- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Invests US$1.9M In National Financial Education Initiative

Reviewed by Simply Wall St

JPMorgan Chase (NYSE:JPM) recently launched MSFCP.org, a significant initiative geared toward enhancing financial health and education, which is backed by a $1.9 million philanthropic investment. This expansion into financial coaching may have positively influenced investor sentiment, contributing to the company's 6.9% stock price increase over the past week. Furthermore, enhanced credit card benefits could bolster consumer engagement and financial performance. Despite broader market declines this week with tech stocks notably sliding, JPMorgan Chase's focus on educational and consumer initiatives possibly helped it outperform the market, which rose 2.9% over the same period.

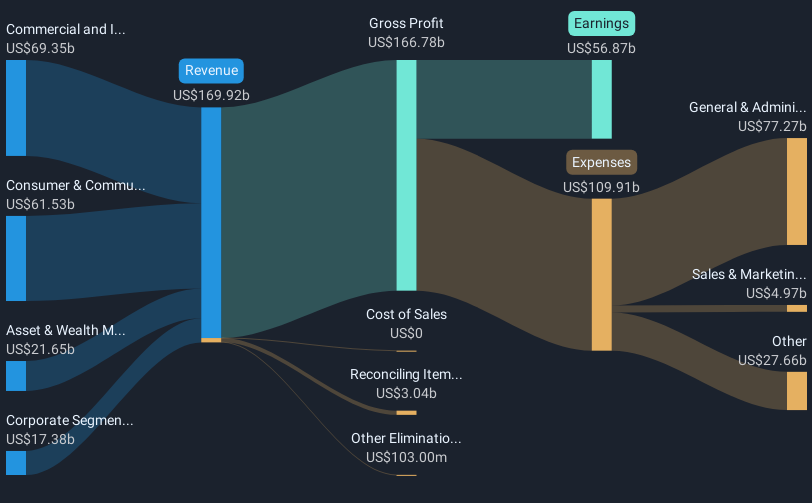

JPMorgan Chase's shares have delivered a remarkable total return of 221.91% over the last five years. This substantial growth reflects successes in multiple areas. A critical factor has been the firm's ability to significantly increase its net income, with the full-year figure reaching US$58.471 billion, buoyed by strong net interest income and asset management inflows. This financial prowess has been complemented by the expansion of consumer and business card benefits, notable for their ability to attract and retain customers, further supporting the firm's overall revenue growth.

Additionally, regulatory challenges have not hindered the firm's growth aspirations, as seen in its ongoing expansion plans, including tripling branch presence in Alabama. Comprehensive community engagement initiatives and strategic hiring indicate a commitment to broadening access to financial services. JPMorgan's focus on modernization through technological enhancements is expected to continue optimizing its operations and financial performance. Over the past year, JPMorgan Chase has outpaced both its industry and the broader US market, a testament to its robust strategy implementation and adaptability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.