- United States

- /

- Banks

- /

- NYSE:FFWM

First Foundation (NYSE:FFWM shareholders incur further losses as stock declines 12% this week, taking three-year losses to 78%

Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of First Foundation Inc. (NYSE:FFWM); the share price is down a whopping 79% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And more recent buyers are having a tough time too, with a drop of 40% in the last year. The falls have accelerated recently, with the share price down 19% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for First Foundation

First Foundation isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years First Foundation saw its revenue shrink by 28% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 21%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

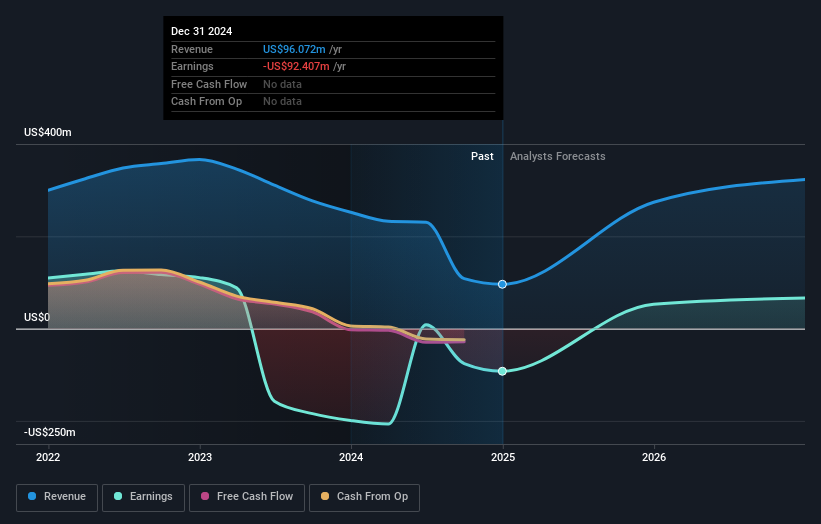

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

First Foundation shareholders are down 39% for the year, but the market itself is up 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for First Foundation that you should be aware of.

We will like First Foundation better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FFWM

First Foundation

Provides banking services, investment advisory, wealth management, and trust services to individuals, businesses, and other organizations in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives