- United States

- /

- Banks

- /

- NYSE:FCF

A Fresh Look at First Commonwealth Financial (FCF) Valuation as Shares Rebound This Month

Reviewed by Simply Wall St

See our latest analysis for First Commonwealth Financial.

Momentum for First Commonwealth Financial has been steady rather than spectacular. After a mild rebound this month, the share price is still trailing year-to-date. Over the past year, its total shareholder return slipped more than 11%, though long-term investors have seen gains of over 87% across five years, highlighting the stock’s durable track record even as recent sentiment has cooled.

If you’re exploring new opportunities beyond traditional banks, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

Despite some recent setbacks, the stock is still trading below analyst price targets and offers a notable discount to its estimated intrinsic value. However, is this a genuine buying opportunity, or has the market already accounted for future growth?

Most Popular Narrative: 16.8% Undervalued

With First Commonwealth Financial closing at $15.98, the most popular narrative suggests a fair value nearly 17% higher. This sets the stage for a deeper look at what is driving that bullish calculation.

Continued investment in scalable digital banking platforms and treasury management solutions is enabling the bank to acquire new customers at lower incremental cost, improve customer experience, and deepen client relationships. This leads to enhanced operational efficiency and the potential for higher net margins over time.

What if the key to unlocking this valuation is a transformation underway? The narrative points to impressive changes in how First Commonwealth makes money, with ambitious growth targets for both earnings and margins. But which assumptions are underpinning analysts’ optimism, and what makes the bank’s profit forecasts so bold? You’ll want to see the full story to find out how these numbers stack up.

Result: Fair Value of $19.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow progress in digital banking and lingering regional concentration could challenge the optimistic case if competition increases or local economies weaken.

Find out about the key risks to this First Commonwealth Financial narrative.

Another View: Multiples Perspective

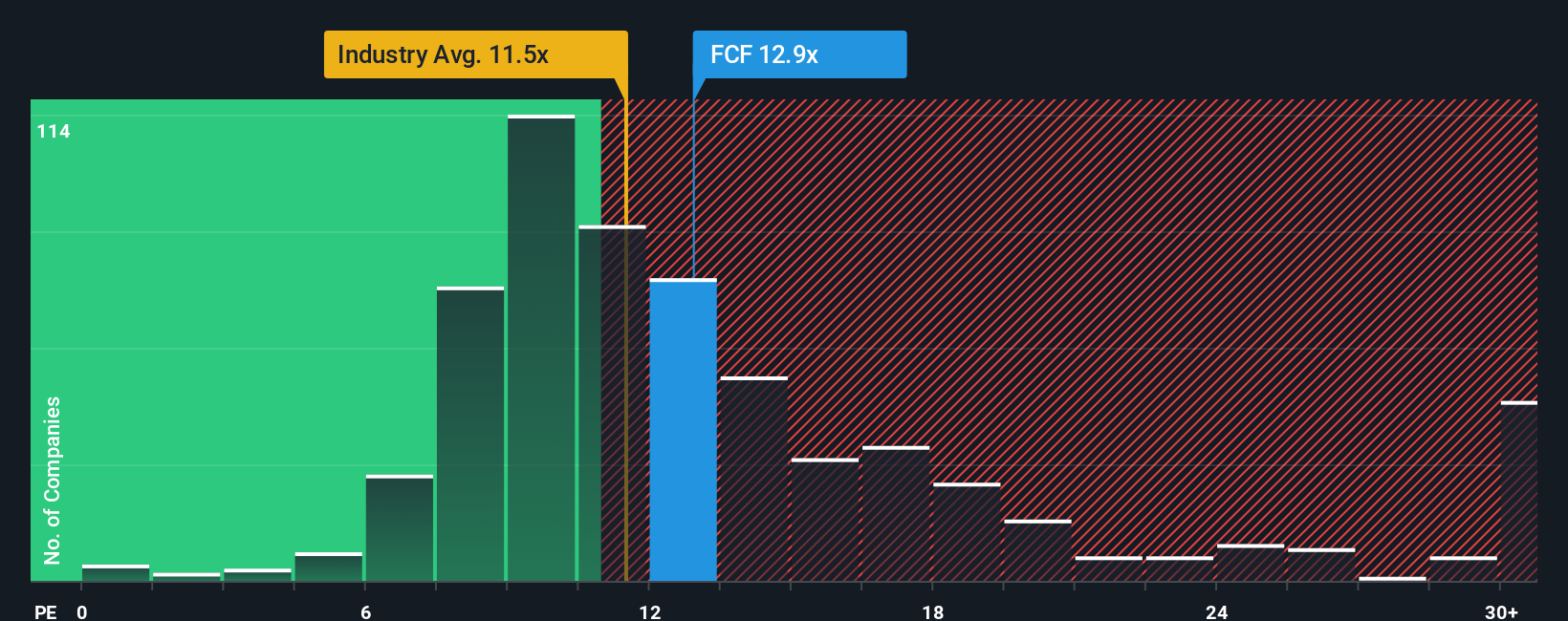

From a different angle, First Commonwealth Financial trades at 11.5 times earnings, which is slightly above the US Banks industry average of 11.2 but below its peer average of 13.5. Compared to its fair ratio of 12.1, the current valuation offers some margin. However, it also suggests limited room for upside if market expectations shift. Could this premium signal investor confidence, or does it simply highlight risks for the cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Commonwealth Financial Narrative

If you prefer to form your own view or want to dig deeper into the numbers, you can build your own narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Commonwealth Financial.

Looking for more investment ideas?

Level up your portfolio by targeting opportunities others overlook. The market’s best stories are just a few clicks away. Do not let potential upside pass you by.

- Uncover unique upside by targeting exciting market entrants through these 3577 penny stocks with strong financials. These companies are ready to surprise with their growth trajectory.

- Boost your returns by tapping into high-yielding names through these 16 dividend stocks with yields > 3%, perfect for building steady income in any environment.

- Stay ahead of the curve by seizing early opportunities with these 26 AI penny stocks. Artificial intelligence could spark the next wave of leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives