- United States

- /

- Banks

- /

- NYSE:FLG

How Investors May Respond To Flagstar Financial (FLG) After Fed Rate Cut and Dovish Outlook

Reviewed by Simply Wall St

- The Federal Reserve recently cut its benchmark interest rate by 25 basis points and indicated the possibility of further reductions before year-end, sparking a broad rally across equity markets.

- This policy shift sparked optimism among regional banks such as Flagstar Financial, as lower rates can ease funding costs and support higher loan demand.

- We’ll explore how the Federal Reserve’s signals about future interest rate moves could influence Flagstar Financial’s overall investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Flagstar Financial's Investment Narrative?

For anyone holding or considering Flagstar Financial, the essential big-picture bet centers on the company’s path to profitability and management’s ability to address lingering credit and operational risks. The recent rate cut by the Federal Reserve and the possibility of further reductions bring potential short-term tailwinds. Lower funding costs could provide some relief after a difficult stretch of falling net interest income and steep net losses, and are likely to support loan activity if demand returns. However, high levels of bad loans and ongoing class action lawsuits mean this optimism is offset by persistent headwinds. The board and management remain relatively new, and prior underperformance compared to the market and industry creates pressure for a turnaround. New monetary policy might ease some immediate strain, but the turnaround remains a work in progress.

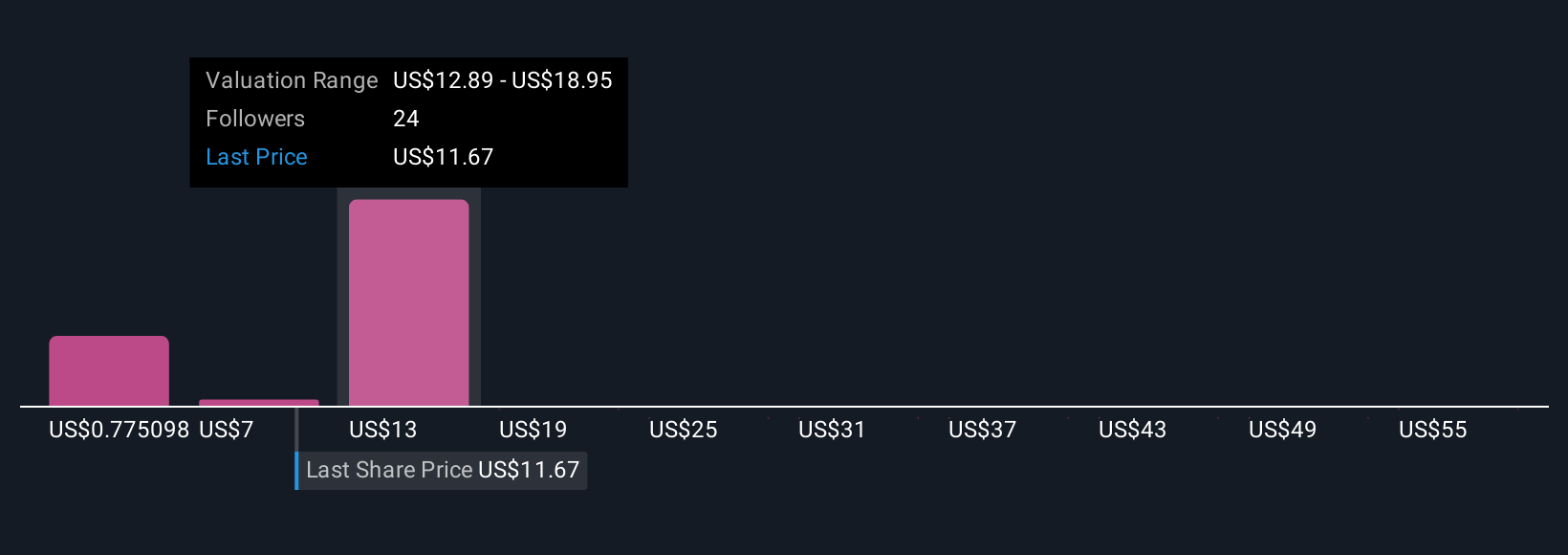

But, investor optimism may overlook the elevated bad loan levels still on the books. Our valuation report unveils the possibility Flagstar Financial's shares may be trading at a premium.Exploring Other Perspectives

Explore 10 other fair value estimates on Flagstar Financial - why the stock might be worth less than half the current price!

Build Your Own Flagstar Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flagstar Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Flagstar Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flagstar Financial's overall financial health at a glance.

No Opportunity In Flagstar Financial?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLG

Flagstar Financial

Operates as the bank holding company for Flagstar Bank, N.A.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives