- United States

- /

- Banks

- /

- NYSE:FCF

First Commonwealth Financial (FCF): Evaluating Valuation After Fed Optimism and Executive Insider Buying

Reviewed by Simply Wall St

First Commonwealth Financial (FCF) saw its stock climb after upbeat remarks from the New York Federal Reserve President about possible interest rate changes, combined with a recent executive share purchase, caught the attention of investors.

See our latest analysis for First Commonwealth Financial.

First Commonwealth Financial’s share price surged on encouraging central bank comments, but it’s been a mixed year overall; the 1-year total shareholder return is down 10.9%, even though the company has nearly doubled shareholder value over the past five years. Recent insider buying and upbeat rate-cut expectations are giving some fresh momentum, but investors are still working through last quarter’s volatility and a soft year-to-date performance.

If the renewed optimism around insider moves has you watching the banking sector closely, it might be the right moment to discover fast growing stocks with high insider ownership

With improving fundamentals, insider confidence, and a share price still trading at a double-digit discount to analyst targets, is First Commonwealth Financial currently undervalued, or is the market already reflecting its growth prospects in the stock’s price?

Most Popular Narrative: 14.8% Undervalued

With the last close price at $16.36, the most popular narrative places First Commonwealth Financial’s fair value well above current trading. This sets the stage for a deeper look into the company’s long-term potential and the key trends that could fuel upside.

Robust organic loan growth across multiple business lines (equipment finance, small business, commercial, indirect and mortgage) and successful integration of recent acquisitions like CenterBank position the company to capitalize on population migration and economic expansion in secondary and tertiary markets, supporting sustainable future revenue and balance sheet growth.

Curious how this bullish forecast stacks up? Want to see the bold financial assumptions and future growth thesis that drive this valuation? The fine print of this narrative includes ambitious projections that challenge conventional banking expectations. Don’t miss out; find out what experts see on First Commonwealth's horizon.

Result: Fair Value of $19.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, digital disruption or regional economic weakness could challenge growth and put pressure on margins. This may make the bullish scenario less certain.

Find out about the key risks to this First Commonwealth Financial narrative.

Another View: What Do Market Ratios Say?

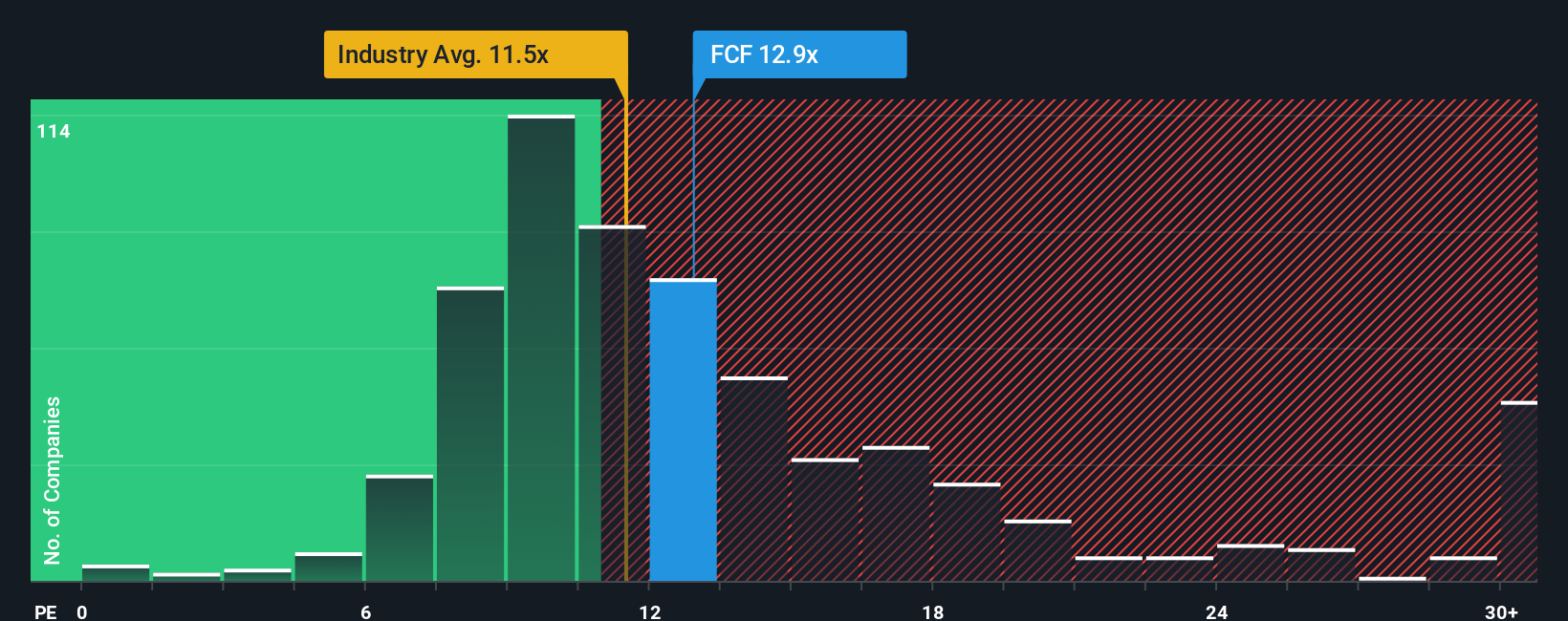

Looking at valuation from a different angle, First Commonwealth Financial trades at a price-to-earnings ratio of 11.8x, slightly higher than the US Banks industry average of 11.4x, but below its peers' average of 13.7x. This suggests the market views the company as broadly in line with competitors, but not a standout bargain. Interestingly, the fair ratio is estimated at 12.1x, which hints there is not much room for re-rating unless the business outperforms. Does this market pricing reflect hidden risks, or is there potential waiting to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Commonwealth Financial Narrative

If you have a different perspective or want to dive deeper into the company’s numbers, building your own valuation story is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Commonwealth Financial.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Smart investors always keep an eye on new markets and sectors that are setting the pace for tomorrow’s winners.

- Unlock future breakthroughs and get ahead of tech megatrends by checking out these 25 AI penny stocks making headlines with artificial intelligence innovations.

- Capture stable returns and boost your passive income by reviewing these 15 dividend stocks with yields > 3% offering generous yields and strong fundamentals.

- Stay ahead of mainstream trends and profit from digital disruption with these 81 cryptocurrency and blockchain stocks at the forefront of blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success