- United States

- /

- Banks

- /

- NYSE:FCF

Did Buyback and Dividend Moves Just Shift First Commonwealth Financial's (FCF) Capital Allocation Story?

Reviewed by Simply Wall St

- First Commonwealth Financial Corporation recently announced a new share repurchase program of up to US$25 million, reported higher net interest income but lower net income for the second quarter of 2025, and approved a quarterly dividend increase to US$0.135 per share.

- This combination of shareholder returns, operating results, and capital management actions highlights both the company's responsiveness to market conditions and its ongoing focus on investor value.

- We'll examine how the buyback program signals management's approach to capital allocation and impacts First Commonwealth Financial's investment thesis.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

First Commonwealth Financial Investment Narrative Recap

To be a shareholder in First Commonwealth Financial today, you need confidence in the company’s ability to expand loan growth and sustain net interest margins as economic and competitive conditions evolve. The recent buyback announcement and dividend increase demonstrate continued capital management discipline, but recent earnings results suggest these initiatives are not likely to materially change the biggest short-term catalyst: delivering consistent earnings growth as the CenterBank acquisition proceeds, nor do they significantly alter the main risk surrounding credit quality trends.

Among the recent announcements, the decline in quarterly net charge-offs from US$4.40 million last year to US$2.76 million this quarter stands out. This reduction is important as credit costs have been a persistent risk and any further improvement could help offset pressures on net margins, reinforcing the case for asset quality stabilization as a potential near-term catalyst.

However, investors should note that while buybacks and dividends are positive signals, the real test may lie in credit trends that could shift quickly if...

Read the full narrative on First Commonwealth Financial (it's free!)

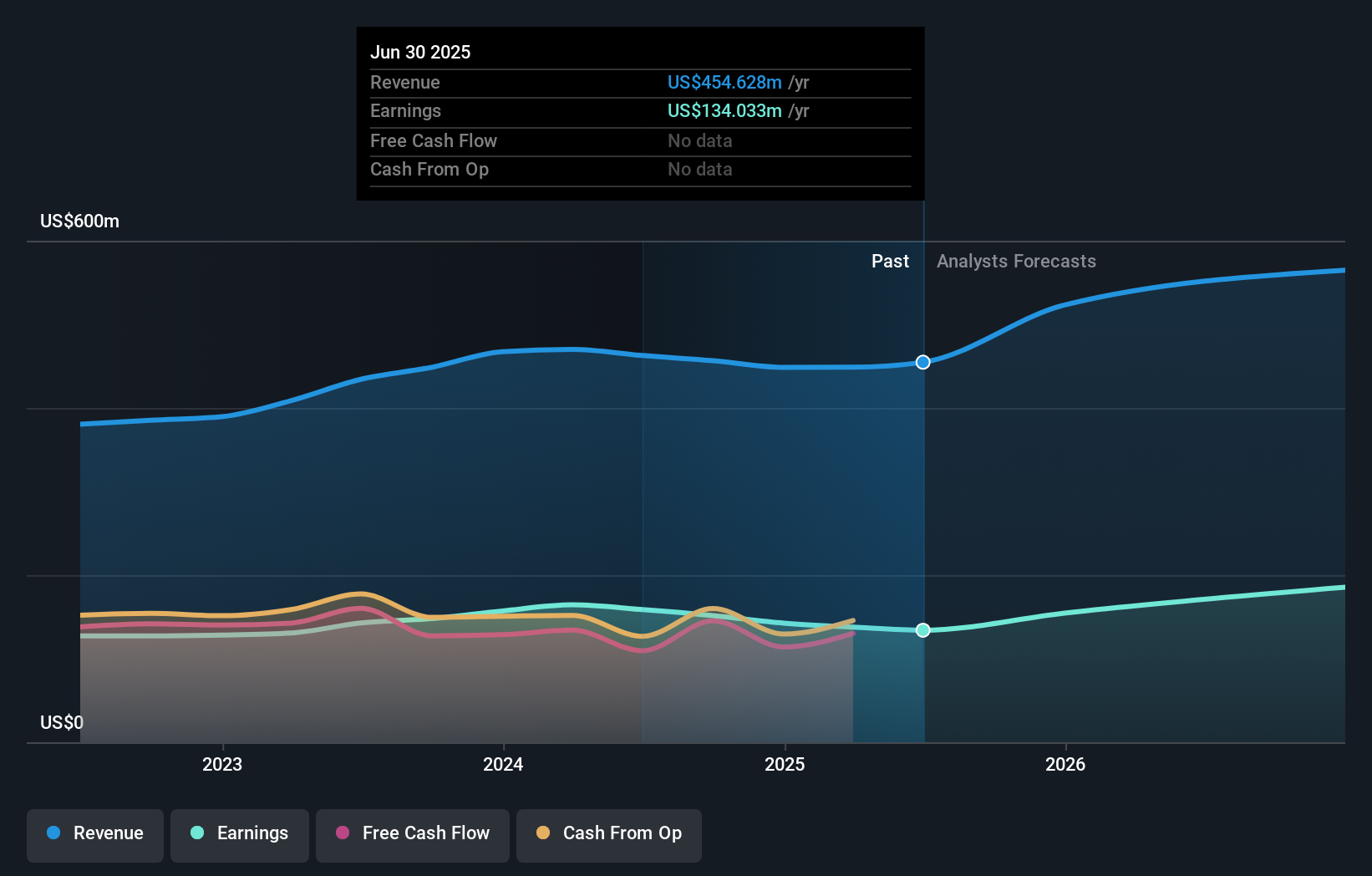

First Commonwealth Financial's narrative projects $643.6 million in revenue and $193.2 million in earnings by 2028. This requires 12.8% yearly revenue growth and a $55.5 million earnings increase from $137.7 million.

Uncover how First Commonwealth Financial's forecasts yield a $18.40 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely from US$16.01 to US$12,644.96 per share. With such diverse outlooks, consider that recurring credit costs remain a key challenge impacting expectations for future performance.

Explore 3 other fair value estimates on First Commonwealth Financial - why the stock might be a potential multi-bagger!

Build Your Own First Commonwealth Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Commonwealth Financial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free First Commonwealth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Commonwealth Financial's overall financial health at a glance.

No Opportunity In First Commonwealth Financial?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives