- United States

- /

- Banks

- /

- NYSE:HTH

Hilltop Holdings (HTH): Assessing Valuation After Broker/Dealer Gains and Analyst Upgrades Post-Earnings

Reviewed by Simply Wall St

Hilltop Holdings (HTH) just reported earnings that put its broker/dealer segment in the spotlight, showing faster growth. Commercial banking continues to improve, even as mortgage headwinds remain for now.

See our latest analysis for Hilltop Holdings.

Hilltop Holdings’ recent earnings have powered the stock higher, with a year-to-date share price return of nearly 23%. This reflects renewed investor confidence as the broker/dealer segment accelerates and commercial banking steadies. Its one-year total shareholder return stands at 11.9%, pointing to consistent value creation for long-term holders while short-term momentum builds on operational progress and steady results.

If you’re scanning for momentum or hidden value, now’s a good time to broaden your search and spot opportunities in fast growing stocks with high insider ownership.

With shares approaching analysts’ targets and insider sales occurring after a strong run, investors must now decide if Hilltop Holdings is undervalued and positioned for additional gains, or if the market is already factoring in its future growth.

Most Popular Narrative: 2% Undervalued

Hilltop Holdings' narrative fair value sits just above the last close, indicating the market is nearly aligned with analysts’ optimistic outlook and slightly undervalued stance. The small premium reflects confidence in the company’s recent buybacks and stable financial projections, even with modest profit margin assumptions.

The ongoing shift toward digital financial services allows Hilltop to gain operational efficiencies and lower operating costs. Management focuses on further digital investments and improving customer analytics, which can lead to better efficiency ratios and expanded net margins over time.

Want to know why analysts believe efficiency, digital momentum, and buybacks could tip the scales? The secret sauce lies in the narrative’s bold projections, especially its assumptions about future margins and earnings. Discover the unexpected drivers behind this valuation and see what analysts expect to propel Hilltop forward next.

Result: Fair Value of $35.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent headwinds in mortgage origination and rising competition in Texas could quickly challenge the bullish outlook. This may keep volatility in focus for investors.

Find out about the key risks to this Hilltop Holdings narrative.

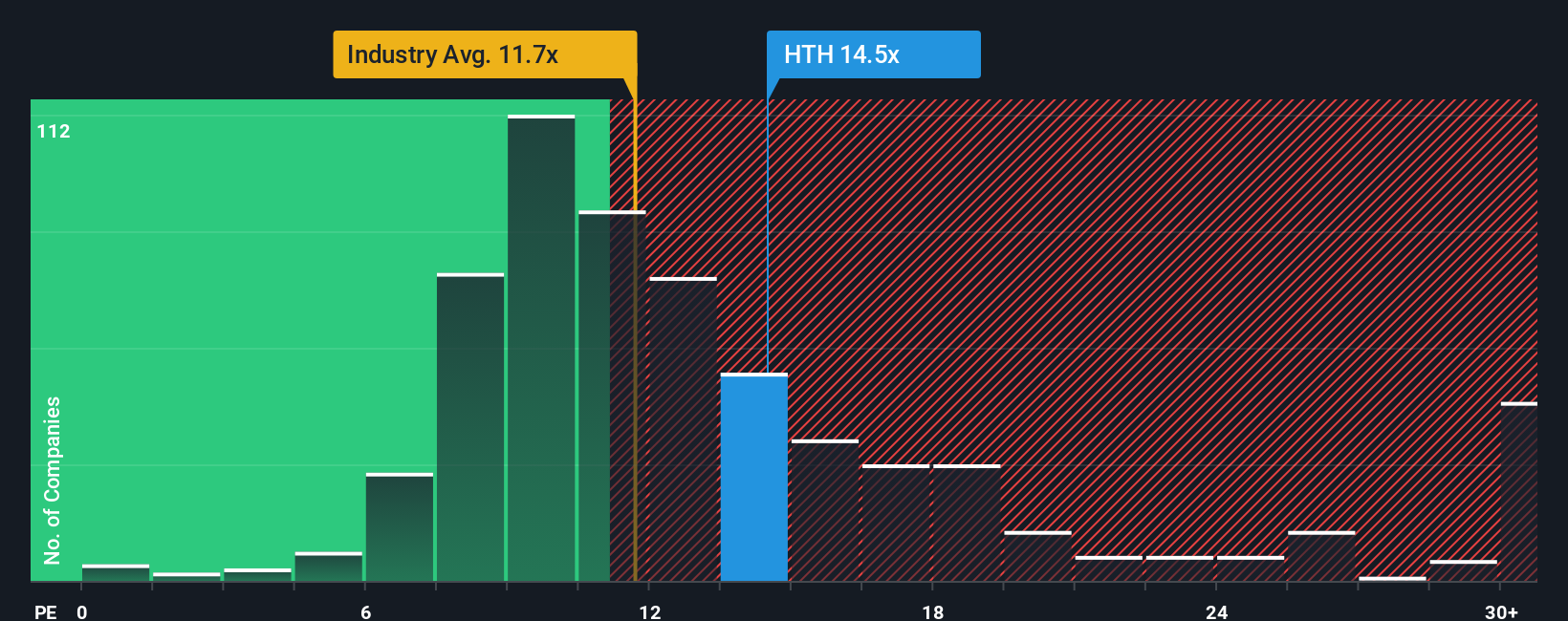

Another View: Market Ratios Tell a Cautionary Tale

Looking at Hilltop Holdings through the lens of price-to-earnings ratios, the shares trade at 13.3x earnings, which is higher than both the US Banks industry average of 11.4x and the peer average of 13.2x. Additionally, when compared to the fair ratio of 8.1x, the gap widens. This suggests investors may be paying a premium, which could introduce more valuation risk if expectations shift. Could further outperformance justify this price, or is the market already pricing in Hilltop's best days?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilltop Holdings Narrative

If you have your own take or want to dig deeper, you can explore the numbers firsthand and shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Hilltop Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and spot tomorrow’s winners before the crowd. The Simply Wall Street Screener unlocks fresh opportunities you can act on now.

- Capture high-yield opportunities and secure your income by checking out these 15 dividend stocks with yields > 3% with yields over 3%. This can be helpful for building consistent returns.

- Pinpoint undervalued businesses that could be trading below their true worth through these 923 undervalued stocks based on cash flows based on strong cash flow trends.

- Ride the AI wave by scanning these 25 AI penny stocks to identify innovative companies at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilltop Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HTH

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.