- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase & Co.'s (NYSE:JPM) Latest Earnings Results Might Have Prolonged Consequences

Summary:

- JPMorgan's latest results show weakness in the sector

- CEO Dimon remains optimistic but takes precautionary measures

- A Higher Capital ratio is in danger of constraining the growth

If banks give an initial pulse to the earnings season, this summer might be volatile. JPMorgan Chase & Co. (NYSE: JPM) is one of the financial institutions that kicked-off Q2 reporting, missing the consensus estimates as fees look to have dropped across the sector. While CEO Jamie Dimon remains optimistic about the bank's capabilities to navigate through a (potential) recession – the bank is already taking preventive actions, the first among them being a suspension of stock buybacks.

Q2 Earnings Results

- Revenue: US$31.6b, +1% Y/

- Net income: US$8.64b (US$2.76 per share): -28% Y/

- Credit costs: US$1.1b (US$428m net reserve build, US$657m net charge-offs

- Average deposits: +9

- Average loans: +7%

The Consumer Banking arm was the biggest loser, with net income declining 45% Y/Y. On the other hand, Asset & Wealth Management arm declined "just" 13% Y/Y.

See our latest analysis for JPMorgan Chase

Crash Tests and Soft Landings

In recent months, CEO Jamie Dimon has been rather vocal about a potential recession incoming, pointing out geopolitical and economic challenges of high inflation, supply chain issues, and geopolitical conflicts. Yet, he remains optimistic about handling the recession, noting that the consumers are in relatively good shape – spending money and having access to a strong labor market.

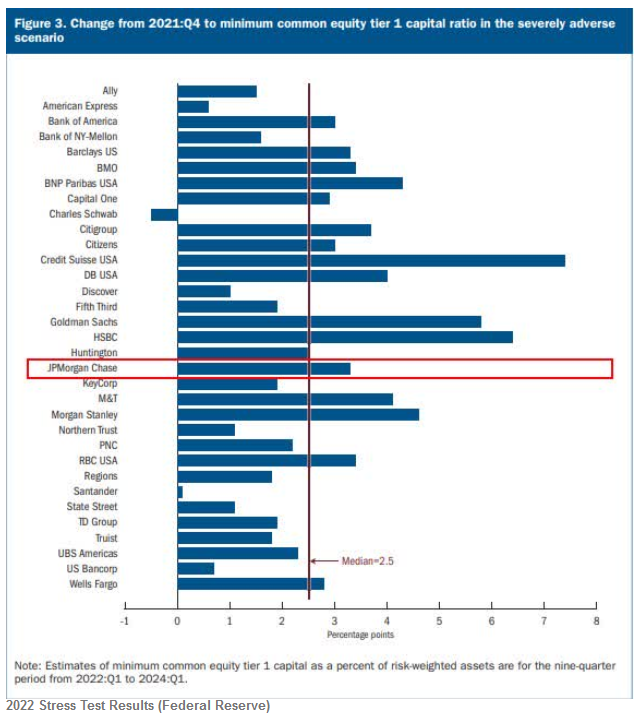

Given the recent stress test results, a decision to suspend the buyback isn't surprising, but the good news is that the bank won't cut the dividend.

The most recent stress test shows that the bank is worse than the median result (lower is better).

Recent times haven't been advantageous for JPMorgan Chase as its earnings have risen slower than most other companies. A Low P/E of 7.8x is probably low because investors think this lackluster earnings performance will not get any better. If this is the case, then existing shareholders will likely struggle to get excited about the future direction of the share price.

Keen to find out how analysts think JPMorgan Chase's future stacks up against the industry? In that case, our free report is a great place to start.

What Are Growth Metrics Telling Us About The Low P/E?

To justify its P/E ratio, JPMorgan Chase would need to produce sluggish growth trailing the market. Looking back, the company grew earnings per share by 7.1% last year. This was backed up by an excellent period before seeing EPS up by 48% in total in the previous three years. Therefore, it's fair to say the earnings growth recently has been superb for the company, yet - over the last 10 years, JPMorgan stock has lagged the S&P500 increase.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 1.1% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 11% each year, which is noticeably more attractive.

The Final Word

Despite these results, the bank kept its full-year guidance while the stock price dipped to levels not seen since November 2020. While this anemic start to the earnings season doesn't inspire much confidence, the latest stress tests and regulatory pressures pose a different problem.

If the banks start pursuing better capital ratios by lowering the exposure to risk assets, they will shrink the loan market, constraining the market growth. A higher interest environment is historically good for banks, but a risk-off climate might negate those benefits.

At the moment, JPM trades at an attractive valuation. Still, its attractiveness remains mainly a question of whether an investor is comfortable with high exposure to the investment banking segment, which seems to be heading for more challenging times.

The company's balance sheet is another critical area for risk analysis. Please look at our free balance sheet analysis for JPMorgan Chase with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on JPMorgan Chase, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives