- United States

- /

- Banks

- /

- NYSE:FNB

Will New AI Hires Signal a Real Shift in F.N.B's Competitive Strategy (FNB)?

Reviewed by Simply Wall St

- In September 2025, F.N.B. Corporation announced the appointment of Santosh Sinha as Director of AI and Innovation and Sundeep Tangirala as Director of Data Science to bolster its strategy leadership team.

- By hiring two accomplished leaders in artificial intelligence and data science, F.N.B. is signaling its intention to prioritize technology-driven enhancements across its business operations and client services.

- We'll explore how F.N.B.'s investment in AI leadership might shape its long-term growth narrative and digital innovation efforts.

Find companies with promising cash flow potential yet trading below their fair value.

F.N.B Investment Narrative Recap

If you are considering F.N.B. as an investment, you need to believe in its ability to leverage digital transformation and innovation to drive sustainable earnings growth, even as it expands in tightly focused geographic regions. While the recent addition of AI and data science leadership reinforces the company’s commitment to digital initiatives, it does not appear to materially shift the immediate catalyst of scaling digital channels to offset higher operating costs, nor does it resolve the persistent risk of regional economic concentration that could affect loan growth and earnings stability in the near term.

Among recent company developments, the rollout of business deposit products into F.N.B.’s eStore Common application is especially relevant, as it shows how the company is executing on digital integration and operational efficiency, key factors in supporting long-term customer acquisition and enhancing fee-based income in a competitive market.

However, in contrast to the company’s tech-focused progress, investors should be mindful that regional economic exposure...

Read the full narrative on F.N.B (it's free!)

F.N.B's narrative projects $2.2 billion revenue and $775.6 million earnings by 2028. This requires 13.0% yearly revenue growth and a $308.6 million earnings increase from the current $467.0 million.

Uncover how F.N.B's forecasts yield a $18.56 fair value, a 14% upside to its current price.

Exploring Other Perspectives

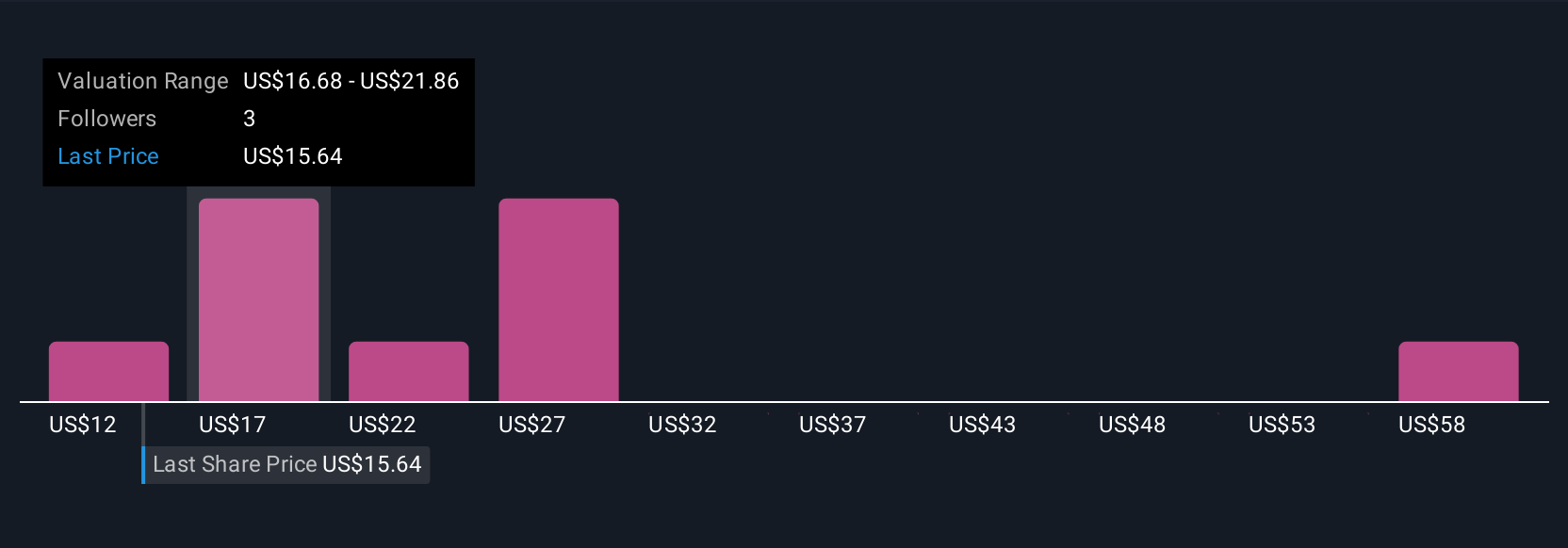

Five fair value estimates from the Simply Wall St Community range from US$11.50 to US$63.31, reflecting a wide variety of individual outlooks. With innovation and digital scaling as ongoing catalysts, it is clear that expectations and risk assessments among market participants can differ markedly, explore several viewpoints to inform your own perspective.

Explore 5 other fair value estimates on F.N.B - why the stock might be worth over 3x more than the current price!

Build Your Own F.N.B Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your F.N.B research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free F.N.B research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate F.N.B's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNB

F.N.B

A bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives