- United States

- /

- Banks

- /

- NYSE:HTH

How Strong Earnings and Aggressive Buybacks at Hilltop Holdings (HTH) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Hilltop Holdings Inc. announced third-quarter 2025 results, reporting US$112.39 million in net interest income and US$45.82 million in net income, with ongoing share repurchases totaling over 6% of shares outstanding and an affirmed quarterly dividend of US$0.18 per share.

- Alongside earnings growth, the significant buyback reflects management’s confidence and enhances shareholder returns through reduced share count and sustained dividend payments.

- We’ll now consider how Hilltop Holdings’ strong earnings and continued buyback activity may influence the company’s future investment outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Hilltop Holdings Investment Narrative Recap

To own shares of Hilltop Holdings, an investor usually needs confidence in the company’s ability to profitably grow across Texas and the Sun Belt while navigating the volatile mortgage market and heightened competition. The recent earnings report, highlighting higher net income and continued share buybacks, suggests no immediate shift to the short-term catalyst of commercial and residential loan growth or the prevailing risk tied to persistent mortgage origination headwinds, this risk remains central for now.

The company’s completion of a buyback program, repurchasing more than 6% of shares outstanding, stands out as particularly relevant. This move reduces share count, potentially supporting per-share metrics, but it does not address underlying challenges in mortgage origination that continue to pressure earnings and heighten revenue volatility across Hilltop’s business lines.

However, investors should also be mindful that while buybacks have supported shareholder returns, the continued exposure to housing and mortgage cycle risks means ...

Read the full narrative on Hilltop Holdings (it's free!)

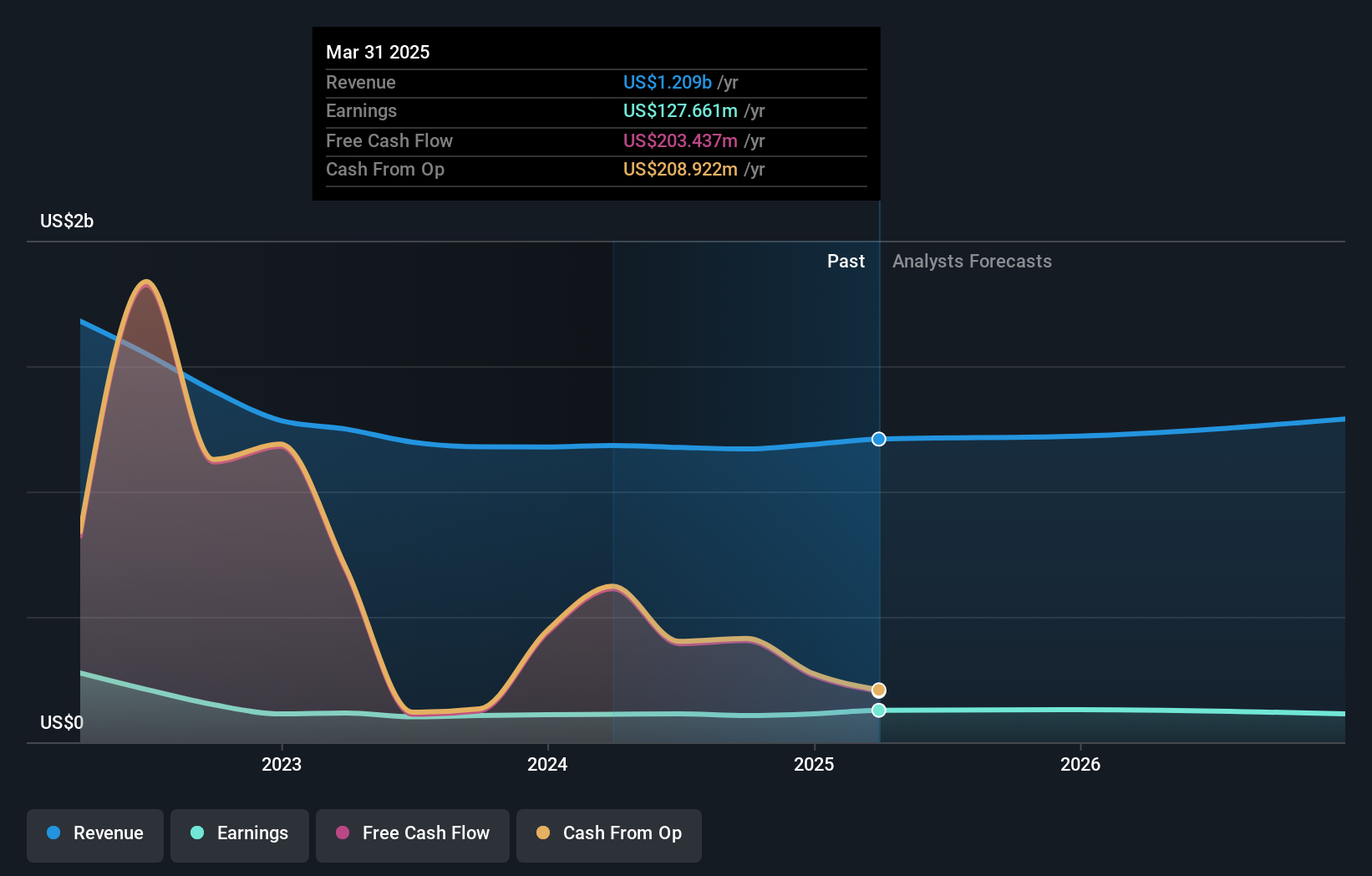

Hilltop Holdings' narrative projects $1.3 billion revenue and $79.8 million earnings by 2028. This requires 1.7% yearly revenue growth and a decrease in earnings of $63.6 million from $143.4 million.

Uncover how Hilltop Holdings' forecasts yield a $34.67 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range from US$32.23 to US$34.67. While some see upside potential, concerns around mortgage origination headwinds continue to influence broader expectations for Hilltop’s performance.

Explore 2 other fair value estimates on Hilltop Holdings - why the stock might be worth just $32.23!

Build Your Own Hilltop Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilltop Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hilltop Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilltop Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilltop Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HTH

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026