The board of KeyCorp (NYSE:KEY) has announced that it will pay a dividend of $0.205 per share on the 15th of March. This makes the dividend yield 5.8%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that KeyCorp's stock price has increased by 32% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for KeyCorp

KeyCorp's Earnings Will Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

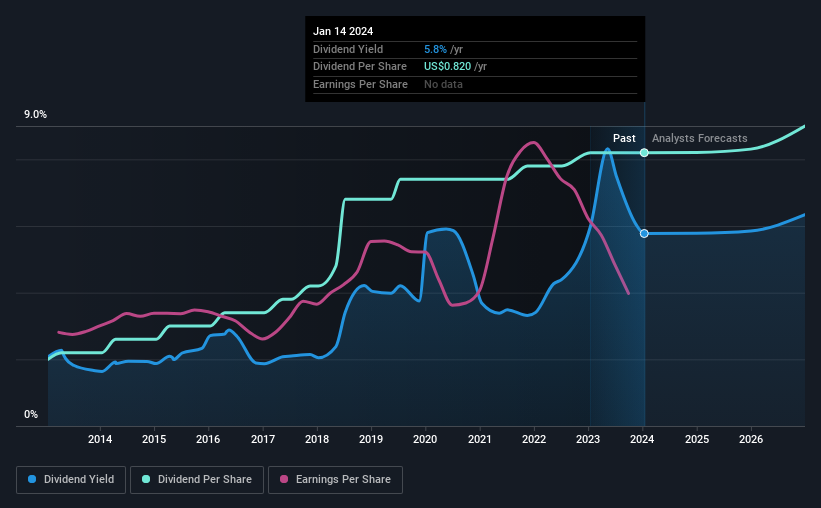

KeyCorp has a long history of paying out dividends, with its current track record at a minimum of 10 years. Based on KeyCorp's last earnings report, the payout ratio is at a decent 66%, meaning that the company is able to pay out its dividend with a bit of room to spare.

The next 3 years are set to see EPS grow by 53.3%. The future payout ratio could be 47% over that time period, according to analyst estimates, which is a good look for the future of the dividend.

KeyCorp Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the dividend has gone from $0.20 total annually to $0.82. This means that it has been growing its distributions at 15% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

KeyCorp May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. It's not great to see that KeyCorp's earnings per share has fallen at approximately 3.2% per year over the past five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

In Summary

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for KeyCorp that you should be aware of before investing. Is KeyCorp not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.