- United States

- /

- Banks

- /

- NYSE:FCF

How a Forecasted Revenue Turnaround at First Commonwealth Financial (FCF) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

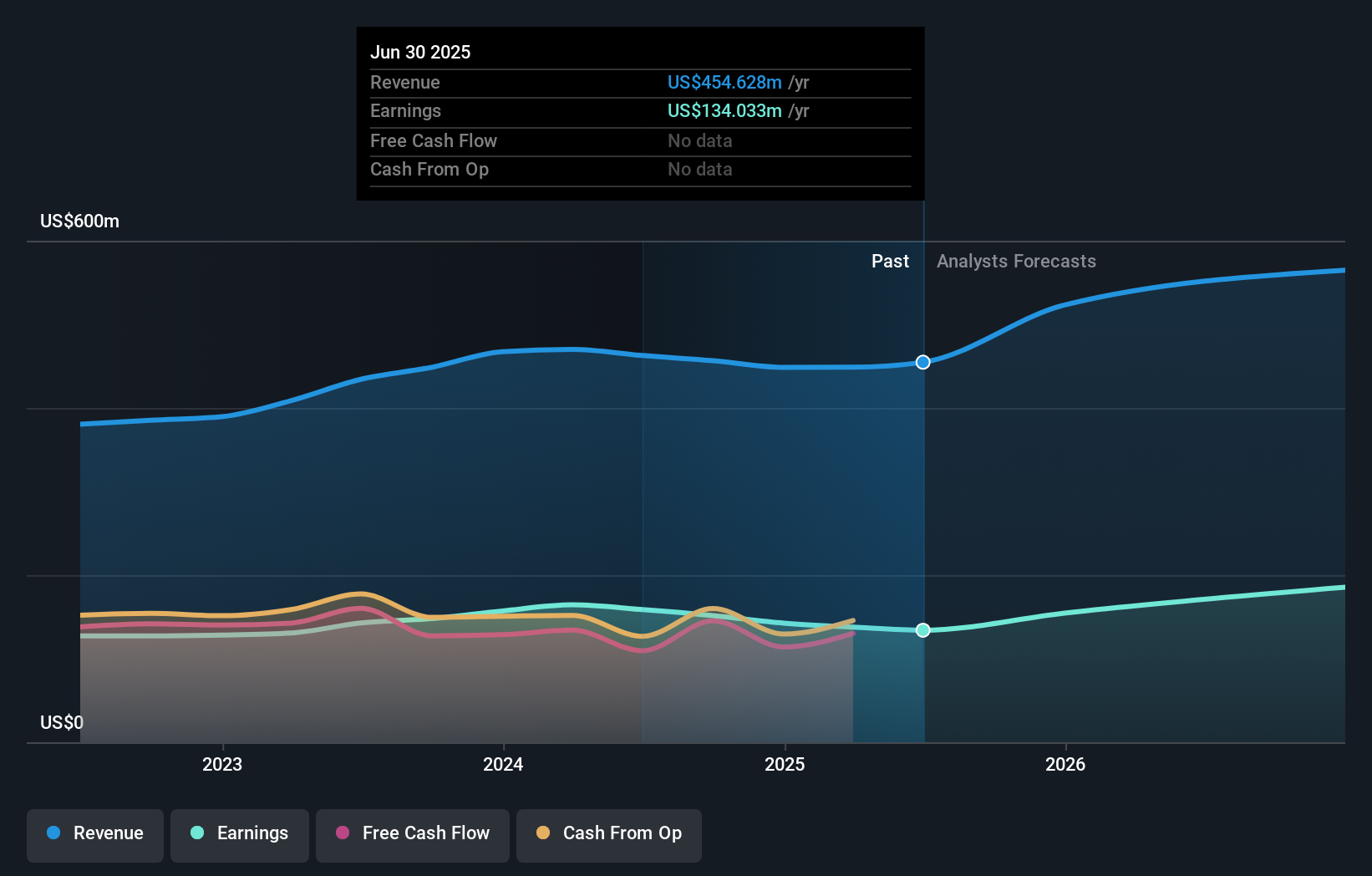

- First Commonwealth Financial (NYSE:FCF) reported its quarterly earnings last Tuesday after market hours, with analysts expecting revenue to reach US$135.9 million, reflecting a 12.1% year-on-year increase and a reversal from last year’s 1.1% decline.

- Analyst forecasts of renewed revenue growth followed by the company's consistent outperformance, particularly strong net interest income last quarter, have generated significant anticipation leading up to this earnings release.

- With analysts highlighting expectations for a revenue turnaround, we'll examine how these forecasts may influence First Commonwealth Financial's broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

First Commonwealth Financial Investment Narrative Recap

To be a shareholder in First Commonwealth Financial, you’d likely believe in the bank’s ability to accelerate top-line growth through sustained net interest income gains, while containing the competitive and regulatory pressures facing regional banks. The latest earnings report may influence short-term sentiment as revenue expectations and net interest income take center stage, but the ongoing shift toward digital banking platforms remains the biggest risk; this news is more of a confirmation than a catalyst for those concerns.

One recent announcement closely tied to this outlook was the July 2025 launch of a new US$25 million share repurchase program, following completion of the prior buyback. This reflects continued efforts to return capital to shareholders and signal management’s confidence, though it does not address the evolving technology and digital adoption gap that defines the near-term risk and opportunity profile for First Commonwealth Financial.

Yet, in contrast to share repurchases and earnings momentum, investors should keep a close eye on potential customer attrition linked to...

Read the full narrative on First Commonwealth Financial (it's free!)

First Commonwealth Financial's narrative projects $698.8 million revenue and $250.5 million earnings by 2028. This requires 15.4% yearly revenue growth and an $116.5 million earnings increase from $134.0 million today.

Uncover how First Commonwealth Financial's forecasts yield a $19.20 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community peg the company’s fair value between US$19.20 and an outlier above US$12,000. While optimism for faster revenue growth is clear, opinions show just how much views on future earnings and risk factors can differ across the market.

Explore 3 other fair value estimates on First Commonwealth Financial - why the stock might be worth just $19.20!

Build Your Own First Commonwealth Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Commonwealth Financial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free First Commonwealth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Commonwealth Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives