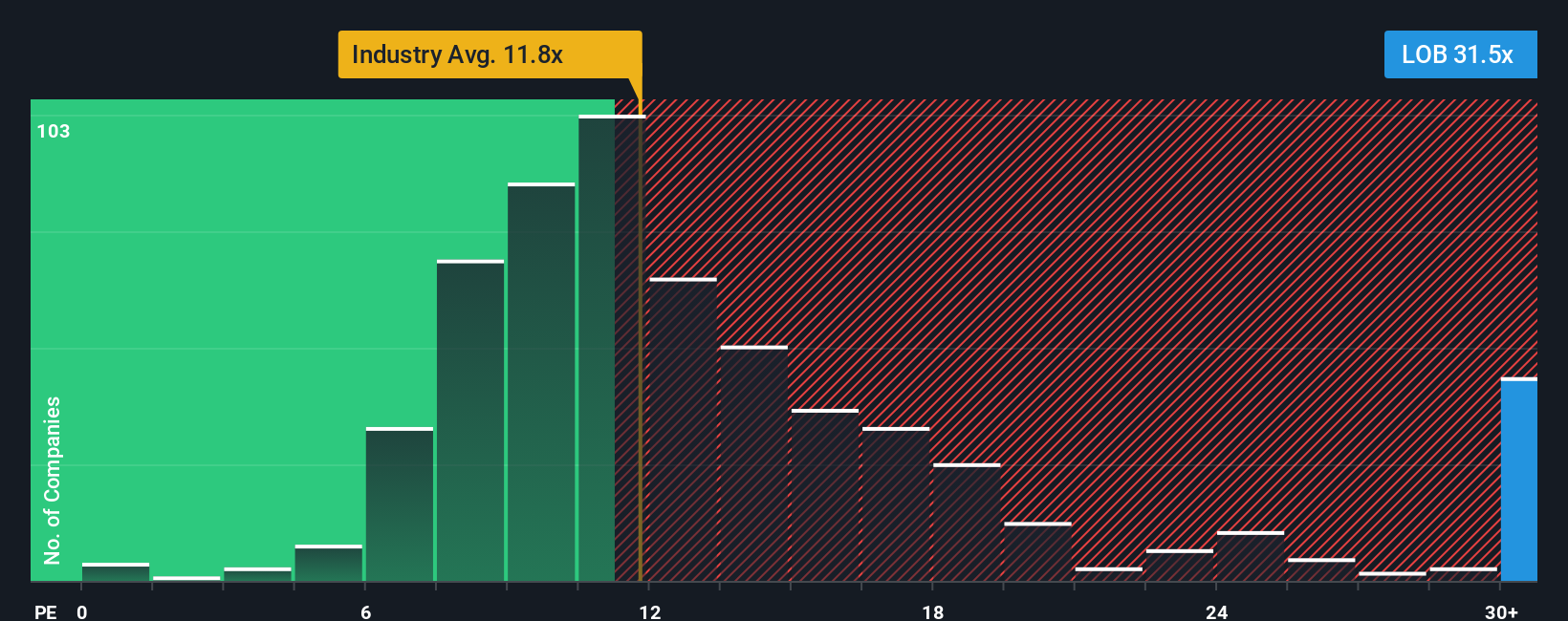

Another Perspective: Valuation by Earnings Multiple

Looking at the price-to-earnings ratio, Live Oak Bancshares trades at 27.3 times earnings, which is higher than both its industry average of 11.2x and the calculated fair ratio of 20.5x. This suggests the stock is expensive compared to peers and could face downward pressure if market expectations shift. Is the premium truly justified by future growth, or does it add risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Oak Bancshares Narrative

If you see the numbers differently or want fresh insights, you can analyze the data and shape your own view in under three minutes, so why not Do it your way

A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Take a fresh approach to finding your next opportunity using these powerful screeners, and stay ahead of the curve on market trends.

- Tap into tomorrow’s tech with these 24 AI penny stocks. These stocks are at the forefront of artificial intelligence breakthroughs and digital transformation.

- Boost your passive income by uncovering high-yield opportunities with these 18 dividend stocks with yields > 3%, offering steady returns above 3%.

- Ride the momentum of undervalued market gems. Supercharge your investment strategy by searching among these 869 undervalued stocks based on cash flows, where cash flow growth meets attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Community Narratives