- United States

- /

- Banks

- /

- NYSE:JPM

Why JPMorgan Chase & Co. (NYSE:JPM) Could be a Stable Dividend Stock for Investors

JPMorgan Chase & Co. (NYSE:JPM) provided a total return (including dividends) of 16% in the last 12 months, and 100% in the last 5 years. For investors looking to double their money, a 5-year timeframe is not a bad proposition. However, that is in the past, and today we will analyze the future dividend and growth prospects for JPMorgan Chase & Co.

Before we begin, we need to put things into perspective, and when we compare JPM total returns with the market, we see that on a 12-month basis, the market returned 9.5% - underperforming JPM, but on a 5-year basis it returned 114%, which is a testament to how hard it is to "beat" the market in the long term.

Overview

With a market cap of US$445b, JPM is one of the biggest players in the financial sector. The company brings in income from interest and other financial services. For 2021 (p 3), the net interest income was US$52.7b and the non-interest revenue was US$72.6b.

Moving to the bottom line, JPM made a US$46.5b net income, up US$19.1b from 2020 - that is an impressive 143% growth from last year.

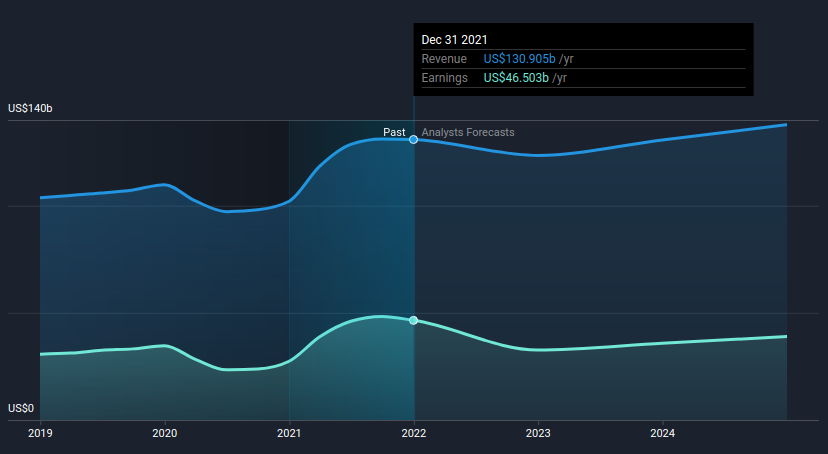

The value of a stock lies in the future, and that is why we need a way to estimate what will happen to earnings going forward. One approach is to see what analysts are forecasting, and since JPM is a well covered company, we have a lot of data to work with.

For the next few years, analysts are estimating that the growth rate in both earnings and revenue will stabilize, and forecast a US$137.8b in revenue by the end of 2024, and US$38.9 in net income for the same period.

The chart below puts things into perspective, and we can see both the performance and average future estimates for JPM:

The fundamentals also show that the company is highly profitable, and posts a net income margin of 35.5%, up from 31.5% in 2020.

Another way to assess the quality of a company is to see how well they manage their capital. In order to get a sense of this, we can utilize return measures, such as return on equity, or ROTCE - return on tangible common shareholders’ equity. For JPM, the ROE is 19%, and their ROTCE is 23%. Both of these metrics grew from 2020.

Putting this overview together, we can see that JPM is a highly profitable financial company, that is expected to stabilize in the future and grow slightly above inflation (as measured by today's US 10-year T Bond Rate).

When companies stabilize, investors see a decline in returns from the stick price going up, but start getting more returns from dividends.

If you take a look at our Value Section, you can see that our model estimates that there is still some room for JPM stock to increase, but they may need to start optimizing dividend income after that.

Dividend Analysis

The current dividend yield is 2.6% as per yesterday's close price. This is quite modest, and it means that investors will double their money in 38 years or 28 years with reinvesting and compounding. While 2.6% is not something investors get excited about, there are positive sides to this, as well as strategies to maximize the returns.

For example, investors that put JPM on their watch list can wait for a possible price drop, which will boost the dividend yield. In a scenario where the stock price would drop to US$133 per share, the dividend yield would become 3%. There are no certainties that this will happen, and keep in mind that in the last 10 years, the yield reached a high around 3.9% - and that was in the market drop of March 2020.

Let's not forget about JPM's buyback program, which returned an equivalent amount of cash to around 3.7% of their market cap this year.

To better understand JPM's dividend history, we can use the chart below and explore the relationship between yield, dividend per share and earnings.

Click the interactive chart for our full dividend analysis

For the purpose of this article, we only scrutinize the last decade of JPMorgan Chase's dividend payments. During this period, the dividend has been stable, which could imply the business has a relatively consistent earnings power.

During the past 10-year period, the first annual payment was US$1.0 in 2012, compared to US$4.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time.

Payout ratios

Dividends are typically paid from company earnings. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax.

Looking at the data, we can see that 25% of JPMorgan Chase's profits were paid out as dividends in the last 12 months. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Additionally, as a company matures and focuses on optimization, they can also afford to increase dividend payments, either via lifting the dividend per share or increasing the payout ratio - which is the more flexible solution.

A payout ratio of 25% is arguably conservative, and JPM may be able to up that in the future.

We update our data on JPMorgan Chase every 24 hours, so you can always get our latest analysis of its financial health, here.

The Stability Argument

While everyone is affected in economic downturns, we can argue that credit is one of the first things that re-vitalize, as businesses that want to develop will need access to debt.

Additionally, banks such as JPM do not lend (at least in theory) below the inflation rate, which means they directly pass on the costs of inflation to their clients.

This does not mean that, should the economy recede, and inflation becomes a lasting issue, that JPM will be protected - they will likely take a hit along with the rest, but may have enough instruments at their disposal to turn things around faster.

Conclusion

JPM is a large cap, diversified and stable financial service company, with consistent growth in long term revenues and net income. The company also provided good returns on equity and on tangible assets to common shareholders.

With growth stabilizing, investors can start analyzing JPM as an income stock and put it on their watch list in the expectation of an appealing opportunity.

The current dividend yield is modest, at 2.6%. But the company may optimize cash returns in the future as it progresses in its maturity.

The worldwide coverage of JPM and stability of operations is an additional argument that may provide defensive characteristics for investors that are estimating an economic downturn in the future.

Alternatively, you may be interested in a list of global stocks with a market capitalization above $1bn and yielding more 3%.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives