- United States

- /

- Banks

- /

- NYSE:JPM

Will JPMorgan’s New Canary Wharf Hub and Defense Push Change JPMorgan Chase's (JPM) Narrative

Reviewed by Sasha Jovanovic

- In recent weeks, JPMorgan Chase has unveiled plans for a three-million-square-foot Canary Wharf headquarters, launched a US$10 billion Security and Resilience Initiative focused on defense and advanced manufacturing, and continued issuing a wide range of long-dated, callable unsecured notes across global markets.

- Taken together, these moves point to an assertive push to expand JPMorgan’s global footprint and funding base while deepening ties to critical infrastructure sectors and the U.K. financial hub.

- We’ll now examine how JPMorgan’s planned Canary Wharf hub reshapes its existing investment narrative built around earnings momentum and new ventures.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

JPMorgan Chase Investment Narrative Recap

To own JPMorgan Chase, you need to believe its diversified earnings, scale, and digital investments can offset rising fintech competition and regulatory complexity. The short term story still centers on earnings resilience and capital returns, which the Canary Wharf plan and flurry of long dated callable notes do not materially change today, though they underscore management’s confidence in funding flexibility and international growth.

The most relevant recent development is the planned three million square foot Canary Wharf headquarters in London, intended to house up to 12,000 employees and serve as JPMorgan’s main U.K. hub. For investors focused on catalysts like wealth management and global payments expansion, this project reinforces the idea that international client acquisition and fee growth may remain central to the equity case.

Yet against this backdrop, investors should still watch how fast growing fintech and blockchain based challengers could erode JPMorgan’s core revenue streams and pricing power...

Read the full narrative on JPMorgan Chase (it's free!)

JPMorgan Chase's narrative projects $186.7 billion revenue and $55.5 billion earnings by 2028. This implies 4.5% yearly revenue growth and a modest $0.3 billion earnings increase from $55.2 billion today.

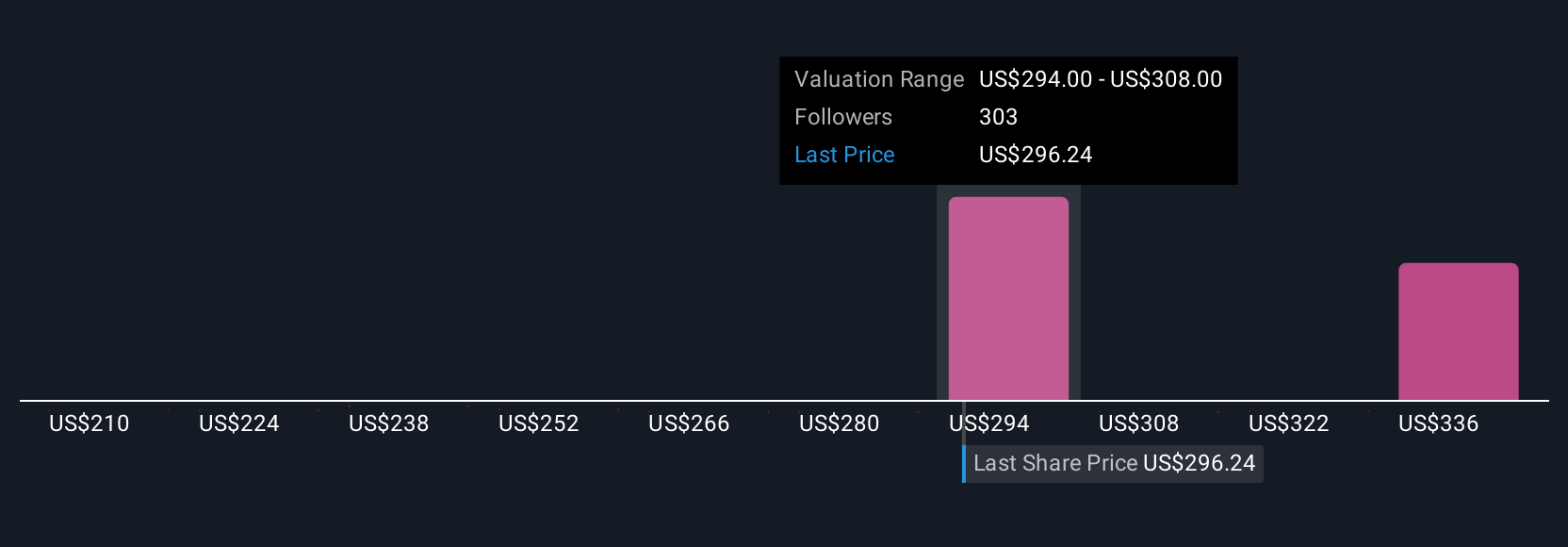

Uncover how JPMorgan Chase's forecasts yield a $328.09 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were already assuming JPMorgan could reach about US$195 billion in revenue and US$59 billion in earnings by 2028, so if you see this new London hub and defense focused lending push as reinforcing that story rather than straining costs, you are buying into a much more ambitious view of what the bank can become compared with the more cautious consensus.

Explore 21 other fair value estimates on JPMorgan Chase - why the stock might be worth as much as 17% more than the current price!

Build Your Own JPMorgan Chase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free JPMorgan Chase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JPMorgan Chase's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026