- United States

- /

- Banks

- /

- NYSE:JPM

Could JPMorgan’s (JPM) Latest Plaid Partnership Reveal a New Era in Digital Banking Strategy?

Reviewed by Simply Wall St

- JPMorgan Chase and Plaid announced a renewed data access agreement to enable secure, consistent access to banking data for clients, alongside a series of commitments to boost innovation in open banking.

- This expanded partnership highlights JPMorgan Chase's ongoing investment in financial technology and commitment to developing secure, consumer-friendly digital platforms.

- We'll explore how JPMorgan Chase's renewed collaboration with Plaid could shape its growth outlook and digital banking strategy.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

JPMorgan Chase Investment Narrative Recap

To be a JPMorgan Chase shareholder, you must believe in the bank’s ability to sustain growth through a mix of technological leadership, strong payments revenue, and digital banking expansion, while staying ahead of fintech disruption and regulatory pressures. The renewed Plaid agreement supports JPMorgan's digital strategy but does not fundamentally change the biggest short-term catalyst, continued momentum in digital payments and card growth, or the key risk of fintech competition eroding fee-based income.

Among recent announcements, the partnership with Plaid stands out for its relevance, reinforcing JPMorgan’s effort to bolster secure, open banking platforms. This move aligns with its strategy to improve client digital experiences and resilience against fintech threats, both of which are core to sustaining growth and addressing margin pressure against a backdrop of evolving regulation and consumer habits.

But investors should also weigh the risk that, despite these partnerships, increased regulatory scrutiny and rising capital requirements could start to weigh on...

Read the full narrative on JPMorgan Chase (it's free!)

JPMorgan Chase's outlook points to $186.7 billion in revenue and $55.5 billion in earnings by 2028. This scenario assumes a 4.5% annual revenue growth rate and a modest $0.3 billion increase in earnings from the current $55.2 billion.

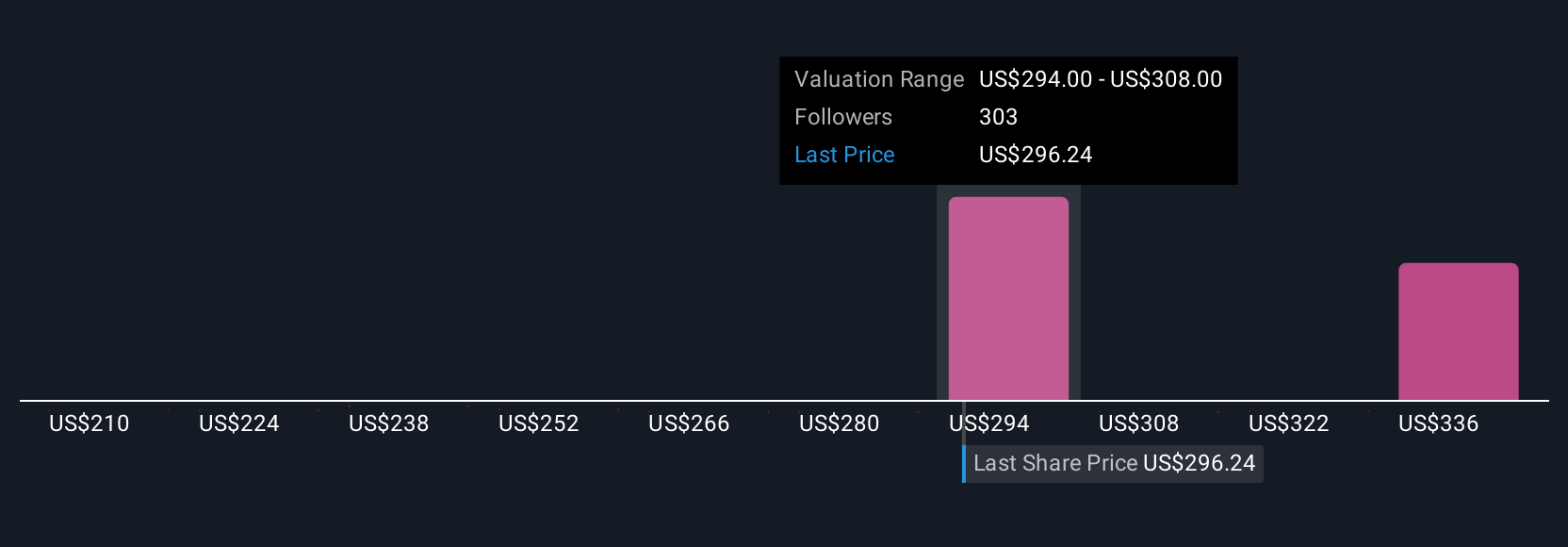

Uncover how JPMorgan Chase's forecasts yield a $306.17 fair value, in line with its current price.

Exploring Other Perspectives

Analysts at the high end expect US$194.8 billion in revenue and US$59.0 billion earnings by 2028, arguing that rapid adoption of blockchain and a global push in payments could fuel even greater growth. Their outlook is more optimistic than consensus, but reflects how new developments like the Plaid partnership have the potential to reshape forecasts. Opinions differ widely, so it’s important to compare various scenarios as the facts change.

Explore 26 other fair value estimates on JPMorgan Chase - why the stock might be worth 29% less than the current price!

Build Your Own JPMorgan Chase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JPMorgan Chase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JPMorgan Chase's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives