- United States

- /

- Banks

- /

- NYSE:HOMB

If You Like EPS Growth Then Check Out Home Bancshares (Conway AR) (NYSE:HOMB) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Home Bancshares (Conway AR) (NYSE:HOMB). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Home Bancshares (Conway AR)

How Quickly Is Home Bancshares (Conway AR) Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Home Bancshares (Conway AR) grew its EPS by 4.0% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

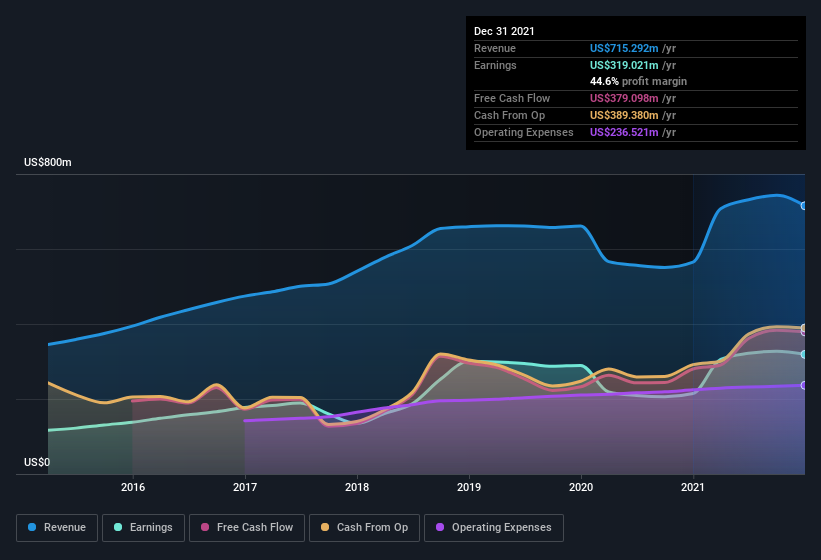

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Home Bancshares (Conway AR)'s revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Home Bancshares (Conway AR)'s EBIT margins were flat over the last year, revenue grew by a solid 27% to US$715m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Home Bancshares (Conway AR).

Are Home Bancshares (Conway AR) Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite -US$206k worth of sales, Home Bancshares (Conway AR) insiders have overwhelmingly been buying the stock, spending US$646k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Co-Founder, John Allison, who made the biggest single acquisition, paying US$240k for shares at about US$23.98 each.

Along with the insider buying, another encouraging sign for Home Bancshares (Conway AR) is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$295m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Home Bancshares (Conway AR) To Your Watchlist?

As I already mentioned, Home Bancshares (Conway AR) is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Home Bancshares (Conway AR) is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But Home Bancshares (Conway AR) isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Home Bancshares (Conway AR) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HOMB

Home Bancshares (Conway AR)

Operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives