- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan (JPM) Valuation Check After Recent 5% Pullback and Cooling Share Price Momentum

Reviewed by Simply Wall St

JPMorgan Chase (JPM) has quietly slipped about 5% over the past month, even as its longer term returns remain strong. This creates a useful moment to reassess what investors are really paying for today.

See our latest analysis for JPMorgan Chase.

That recent pullback, including a sharp 1 day share price return of minus 4.66% to about $300.51, sits against a resilient backdrop of roughly 25% year to date share price gains and a powerful multi year total shareholder return. This suggests momentum is cooling rather than collapsing as investors reassess growth and risk after a strong run.

If JPMorgan Chase has you thinking about where the next wave of returns could come from, this is a good moment to explore fast growing stocks with high insider ownership.

With the shares still trading below analyst targets and some intrinsic value estimates, yet sitting on hefty long term gains, investors now face a key question: is JPMorgan Chase undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 8.4% Undervalued

With the narrative fair value sitting above JPMorgan Chase's recent $300.51 close, the story leans toward upside potential built on durable earnings power.

Management's confidence in organic and inorganic growth, ongoing capital deployment into new business lines (e.g., innovation economy middle market banking, international expansion), and ability to reinvest at high ROTCE levels, create a platform for structurally higher long-term revenue and earnings, even as regulatory frameworks evolve.

Curious what kind of long term revenue path and profit margins could justify a richer earnings multiple than most large banks, without any hype baked in? The projections behind this fair value lean on steady expansion rather than heroic growth swings. Want to see exactly how those assumptions stack up over the next few years, and what it says about where JPMorgan's valuation could settle?

Result: Fair Value of $328.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying fintech competition and tighter capital rules could erode JPMorgan's fee growth and margins, which may challenge assumptions behind its premium earnings multiple.

Find out about the key risks to this JPMorgan Chase narrative.

Another View: Earnings Multiple Sends a Different Signal

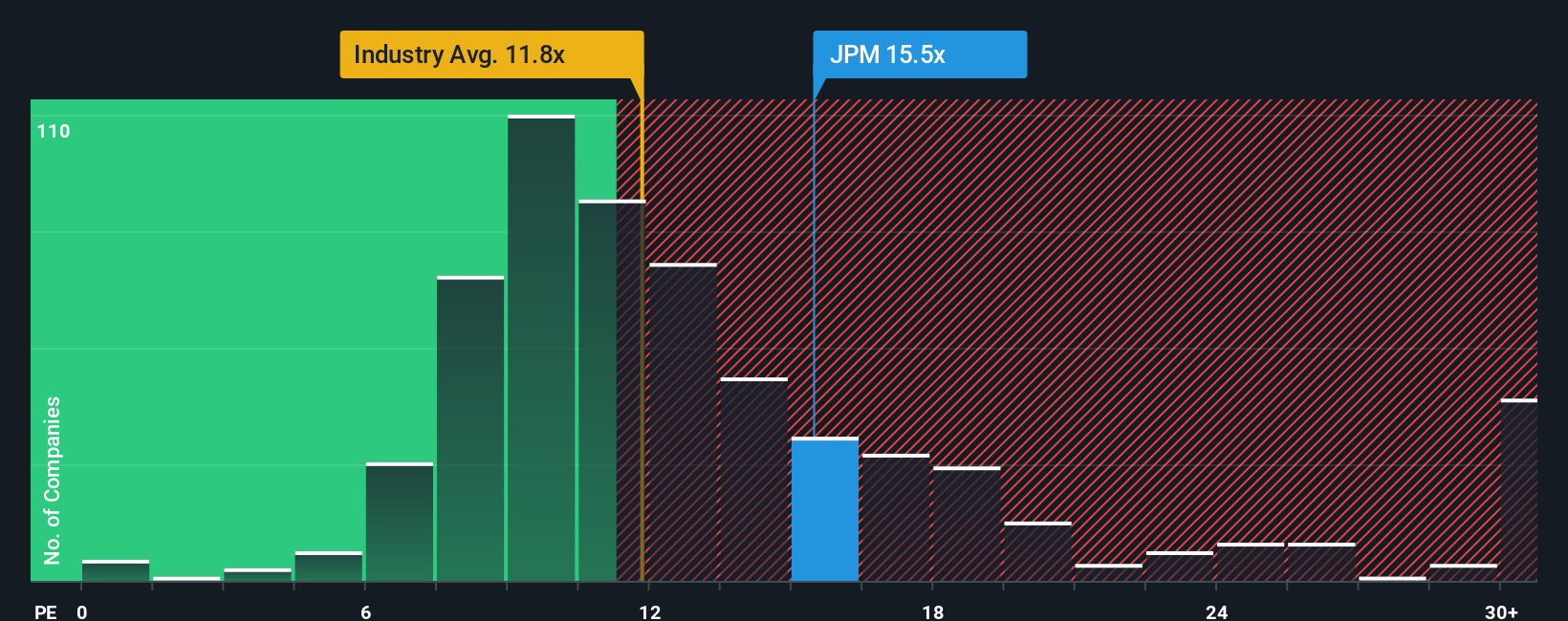

While our fair value work points to upside, JPMorgan currently trades at about 14.4 times earnings versus 11.7 times for the US banks sector and 13.5 times for peers. That premium, even against a fair ratio of 15.5 times, hints at less margin for error if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JPMorgan Chase Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding JPMorgan Chase.

Looking for more investment ideas?

If you stop at JPMorgan, you could miss the next wave of opportunities. Put Simply Wall St's powerful Screener to work for your portfolio now.

- Capture high potential value by reviewing these 900 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows and fundamentals.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks bringing data driven innovation to medicine, diagnostics, and clinical decision making.

- Position early in transformative digital assets by evaluating these 80 cryptocurrency and blockchain stocks reshaping payments, infrastructure, and blockchain enabled business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026